Question: its so important i only have these left, please solve. Ostin 17010 Question 17 Your computer system crashed and duraped the accounting records of your

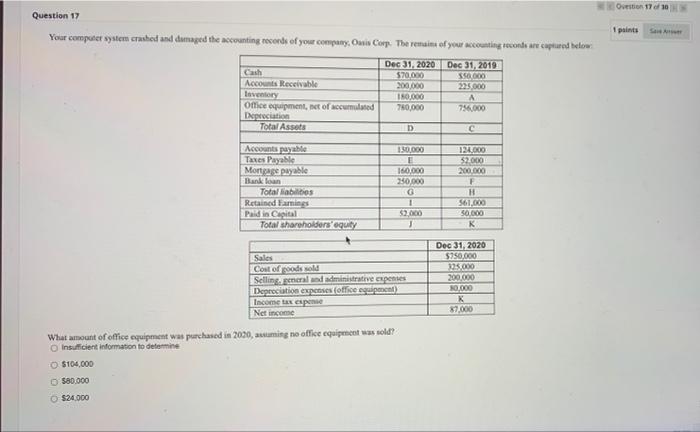

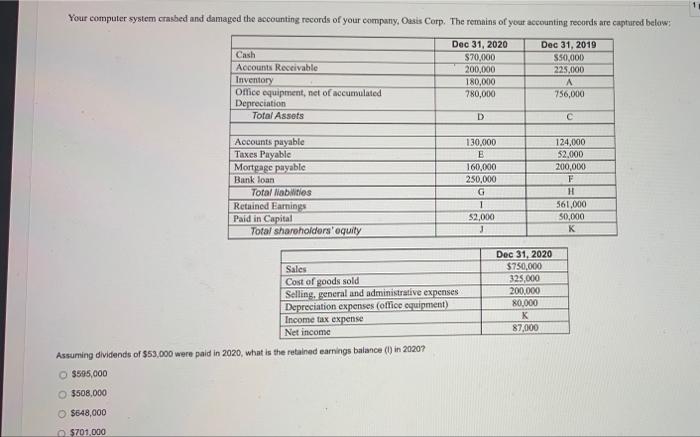

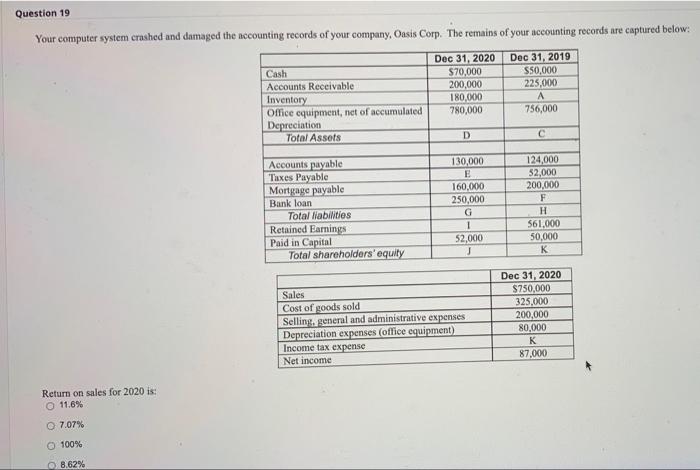

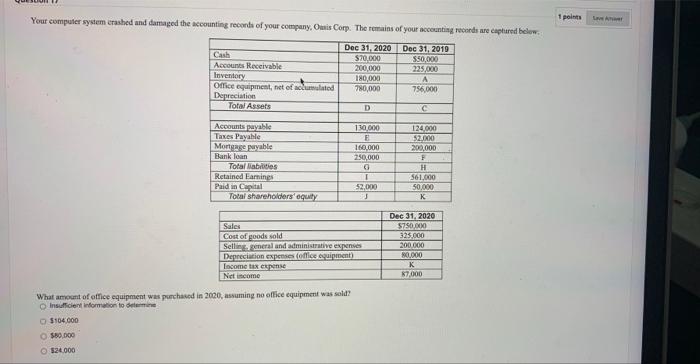

Ostin 17010 Question 17 Your computer system crashed and duraped the accounting records of your company. Ouris Coop. The remains of your accounting seconds are captured below paints Dec 31, 2020 570.000 200,000 180.000 780,000 Dec 31, 2019 350.000 225.000 A Accounts Receivable Inventory Office equipment, et of accumulated Depreciation Total Assets D Accounts payable Taxes Payable Mortgage payable Bank loan Total liabilities Retained larings Paid in Capital Total Shareholders oquity 150,000 E 160.000 250.000 124 $2.000 200.000 F H 1 $2.000 SO 000 K Sales Cost of goods sold Selling, peradministrative spentes Depreciation expenses (office equipment Income tax expense Not income Dec 31, 2020 $750,000 105.000 200 000 0.000 K 87.000 What amount of office equipment was purchased in 2030, assuming no office equipment was told! Insufficient information to determine $104,000 $80.000 524.000 Your computer system crasbed and damaged the accounting records of your company, Oasis Corp. The remains of your accounting records are captured below: Cash Accounts Receivable Inventory Office equipment, net of accumulated Depreciation Total Assets Dec 31, 2020 $70,000 200,000 180,000 780,000 Dec 31, 2019 $50,000 225,000 A 756,000 D Accounts payable Taxes Payable Mortgage payable Bank loan Total Mobiles Retained Earnings Paid in Capital shareholders' equity 130.000 E 160,000 250,000 G 1 $2,000 124,000 52.000 200,000 F H 561,000 50,000 K Dec 31, 2020 $750,000 325,000 200.000 80,000 K 87,000 Sales Cost of goods sold Selling, general and administrative expenses Depreciation expenses (office equipment) Income tax expense Net income Assuming dividends of $53,000 were paid in 2020, what is the retained earnings balance (1) in 2020? $595,000 $508,000 $548,000 $701 000 Question 19 Your computer system crashed and damaged the necounting records of your company, Oasis Corp. The remains of your accounting records are captured below: Cash Accounts Receivable Inventory Office equipment, net of accumulated Depreciation Total Assets Dec 31, 2020 $70,000 200,000 180,000 780,000 Dec 31, 2019 S50,000 225,000 756,000 D Accounts payable Taxes Payable Mortgage payable Bank loan Total liabilities Retained Earnings Paid in Capital Total shareholders' equity 130,000 E 160,000 250,000 G 1 52,000 124,000 32,000 200,000 F H 561,000 50,000 K Sales Cost of goods sold Selling, general and administrative expenses Depreciation expenses (office equipment) Income tax expense Net income Dec 31, 2020 $750,000 325.000 200,000 80,000 K 87,000 Return on sales for 2020 is 11.6% 07.07% 100% O 8.62% points Your computer system crashed and damaged the accounting records of your company. Ois Corp. The remains of your accounting records are captured below Cash Accounts Receivable Inventory Office equipment, niet of oumated Depreciation Total Assets Dec 31, 2020 $70,000 200,000 180,000 780,000 Dec 31, 2019 $50,000 225.000 A 756,000 D C Accounts payable Taxes Payable Mortgage payable Bank loan Total abilities Retained Earnings Paid in Capital Total Shareholders' equity 130,000 E 160.000 250,000 124.000 520000 200,000 F 561.000 50.000 K 1 52.000 Sales Cost of goods sold Selling general and administrative expenses Depreciation expenses office equipment) Income tax expense Net Income Dec 31, 2020 $750,000 325.000 200 000 0.000 K 57.000 What amount of office equipment was purchased in 2000, asuming no office equipment was sold? Insufficient Information to tootmine 1104 000 550.000 524.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts