Question: it's three questions if someone can help me before the deadline Homework: Homework ch7 Question 3, P7-13 (similar to) HW Score: 29.17%, 1.75 of 6

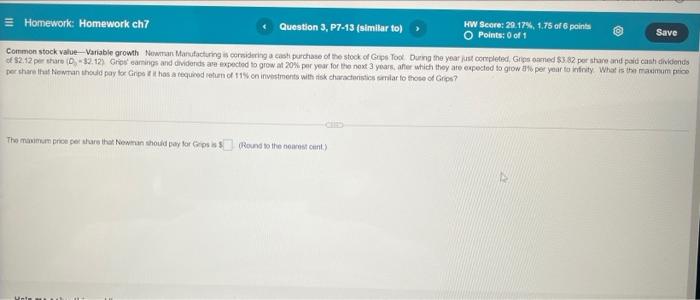

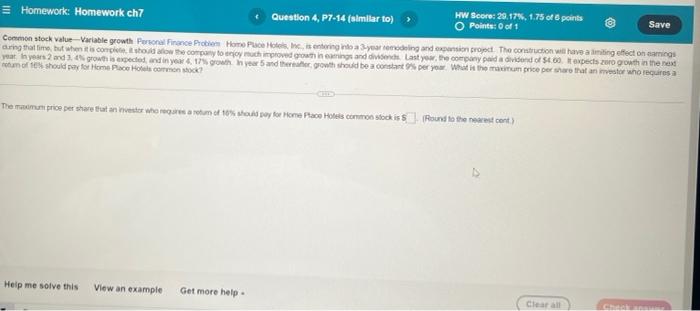

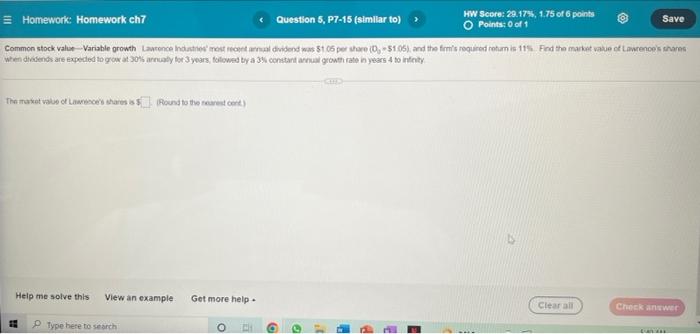

Homework: Homework ch7 Question 3, P7-13 (similar to) HW Score: 29.17%, 1.75 of 6 points O Points: 0 of 1 Save Common stock value-Variable growth Newman Manufacturing is considering a cash purchase of the stock of Grips Tool During the year just completed, Grips oamed $3.82 per share and paid cash dividends of $2.12 per share (D-32.12) Grips' earings and dividends are expected to grow at 20% per year for the next 3 years, after which they are expected to grow 8% per year to infinity What is the maximum price per share that Newman should pay for Grips if it has a required return of 11% on investments with risk characteristics similar to those of Grips? The maximum price per share that Newman should pay for Grips is $(Round to the nearest cent) Homework: Homework ch7 Question 4, P7-14 (similar to) HW Score: 29.17%, 1.75 of 6 points O Points: 0 of 1 Save Common stock value-Variable growth Personal Finance Problem Home Place Hotels, Inc, is entering into a 3-year remodeling and expansion project. The construction will have a limiting effect on earings during that time, but when it is complete, it should allow the company to enjoy much improved growth in earnings and dividends. Last year, the company paid a dividend of $4.00. It expects zero growth in the next year in years 2 and 3, 4% growth is expected, and in year 4, 17% growth in year 5 and thereafter, growth should be a constant 9% per year. What is the maximum price per share that an investor who requires a rotum of 10% should pay for Home Place Hotels common stock? The maximum price per share that an investor who requires a retum of 10% should pay for Home Place Hotels common stock is $(Round to the nearest cont.) Help me solve this View an example Get more help Chick an Clear all HW Score: 29.17%, 1.75 of 6 points O Points: 0 of 1 Save = Homework: Homework ch7 Question 5, P7-15 (similar to) Common stock value Variable growth Lawrence Industries' most recent annual dividend was $1.05 per share (D, -51.05), and the firm's required return is 11% Find the market value of Lawrence's shares when dividends are expected to grow at 30% annualy for 3 years, followed by a 3% constant annual growth rate in years 4 to infinity Kup The market value of Lawrence's shares is 5 (Round to the nearest cont.) Help me solve this View an example Get more help. Clear all Check answer 214 CONTA E Type here to search B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts