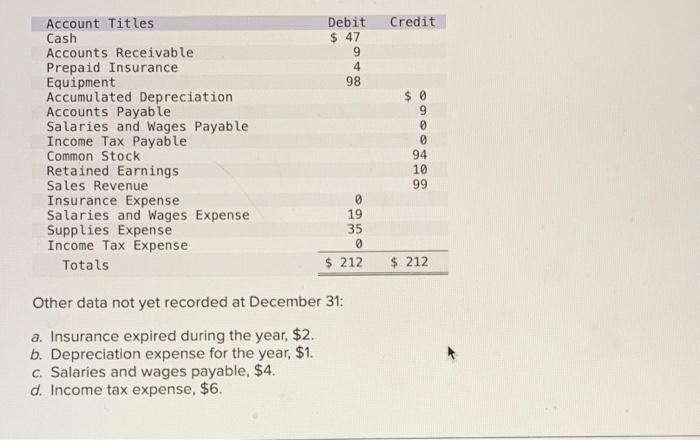

Question: its plugging in the info go make the sheet Other data not yet recorded at December 31 : a. Insurance expired during the year, $2.

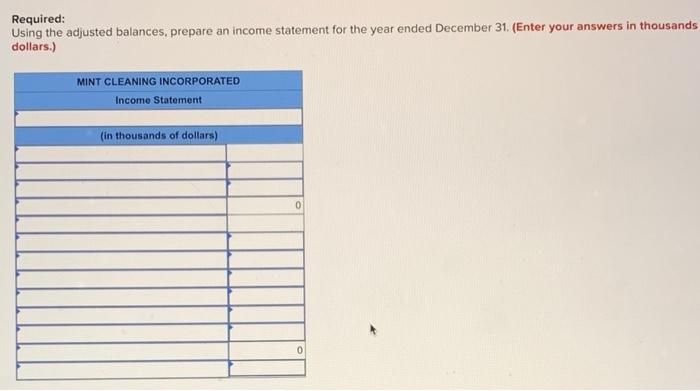

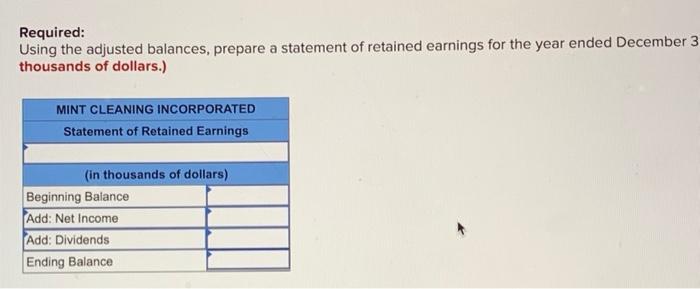

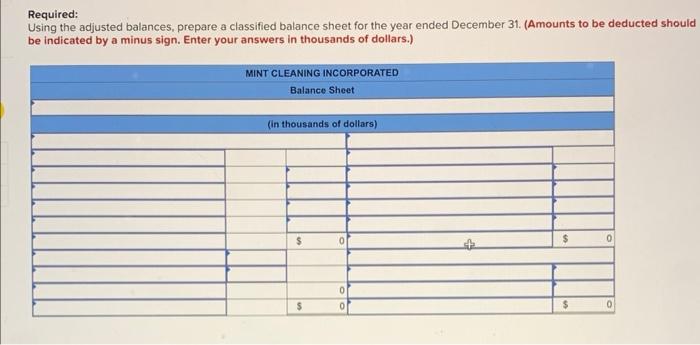

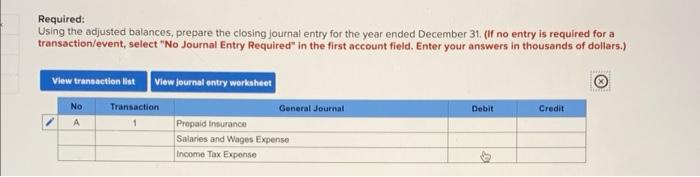

Other data not yet recorded at December 31 : a. Insurance expired during the year, $2. b. Depreciation expense for the year, $1. c. Salaries and wages payable, $4. d. Income tax expense, $6. Required: Using the adjusted balances, prepare an income statement for the year ended December 31 . (Enter your answers in thousands dollars.) Required: Using the adjusted balances, prepare a statement of retained earnings for the year ended December 3 thousands of dollars.) Required: Using the adjusted balances, prepare a classified balance sheet for the year ended December 31 . (Amounts to be deducted should Required: Using the adjusted balances, prepare the closing journal entry for the year ended December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in thousands of dollars.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts