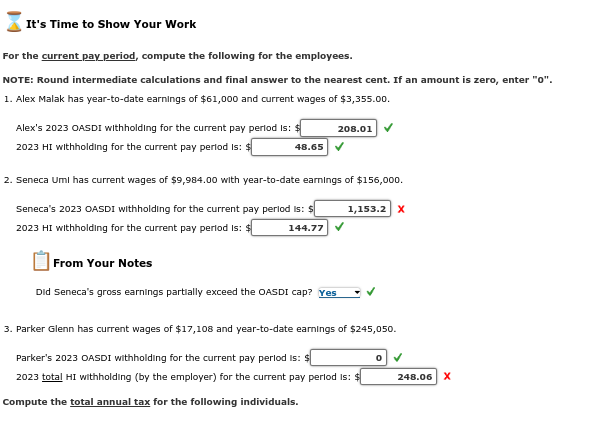

Question: It's Time t o Show Your Work For the current pay period, compute the following for the employees. NOTE: Round intermediate calculations and final answer

It's Time Show Your Work

For the current pay period, compute the following for the employees.

NOTE: Round intermediate calculations and final answer the nearest cent. amount zero, enter

Alex Malak has yeardate earnings and current wages

Alex's OASDI withholding for the current pay period : :

withholding for the current pay period :

Seneca Uml has current wages with yeardate earnings

Seneca's OASDI withholding for the current pay perlod : $

withholding for the current pay period :

From Your Notes

DId Seneca's gross earnings partially exceed the OASDI cap?

Parker Glenn has current wages and yeardate earnings $

Parker's OASDI withholding for the current pay perlod : $ total withholding the employer for the current pay period :

Compute the total annual tax for the following individuals.

From Your Notes

Hint: Recall that selfemployed individuals owe the additional tax their earnings exceed $ Although there employer withhold, should included their total lability.

Note: Round intermediate calculations and final answer the nearest cent.

Bobbl Cay has selfemployment earnings $

Bobbi's total annual selfemployment taxes are: $

Jerl Keely has selfemployment earnings $

Jerl's total annual selfemployment taxes are:

Laken Sasha has selfemployment earnings $

Laken's total annual selfemployment taxes are: $

Compute the following for Wayne Gretzky, who both employee and selfemployed.

Note: Round intermediate calculations and final answer the nearest cent.

Wayne Gretzky employed the National Hockey League earning $ annually. And, during the off season, earns $ giving golf lessons.

Wayne's total FICA and SECA taxes for the year are: $

Nalser has current wages $ and yeardate earnings $

Nalser has withholding, for this pay perlod, : $

The supplemental withholding the employer for this pay period, : $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock