Question: its one whole problem We are given the information that Microthin's stock price was $21 in December 2016, $29 in December 2017, S27 in December

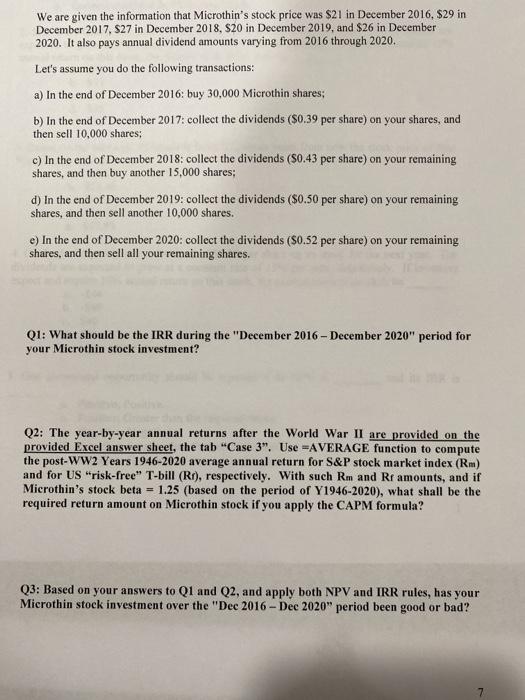

We are given the information that Microthin's stock price was $21 in December 2016, $29 in December 2017, S27 in December 2018, $20 in December 2019, and $26 in December 2020. It also pays annual dividend amounts varying from 2016 through 2020. Let's assume you do the following transactions: a) In the end of December 2016: buy 30,000 Microthin shares; b) In the end of December 2017: collect the dividends ($0.39 per share) on your shares, and then sell 10,000 shares; c) In the end of December 2018: collect the dividends ($0.43 per share) on your remaining shares, and then buy another 15,000 shares; d) In the end of December 2019: collect the dividends ($0.50 per share) on your remaining shares, and then sell another 10,000 shares. e) In the end of December 2020: collect the dividends ($0.52 per share) on your remaining shares, and then sell all your remaining shares. Q1: What should be the IRR during the "December 2016 - December 2020" period for your Microthin stock investment? Q2: The year-by-year annual returns after the World War II are provided on the provided Excel answer sheet, the tab "Case 3". Use AVERAGE function to compute the post-WW2 Years 1946-2020 average annual return for S&P stock market index (Rm) and for US "risk-free" T-bill (R), respectively. With such Rm and Rf amounts, and if Microthin's stock beta = 1.25 (based on the period of Y1946-2020), what shall be the required return amount on Microthin stock if you apply the CAPM formula? Q3: Based on your answers to Q1 and Q2, and apply both NPV and IRR rules, has your Microthin stock investment over the "Dec 2016 - Dec 2020" period been good or bad? 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts