Question: Its derivative course chapter 2 Question 4: Suppose that the exchange rate between euro and US dollar is 1.35S/euro. Mac Beauty Inc. entered into a

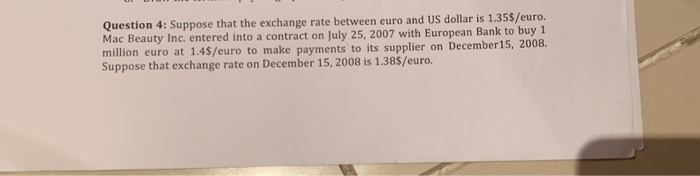

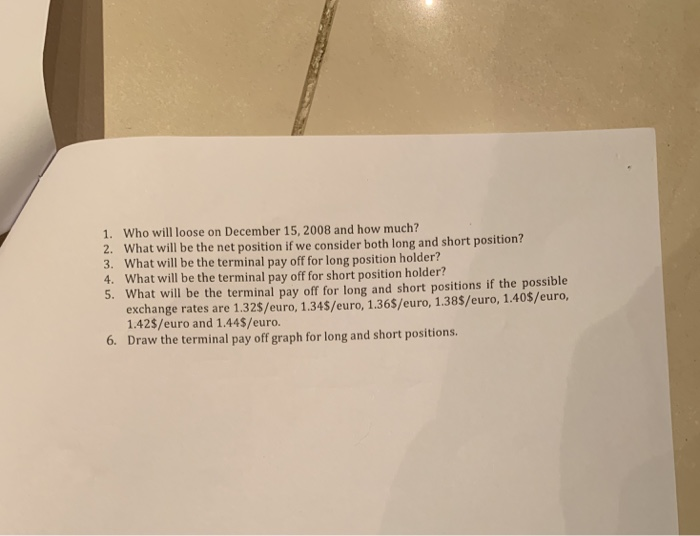

Question 4: Suppose that the exchange rate between euro and US dollar is 1.35S/euro. Mac Beauty Inc. entered into a contract on July 25, 2007 with European Bank to buy 1 llion euro at 1.4S/euro to make payments to its supplier on December15, 2008. Suppose that exchange rate on December 15, 2008 is 1.38S/euro. 1. 2. 3. 4. 5. Who will loose on December 15,2008 and how much? What will be the net position if we consider both long and short position? What will be the terminal pay off for long position holder? What will be the terminal pay off for short position holder? What will be the terminal pay off for long and short positions if the possible exchange rates are 1.32S/euro, 1.34S/euro, 1.36S/euro, 1.38S/euro, 1.405/euro 1.42S/euro and 1.44S/euro. Draw the terminal pay off graph for long and short positions. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts