Question: Its look clear on my end im going to do it again Required information Exercise 13.15 (Static) Home Depot, Inc. Using a Statement of Cash

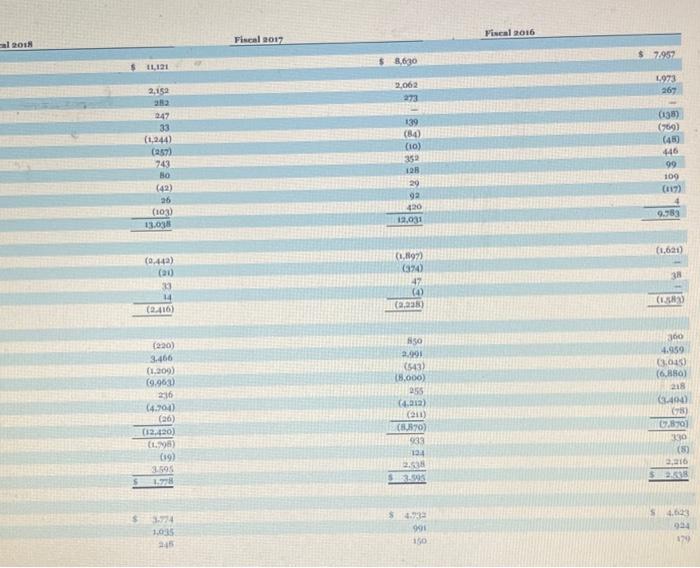

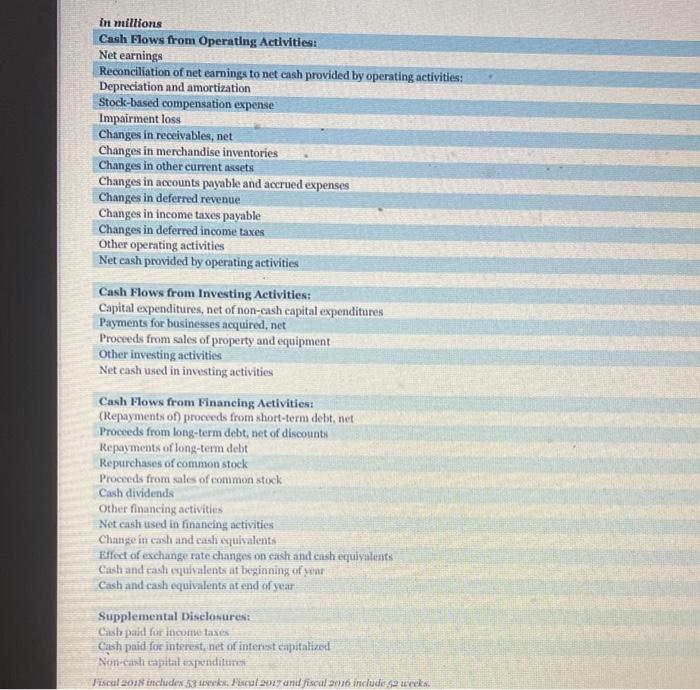

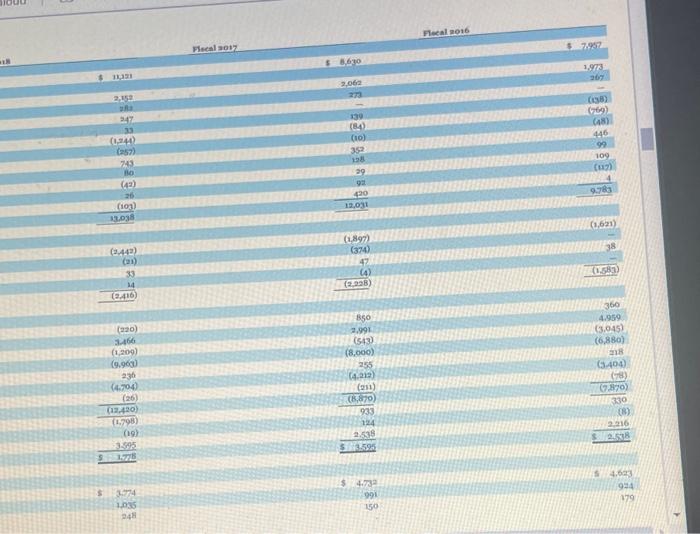

Required information Exercise 13.15 (Static) Home Depot, Inc. Using a Statement of Cash Flows (LO13-1, LO13-2, LO13-4) The following information applies to the questions displayed below) Statements of cash flow for Home Depot, Inc. for fiscal years 2018, 2017 and 2016 are included in Appendix A Exercise 13.15 (Static) Part d d. Calculate the amount of free cash flow for each of 2016, 2017 and 2018 (Enter your answers in millions.) Year Free Cash Flow (in millions) 2016 2017 2010 i El Arab Baile politie heel Fiscal 2016 al 2018 Fiscal 2017 7957 8,630 11,120 L.973 267 2,062 273 2,152 CUC 038) (69) 247 33 (1,244) (257) 743 Bo 139 (84) (10) 352 HUI (48) 446 99 109 () 4 9.58 (411 26 (103) 13.038 29 92 420 19,031 (1621) (0.44) (20 (14) NE (6.89 ( 47 (4) (23) CE 14 (2416) (2) (H) (220) 3.466 (1209) (9.963) 2:36 (4.300) 360 4.959 03.045) ( 60) 215 3:44 350 2.00 (543) 15,000) 255 (4.212) (211) (32870 933 124 ( ( (90) ( 0.80 230 ( 2216 S2 (12.420) 1.) (19) 3.595 1.78 (8) 3.74 1.0:15 2:15 $4.33 901 S 4.643 934 050 in millions Cash Flows from Operating Activities: Net earnings Reconciliation of net eamings to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Impairment loss Changes in receivables, net Changes in merchandise inventories Changes in other current assets Changes in accounts payable and accrued expenses Changes in deferred revenue Changes in income taxes payable Changes in deferred income taxes Other operating activities Net cash provided by operating activities Cash Flows from Investing Activities: Capital expenditures, net of non-cash capital expenditures Payments for businesses acquired, net Proceeds from sales of property and equipment Other investing activities Net cash used in investing activities Cash Flows from Financing Activities: (Repayments o proceeds from short-term debt.net Proceeds from long-term debt, net of discounts Repayments of long-term debt Repurchases of common stock Proceeds from sales of common stock Cash dividends Other financing activities Net ensh used in financing netivities Change in cash and cash equivalents Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental Disclosures: Cash paid for contaxe Cash paid for interest, net of interest capitalized Non-cash capital expenditur Fiscal 2015 includes 531 Hiscal 2007 and fiscal 2016, includisse uveks. Focal 2016 Focals $ 77,29872 $8.630 TE 1.9773 367 2.06 2.153 130 (1246 ( (ou) (48) 445 99 109 20 30 18 29 C) 6 8 (e) 26 (10) 420 12.031 Cort (0.621) (1.4) (1) (1.897 (370 47 (4) (28) (158 33 14 (9.416) ) (120) 1466 (1.200 360 4.959 13.045) (6,880) 18 (400 (CIS) ( (1966) 296 (4.700 850 2.991 ( (8,000) 255 (21) (211) (8,870) 933 124 2.535 ( (O (26) ( (12.420 0.798 210 08 2016 28 (00 SOS SET 5 3.595 $ 4.7 S 4.603 934 179 $ 991 2014 1 9:48 Scott

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts