Question: its calculations and recommendation Appendix Three (Cost-Volume-Profit Analysis for a proposed storefront) Objective: In order to maximize revenue, the consulting group would like to analyze

its calculations and recommendation

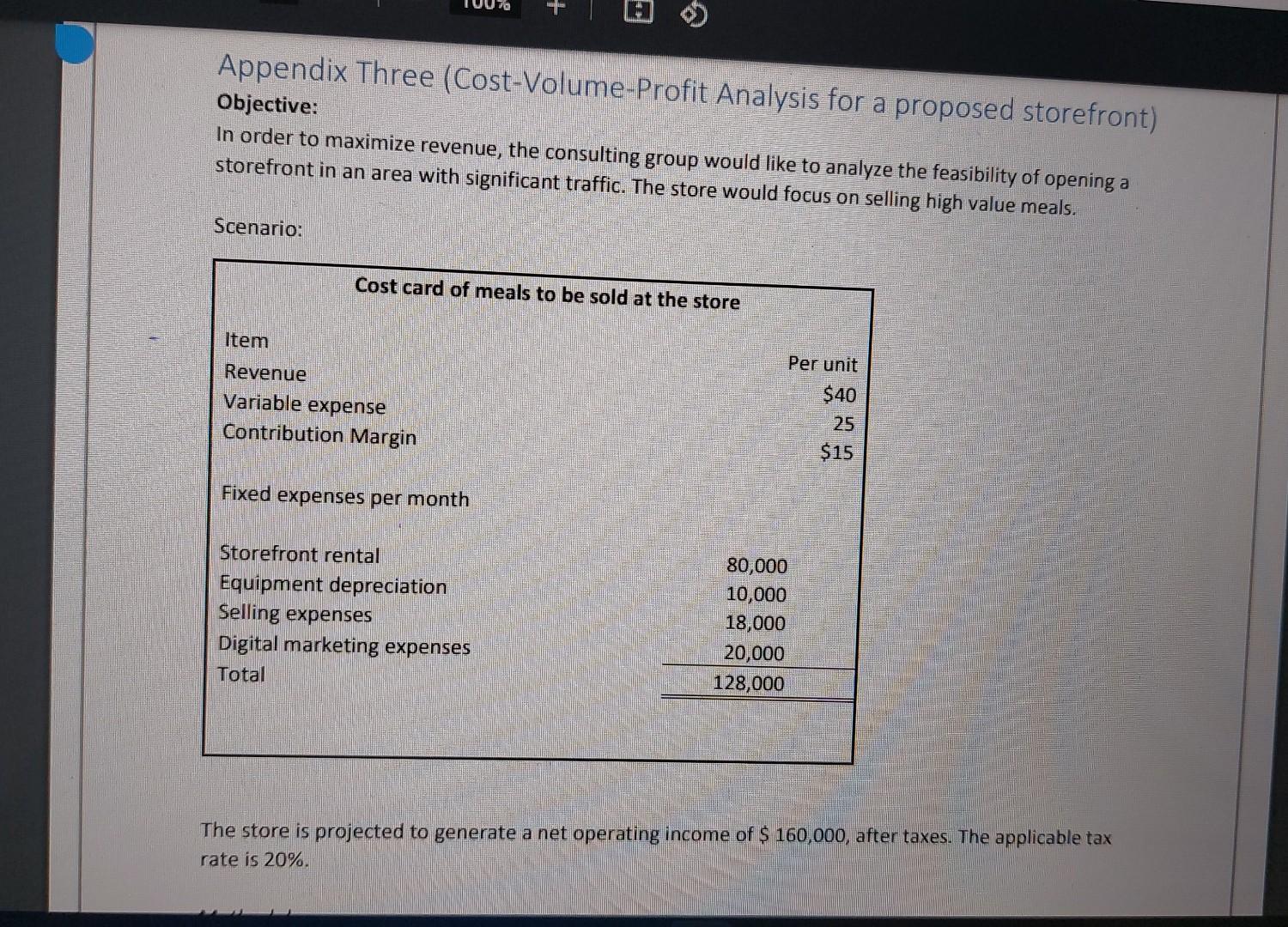

Appendix Three (Cost-Volume-Profit Analysis for a proposed storefront) Objective: In order to maximize revenue, the consulting group would like to analyze the feasibility of opening a storefront in an area with significant traffic. The store would focus on selling high value meals. Scenario: The store is projected to generate a net operating income of $160,000, after taxes. The applicable tax rate is 20%. The store is projected to generate a net operating income of $160,000, after taxes. The applicable tax rate is 20% Methodology: The group would analyze the sales volume required to reach the target net operating income. Based on this sales figure, they would also like to iterate the staffing pattern and further analyze the impact on net operating income. The iteration would include, adding another two part time salespersons. As a result, the selling expenses will increase by $50,000 and will bring in an additional $ 90,000 in revenue. They would prepare a Contribution margin income statement and calculate the degree of operating leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts