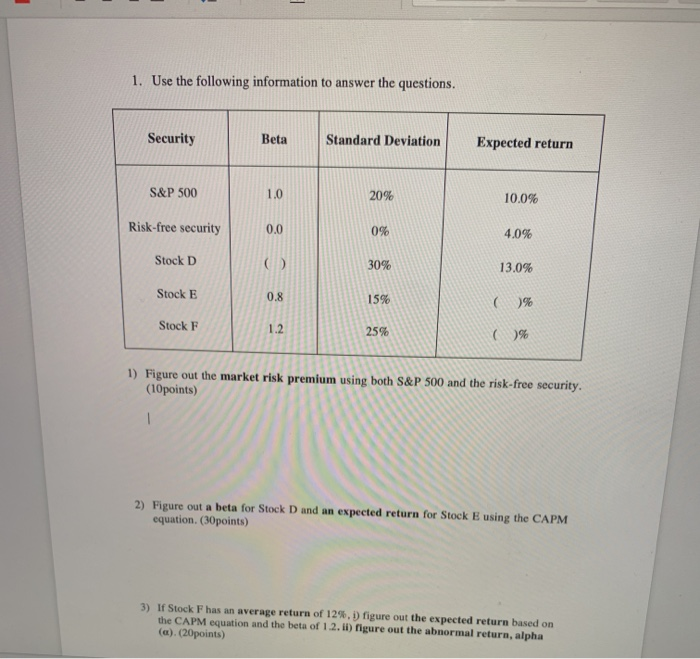

Question: its the same question. 1. Use the following information to answer the questions. Security Beta Standard Deviation Expected return S&P 500 20% 10.0% Risk-free security

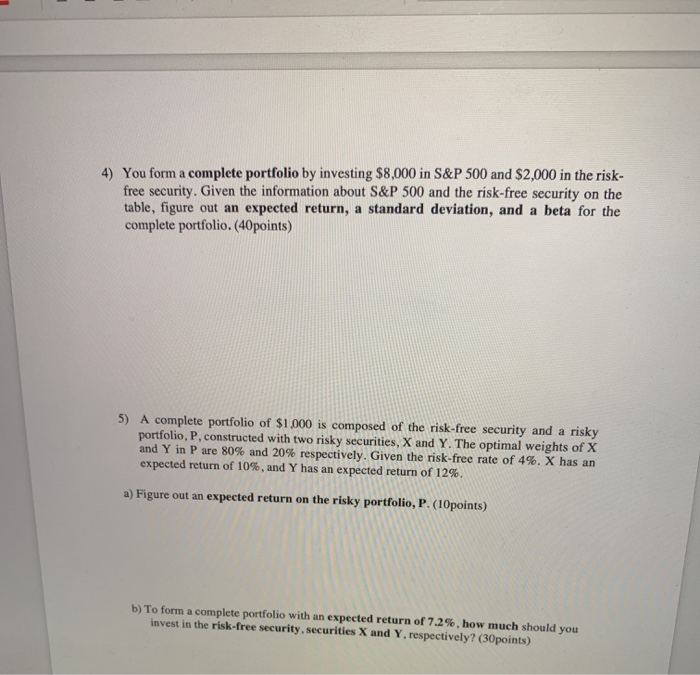

1. Use the following information to answer the questions. Security Beta Standard Deviation Expected return S&P 500 20% 10.0% Risk-free security 0% 4.0% Stock D 30% 13.0% Stock E 15% ( )% Stock F 25% ( % 1) Figure out the market risk premium (10points) using both S&P 500 and the risk-free security. 2) Figure out a beta for Stock D and an expected return for Stock E using the CAPM equation. (30points) 3) I Stock F has an average return of 129.D) figure out the expected return based on the CAPM equation and the beta of 1.2.) figure out the abnormal return, alpha (a) (20points) 4) You form a complete portfolio by investing $8,000 in S&P 500 and $2,000 in the risk- free security. Given the information about S&P 500 and the risk-free security on the table, figure out an expected return, a standard deviation, and a beta for the complete portfolio. (40points) 5) A complete portfolio of $1,000 is composed of the risk-free security and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 80% and 20% respectively. Given the risk-free rate of 4%. X has an expected return of 10%, and Y has an expected return of 12%. a) Figure out an expected return on the risky portfolio, P. (10points) b) To form a complete portfolio with an expected return of 7.2%, how much should you invest in the risk-free security, securities X and Y respectively? (30points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts