Question: its theoretical rationale. ( Do not prepare a revised statement. ) P 4 . 6 ( LO 3 , 4 , 5 ) ( Retained

its theoretical rationale. Do not prepare a revised statement.

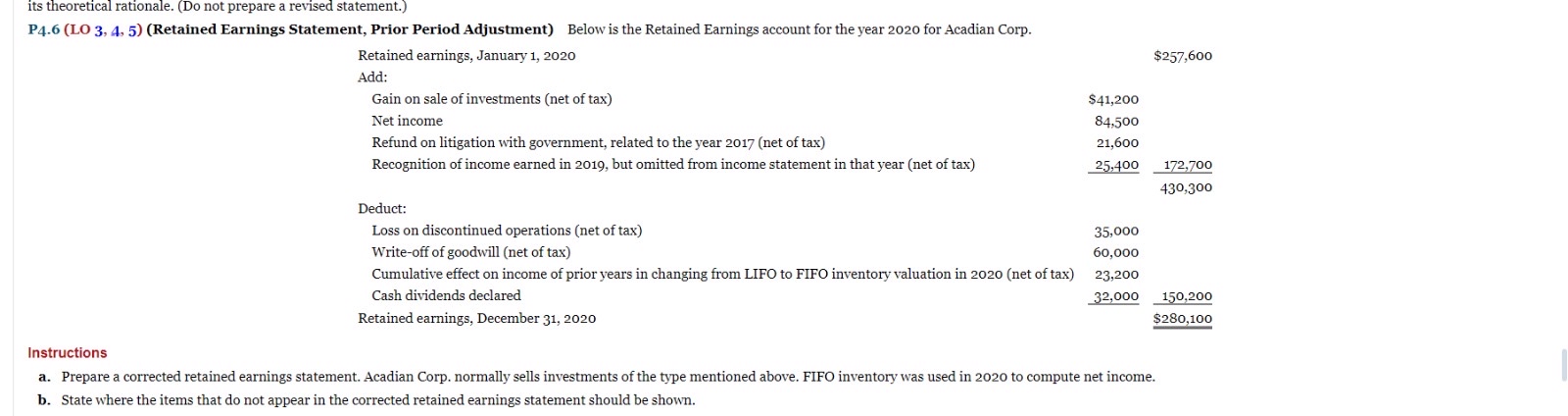

PLO Retained Earnings Statement, Prior Period Adjustment Below is the Retained Earnings account for the year for Acadian Corp.

tableRetained earnings, January Add:Gain on sale of investments net of taxNet incomeRefund on litigation with government, related to the year net of taxRecognition of income earned in but omitted from income statement in that year net of taxDeduct:Loss on discontinued operations net of taxWriteoff of goodwill net of taxCumulative effect on income of prior years in changing from LIFO to FIFO inventory valuation in net of taxCash dividends declaredRetained earnings, December

Instructions

a Prepare a corrected retained earnings statement. Acadian Corp. normally sells investments of the type mentioned above. FIFO inventory was used in to compute net income.

b State where the items that do not appear in the corrected retained earnings statement should be shown.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock