Question: its only one question please!! 5 points Real World Case 4-15 (Static) Income statement format, restructuring costs; earnings per share; comprehensive income; statement of cash

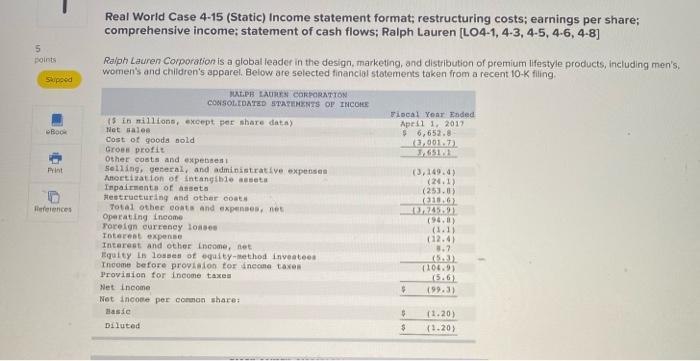

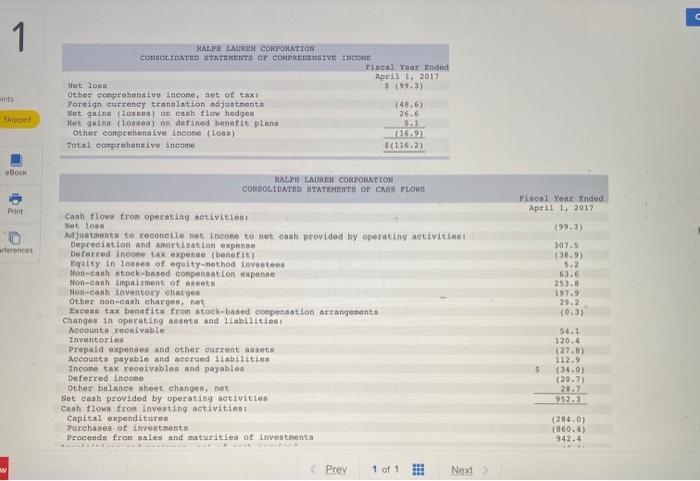

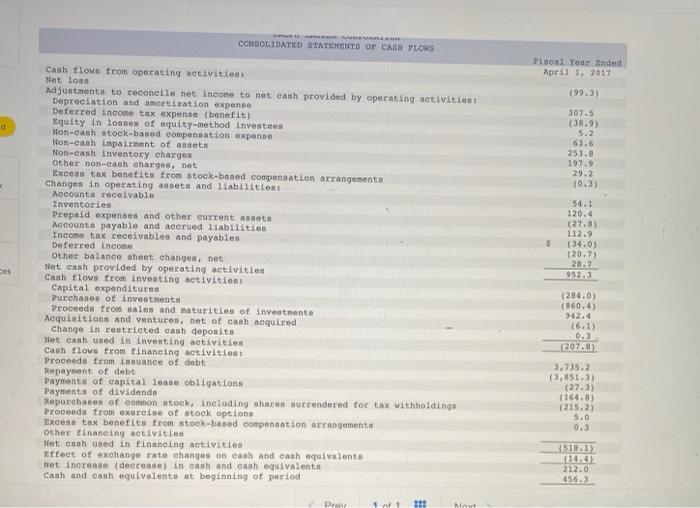

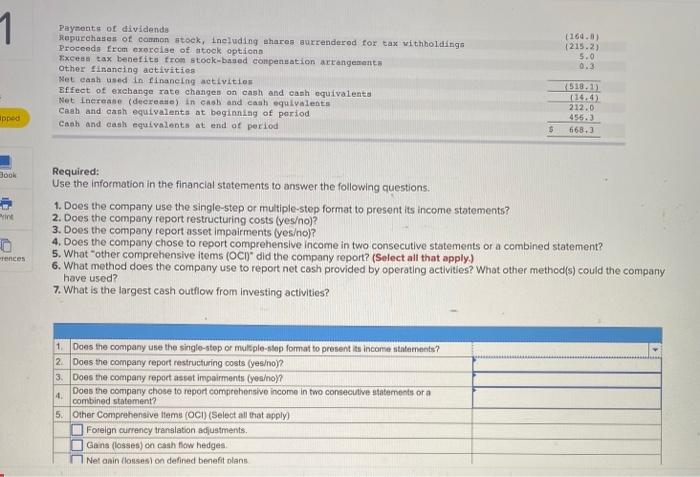

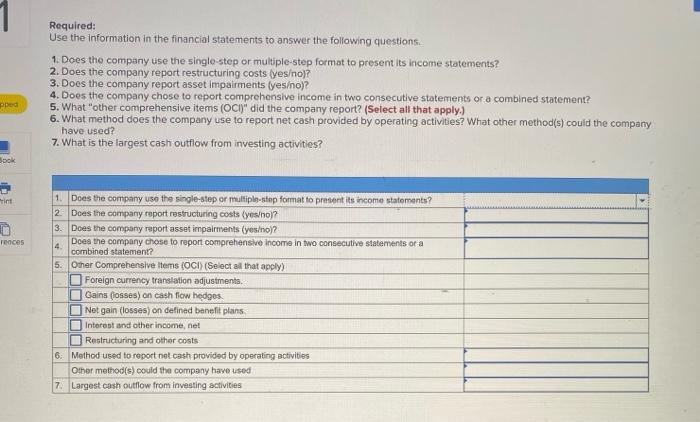

5 points Real World Case 4-15 (Static) Income statement format, restructuring costs; earnings per share; comprehensive income; statement of cash flows; Ralph Lauren (L04-1,4-3, 4-5, 4-6, 4-8) Ralph Lauren Corporation is a global leader in the design, marketing, and distribution of premium lifestyle products, including men's women's and children's apparel. Below are selected financial statements taken from a recent 10-K filing Supood ROOR Print MULPH LAUREN CORPORATION CONSOLIDATED STATEMENTS OF INCORE 15 in millions, except per share data) Natale Cost of goods sold Groos profit Other costs and expebe Selling, general, and administrative expenses Amortization of intangible sota Impairments of an eta Hestructuring and other coat Total other coats and expenses.net Operating income Foreign currency los Toteret expense Interest and other income, net Equity in loc o equity-method investees Thcome before provision for income taxon Provision for Income taxe Net Income Net Income per common share: Basse Fiscal Year Ended April 1, 2017 $ 6,652.8 2.001.1) 165111 (3,149.4) (20.1) (253.03 (6) 24503 (94.0) (1.1) (12.4) 3.7 Heerences 106.9) (5.6) 199.3) $ Diluted (1.20) (1.20) $ 1 RALPH LAUREN CORPORATION CONSOLIDATED STATEMENT OF COMPRENSIVE HOME Fiscal Year Ended Aprill 2017 Bet lose $199.3) Other comprehensive income, net of taxt Poreign currency translation adjustments 148.6) Not gains (losses) on canh tlow hedges 26.6 Hot gains (losa) on dofined benefit plena 5.1 other comprehensive incon (los) (169) Total comprehensive income $(1162) Shipped ebook RALPH LAURCH CORPORINTION CONSOLIDATED STATES OF CASH TO Fiscal Yen Inded April 1, 2017 Print (99.33 forences 307.5 38.9) 5.2 63.6 253.8 197.9 29.2 (0.3) Cash flows from operating activities Net loss ad Justments to reconcile et Income to net cash provided by operating activities Depreciation and mortisation expense Deferred Income tax expense (benefit) Equity in lood of equity-method investees Non-canh toek-based compensation expense Non-cash impairment of assets Non-canh Inventory charges Other non-canh charges, net Excess tax benefits from stock-based compensation arrangements Changes in operating assets and liabilities Accounts receivable Inventories Prepaid expenses and other current assets Accounts payable and accrued liabilities Income tax receivables and payables Deferred income Other balance sheet changes.net Net cash provided by operating activities Cash flows from investing activities Capital expenditures Purchases of investments Proceeds from sales and maturities of investments 54.1 120.4 (27.8) 112.9 (34.0) (20.7) 28.7 952.) (284.0) (860.4) 942.4 w Prey 1 of 1 Next CONSOLIDATED STATEMENTS OP CASH FLOWS Tiscal Year Ended April 1, 2017 (99.)) d 307.5 (38.93 5.2 63.6 253.0 197.9 29.2 (0.3) $ Cash flows from operating activities Not loss adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization expense Deferred income tax expense (benefit) Equity in lonnes of equity-method investees Non-cash stock-based compensation expense Non-cash impairment of assets Non-cash inventory charges other non-cal charges, net Excess tax benefits from stock-based compensation arrangements Changes in operating assets and abilities: Accounts receivable Inventories Prepaid expenses and other current assets Accounts payable and accrued liabilities Income tax receivables and payables Deferred Income Other balance sheet changes, net Net cash provided by operating activities Cash flows from investing activities Capital expenditures Purchases of investments Proceeds from sales and maturities of investments Acquisition and ventures, net of cash required Change in restricted cash deposits Net cash and in Investing activities Cash flows from financing activities Proceeds from suance of debt Repaynent of debt Payment of capital leave obligations Payment of dividendo Repurchases of common stock, including shacen surrendered for tax withholdings proceeds from exercise of stock options Excess tax benefit from stock-based compensation arrangements Other Financing activities Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Net inorento (decrease in cash and can equivalenta Cash and cash equivalents at beginning of period 54.1 120.4 (27.0) 112.9 (34.0) 120.23 28.7 952.3 es (284.0) (860.4) 942.4 16.1) 0.3 (207.0) 3.735.2 (3,851.3) (27.3) (164.0) (235.2) 5.0 0.3 15111 10.42 212.0 456.3 Prey 1 (164.0) 1215.2 5.0 0.3 Payment of dividende Repurchases of common stock, including shares surrendered for tax withholdings Proceeds from exercise of stock options Excess tax benefits from stock-based compensation arrangements Other financing activities Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalenta Net Lercase (decrease in cash and cash equivalents Caab and cash equivalents at beginning of period Cash and cash equivalents at end of period X518.1 (14.4) 212.0 pped $ 668.3 Book Print Required: Use the information in the financial statements to answer the following questions. 1. Does the company use the single-step or multiple-step format to present its income statements? 2. Does the company report restructuring costs (yeso)? 3. Does the company report asset Impairments (yeso)? 4. Does the company chose to report comprehensive income in two consecutive statements or a combined statement? 5. What other comprehensive items (OC)" did the company report? (Select all that apply.) 6. What method does the company use to report net cash provided by operating activities? What other method(s) could the company have used? 7. What is the largest cash outflow from Investing activities? rences 1. Does the company use the single-stop or multiple-stop format to present its income statements? 2. Does the company report restructuring costs (yeso)? 3. Does the company report asset impairments (yeao? Does the company chose to report comprehensive income in two consecutive statements or a combined statement? 5. Other Comprehensive Items (OCI) (Select all that apply) Foreign currency translation adjustments, Gains (losses) on cash flow hedges Netanin losses) on defined benefit olans Required: Use the information in the financial statements to answer the following questions 1. Does the company use the single-step or multiple-step format to present its income statements? 2. Does the company report restructuring costs yeso)? 3. Does the company report asset impairments (yeso)? 4. Does the company chose to report comprehensive income in two consecutive statements or a combined statement? 5. What "other comprehensive items (OCIY" did the company report? (Select all that apply.) 6. What method does the company use to report net cash provided by operating activities? What other method(s) could the company have used? 7. What is the largest cash outflow from investing activities? pped BOOK int rences 1. Does the company use the single-step or multiple-stop format to present its income statements? 2. Does the company report restructuring costs (yeso)? 3. Does the company report asset impairments (yesino)? 4. Does the company chose to report comprehensive income in two consecutive statements of a combined statement? 5. Other Comprehensive Items (OCI) (Select all that apply) Foreign currency translation adjustments. Gains (osses) on cash flow hedges. | Net gain (losses) on defined benefit plans Interest and other income, nel Restructuring and other costs 6. Method used to report net cash provided by operating activities Other method(s) could the company have used 7. Largest cash outflow from investing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts