Question: its only a one question please solve it quickly Global Company and Local Company are competitors in the same industry. Selected financial data from their

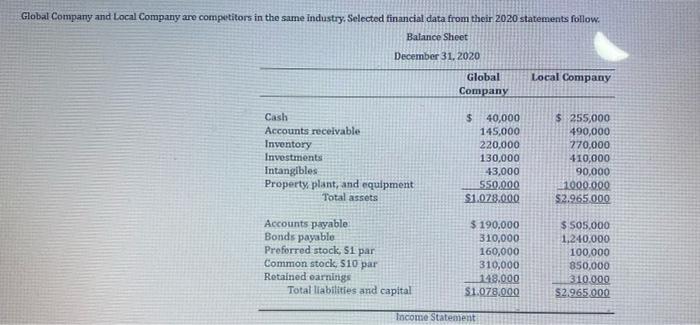

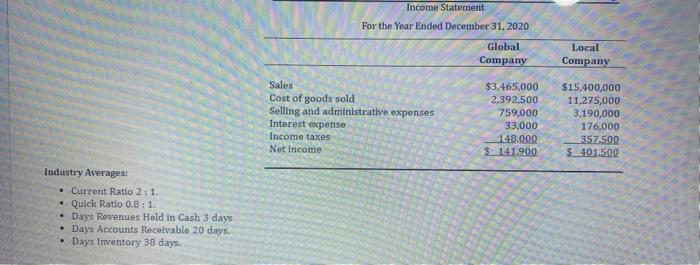

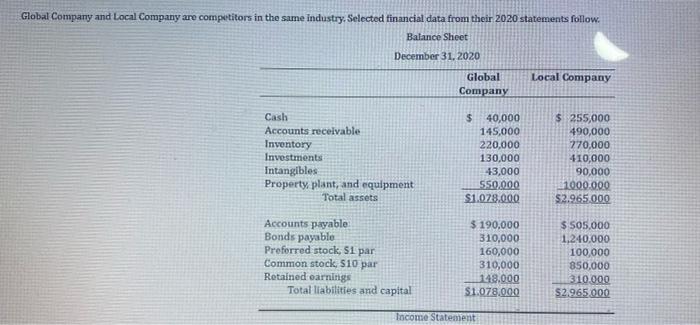

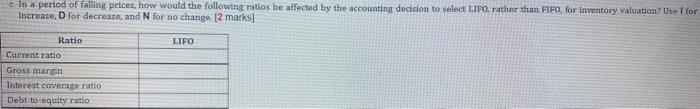

Global Company and Local Company are competitors in the same industry. Selected financial data from their 2020 statements follow. Balance Sheet December 31, 2020 Local Company Cash $ 255,000 Accounts receivable 490,000 Inventory 770,000 Investments 410,000 Intangibles 90,000 Property, plant, and equipment 1000.000 Total assets $2.965.000 $ 505,000 Accounts payable Bonds payable 1,240,000 100,000 Preferred stock, 51 par Common stock, $10 par 850,000 Retained earnings 310.000 $2.965.000 Total liabilities and capital Global Company $ 40,000 145,000 220,000 130,000 43,000 550,000 $1.078.000 $ 190,000 310,000 160,000 310,000 148.000 $1.078.000 Income Statement Industry Averages: . Current Ratio 2: 1. Quick Ratio 0.8: 1. Days Revenues Held in Cash 3 days Days Accounts Receivable 20 days. Days Inventory 38 days. Income Statement For the Year Ended December 31, 2020 Global Company Sales Cost of goods sold Selling and administrative expenses Interest expense Income taxes Net income $3,465,000 2,392,500 759,000 33,000 148.000 $141.900 Local Company $15,400,000 11,275,000 3,190,000 176,000 357.500 $ 401.500 Global Company and Local Company are competitors in the same industry. Selected financial data from their 2020 statements follow. Balance Sheet December 31, 2020 Local Company Cash $ 255,000 Accounts receivable 490,000 Inventory 770,000 Investments 410,000 Intangibles 90,000 Property, plant, and equipment 1000.000 Total assets $2.965.000 $ 505,000 Accounts payable Bonds payable 1,240,000 100,000 Preferred stock, 51 par Common stock, $10 par 850,000 Retained earnings 310.000 $2.965.000 Total liabilities and capital Global Company $ 40,000 145,000 220,000 130,000 43,000 550,000 $1.078.000 $ 190,000 310,000 160,000 310,000 148.000 $1.078.000 Income Statement e in a period of falling prices, how would the following ratios be affected by the accounting decision to select LIPO, rather than FIFO, for inventory valuation? Use I for Increase, D for decrease, and N for no change [2 marks] Ratio LIFO Current ratio Gross margin Interest coverage ratio Debt to equity ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts