Question: its not the 2017 one. this is another question with different percentages as well so please do not copy and paste the other answer from

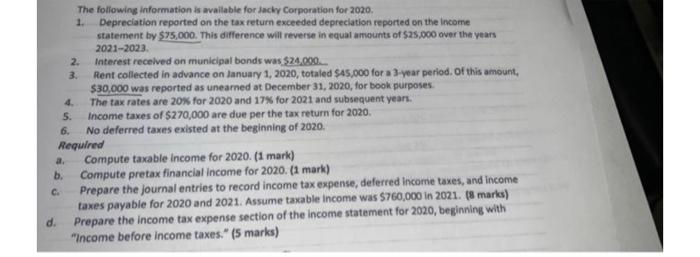

The following information is available for Jacky Corporation for 2020 Depreciation reported on the tax return exceeded depreciation reported on the income statement by $75,000. This difference will reverse in equal amounts of $25,000 over the years 2021-2023 2. Interest received on municipal bonds was $24,000 3. Rent collected in advance on January 1, 2020, totaled $45,000 for a 3-year period of this amount, $30,000 was reported as unearned at December 31, 2020, for book purposes The tax rates are 20% for 2020 and 17% for 2021 and subsequent year. 5. Income taxes of $270,000 are due per the tax return for 2020 6. No deferred taxes existed at the beginning of 2020, Required a. Compute taxable income for 2020. (1 mark) b. Compute pretax financial income for 2020. (1 mark) C Prepare the journal entries to record income tax expense, deferred Income taxes, and income taxes payable for 2020 and 2021. Assume taxable income was $760,000 in 2021. (8 marks) d. Prepare the income tax expense section of the income statement for 2020, beginning with "Income before income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts