Question: its all one question using year 2020. 4 Required information Problem 6-54 (LO 6-3) (Static) Part 1 of 3 [The following information applies to the

![to the questions displayed below.] Jackson is 18 years old and has](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66faf644e94e2_07666faf6445beee.jpg)

its all one question using year 2020.

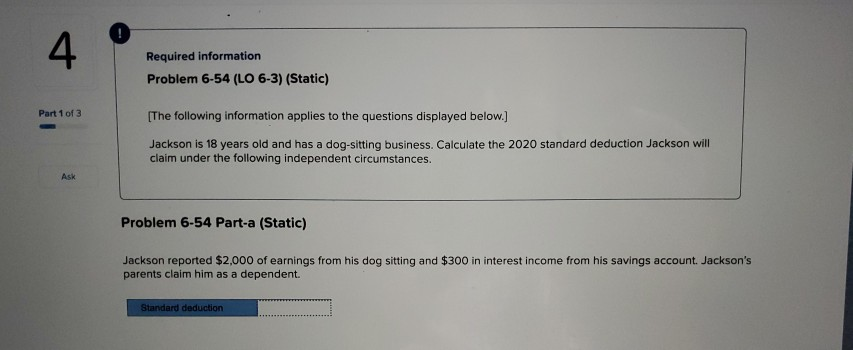

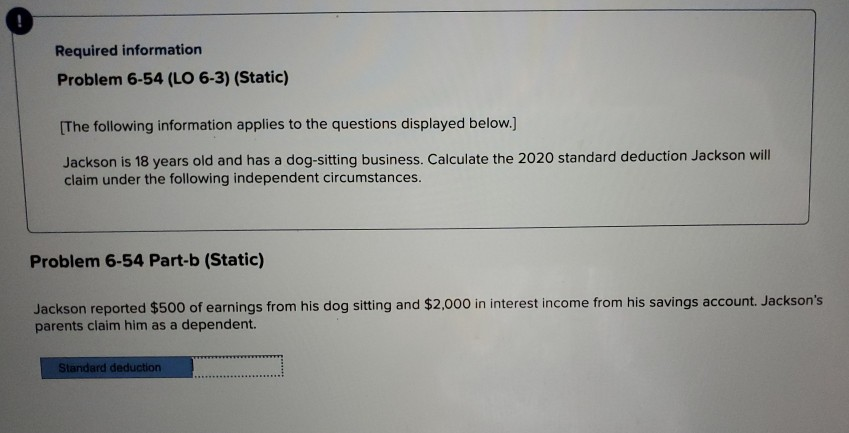

4 Required information Problem 6-54 (LO 6-3) (Static) Part 1 of 3 [The following information applies to the questions displayed below.] Jackson is 18 years old and has a dog-sitting business. Calculate the 2020 standard deduction Jackson will claim under the following independent circumstances. Ask Problem 6-54 Part-a (Static) Jackson reported $2,000 of earnings from his dog sitting and $300 in interest income from his savings account. Jackson's parents claim him as a dependent. Standard deduction Required information Problem 6-54 (LO 6-3) (Static) [The following information applies to the questions displayed below.) Jackson is 18 years old and has a dog-sitting business. Calculate the 2020 standard deduction Jackson will claim under the following independent circumstances. Problem 6-54 Part-b (Static) Jackson reported $500 of earnings from his dog sitting and $2,000 in interest income from his savings account. Jackson's parents claim him as a dependent. Standard deduction Required information Problem 6-54 (LO 6-3) (Static) [The following information applies to the questions displayed below.] Jackson is 18 years old and has a dog-sitting business. Calculate the 2020 standard deduction Jackson will claim under the following independent circumstances. Problem 6-54 Part-c (Static) Jackson reported $8,000 of earnings from his dog sitting and $3,000 in interest income. Jackson's parents do not claim him as a dependent Standard deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts