Question: its Question 35 sorry for the mix up. CHAPTER 3 Working with Pinancial Statements 91 LO 3 LO 2 Profitability ratios 2 Profit margin Return

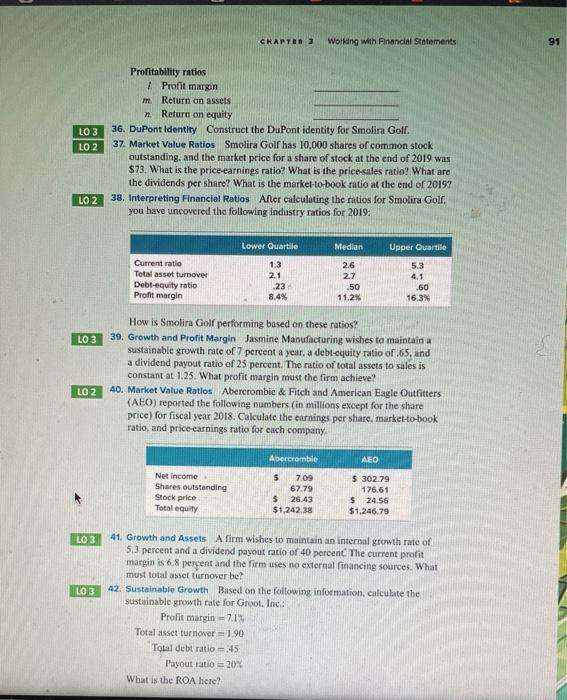

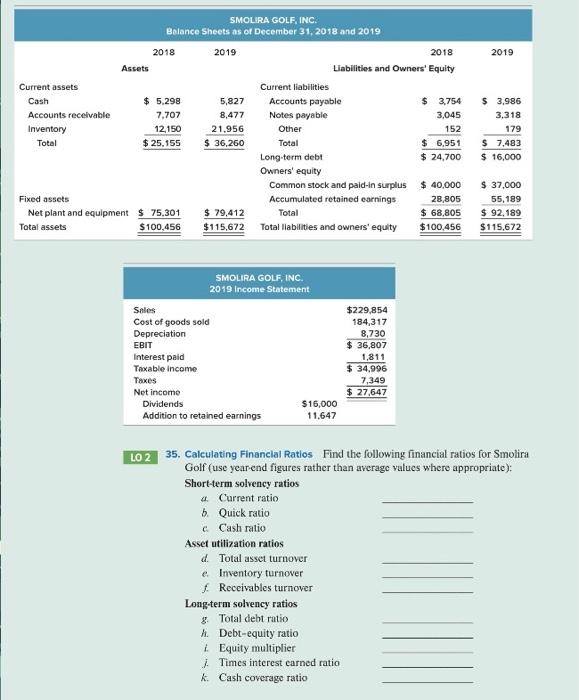

CHAPTER 3 Working with Pinancial Statements 91 LO 3 LO 2 Profitability ratios 2 Profit margin Return on assets 7. Return on equity 36. DuPont Identity Construct the DuPont identity for Smolira Golf 37. Market Value Ratios Smolira Golf has 10,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2019 was $73. What is the price earnings ratio? What is the price-sales ratio? What are the dividends per share? What is the market-to book ratio at the end of 2019? 38. Interpreting Financial Ratios Afer calculating the ratios for Smolira Golf, you have uncovered the following industry ratios for 2019: LO 2 Lower Quartile Median Upper Quartile 1.3 2.1 Current ratio Total asset turnover Debt-equity ratio Profit margin 23 2.6 2.7 .50 11.2% 5.3 4.1 .60 16.3% 8.4% LO 3 How is Smolira Golf performing based on these ratios? 39. Growth and Profit Margin Jasmine Manufacturing wishes to maintain a sustainable growth rate of 7 percent a year, a debt-equity ratio of 65, and a dividend payout ratio of 25 percent. The ratio of total assets to sales is constant at 1.25. What profit margin must the firm achieve? 40. Market Value Ratlos Abercrombie & Fitch and American Eagle Outfitters (AEO) reported the following numbers (in millions except for the share price) for fiscal year 2018. Calculate the earnings per share, market-to-book ratio, and price carnings ratio for each company LO 2 Abercrombie AEO Net income Shares outstanding Stock price Total equity $ 7.09 67.79 $ 26.43 $1,242.38 $ 302.79 176.61 $24.56 $1,246.79 LO 3 41. Growth and Assets Afirm wishes to maintain an internal growth rate of 5.3 percent and a dividend payout ratio of 40 percent. The current profit margin is 6.8 percent and the firm uses no external financing sources. What must total asset turnover be? LO 3 42. Sustainable Growth Based on the following information, calculate the sustainable growth rate for Groot, Inc. Profit margin = 713 Total asset turnover=1.90 Total debt ratio = 45 Payout ratio = 20% What is the ROA here? 2019 8.477 SMOLIRA GOLF, INC Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 5.298 5,827 Accounts payable $ 3.754 Accounts receivable 7,707 Notes payable 3,045 Inventory 12,150 21.956 Other 152 Total $ 25,155 $ 36,260 Total $ 6,951 Long-term debt $ 24,700 Owners' equity Common stock and paid-in surplus $ 40,000 Fixed assets Accumulated retained earnings 28,805 Net plant and equipment $ 75.301 $ 79,412 Total $ 68,805 Total assets $100.456 $115,672 Total llabilities and owners' equity $100,456 $ 3,986 3,318 179 $ 7,483 $ 16,000 $ 37,000 55,189 $ 92,189 $115,672 SMOLIRA GOLF, INC. 2019 Income Statement Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes Net income Dividends $15,000 Addition to retained earnings 11.647 $229,854 184,317 8.730 $ 36,807 1,811 $ 34,996 7,349 $ 27,647 LO 2 35. Calculating Financial Ratios Find the following financial ratios for Smolira Golf (use year end figures rather than average values where appropriate): Short-term solvency ratios 4. Current ratio 6. Quick ratio c Cash ratio Asset utilization ratios d. Total asset turnover e Inventory turnover Receivables turnover Long-term solvency ratios & Total debt ratio A Debt-equity ratio i Equity multiplier Times interest earned ratio k Cash coverage ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts