Question: IT'S One Question Cannot be solved separately Please Make It Clear as Possible (Solve It in way that I can copy It) Question 6: The

IT'S One Question Cannot be solved separately

Please Make It Clear as Possible

(Solve It in way that I can copy It)

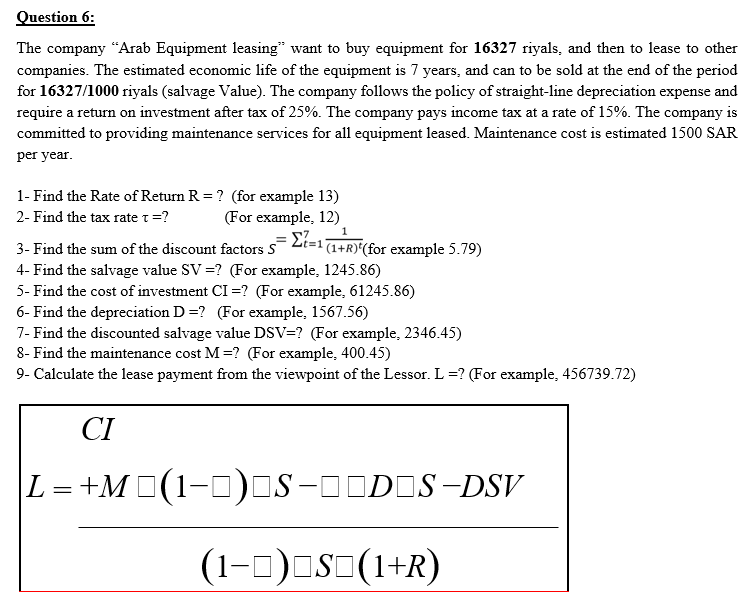

Question 6: The company Arab Equipment leasing want to buy equipment for 16327 riyals, and then to lease to other companies. The estimated economic life of the equipment is 7 years, and can to be sold at the end of the period for 16327/1000 riyals (salvage Value). The company follows the policy of straight-line depreciation expense and require a return on investment after tax of 25%. The company pays income tax at a rate of 15%. The company is committed to providing maintenance services for all equipment leased. Maintenance cost is estimated 1500 SAR per year. 1 =1 (1+R)*(for example 5.79) t=1 1- Find the Rate of Return R = ? (for example 13) 2- Find the tax rate r =? (For example, 12) 3- Find the sum of the discount factors 5 4- Find the salvage value SV =? (For example, 1245.86) 5- Find the cost of investment CI =? (For example, 61245.86) 6- Find the depreciation D =? (For example, 1567.56) 7- Find the discounted salvage value DSVE? (For example, 2346.45) 8- Find the maintenance cost M=? (For example, 400.45) 9- Calculate the lease payment from the viewpoint of the Lessor. L =? (For example, 456739.72) CI L = +MO(1-0)OS-DODOS-DSV = (1-0) Oso(1+R) Question 6: The company Arab Equipment leasing want to buy equipment for 16327 riyals, and then to lease to other companies. The estimated economic life of the equipment is 7 years, and can to be sold at the end of the period for 16327/1000 riyals (salvage Value). The company follows the policy of straight-line depreciation expense and require a return on investment after tax of 25%. The company pays income tax at a rate of 15%. The company is committed to providing maintenance services for all equipment leased. Maintenance cost is estimated 1500 SAR per year. 1 =1 (1+R)*(for example 5.79) t=1 1- Find the Rate of Return R = ? (for example 13) 2- Find the tax rate r =? (For example, 12) 3- Find the sum of the discount factors 5 4- Find the salvage value SV =? (For example, 1245.86) 5- Find the cost of investment CI =? (For example, 61245.86) 6- Find the depreciation D =? (For example, 1567.56) 7- Find the discounted salvage value DSVE? (For example, 2346.45) 8- Find the maintenance cost M=? (For example, 400.45) 9- Calculate the lease payment from the viewpoint of the Lessor. L =? (For example, 456739.72) CI L = +MO(1-0)OS-DODOS-DSV = (1-0) Oso(1+R)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts