Question: Its under one question but different scenarios so please I will need all answered. Thanks!! March 15 Health Insurance, retirement, unemployment insurance 1. Ruth contributes

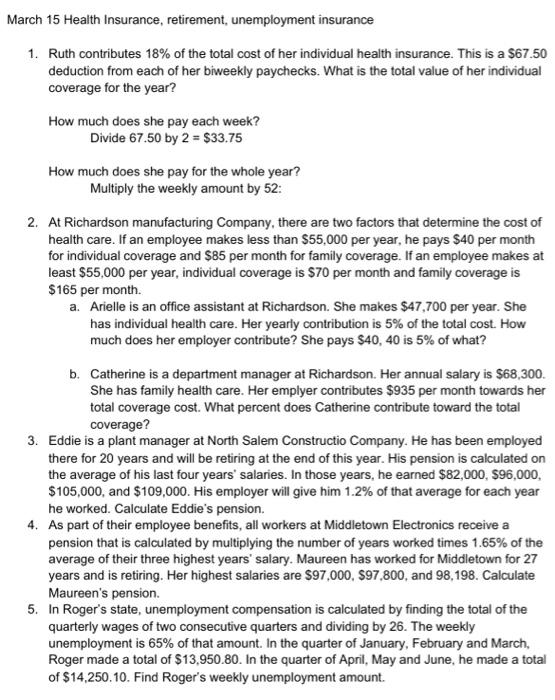

March 15 Health Insurance, retirement, unemployment insurance 1. Ruth contributes 18% of the total cost of her individual health insurance. This is a $67.50 deduction from each of her biweekly paychecks. What is the total value of her individual coverage for the year? How much does she pay each week? Divide 67.50 by 2 = $33.75 How much does she pay for the whole year? Multiply the weekly amount by 52: 2. At Richardson manufacturing Company, there are two factors that determine the cost of health care. If an employee makes less than $55,000 per year, he pays $40 per month for individual coverage and $85 per month for family coverage. If an employee makes at least $55,000 per year, individual coverage is $70 per month and family coverage is $165 per month. a. Arielle is an office assistant at Richardson. She makes $47,700 per year. She has individual health care. Her yearly contribution is 5% of the total cost. How much does her employer contribute? She pays $40, 40 is 5% of what? b. Catherine is a department manager at Richardson. Her annual salary is $68,300. She has family health care. Her emplyer contributes $935 per month towards her total coverage cost. What percent does Catherine contribute toward the total coverage? 3. Eddie is a plant manager at North Salem Constructio Company. He has been employed there for 20 years and will be retiring at the end of this year. His pension is calculated on the average of his last four years' salaries. In those years, he earned $82,000, $96,000, $105,000, and $109,000. His employer will give him 1.2% of that average for each year he worked. Calculate Eddie's pension. 4. As part of their employee benefits, all workers at Middletown Electronics receive a pension that is calculated by multiplying the number of years worked times 1.65% of the average of their three highest years' salary. Maureen has worked for Middletown for 27 years and is retiring. Her highest salaries are $97,000, $97,800, and 98,198. Calculate Maureen's pension 5. In Roger's state, unemployment compensation is calculated by finding the total of the quarterly wages of two consecutive quarters and dividing by 26. The weekly unemployment is 65% of that amount. In the quarter of January, February and March, Roger made a total of $13,950.80. In the quarter of April, May and June, he made a total of $14,250.10. Find Roger's weekly unemployment amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts