Question: IV. (8 points) EXPLAIN FULLY why, for a home country linked to the world through the FX market, home monetary policy is completely ineffective at

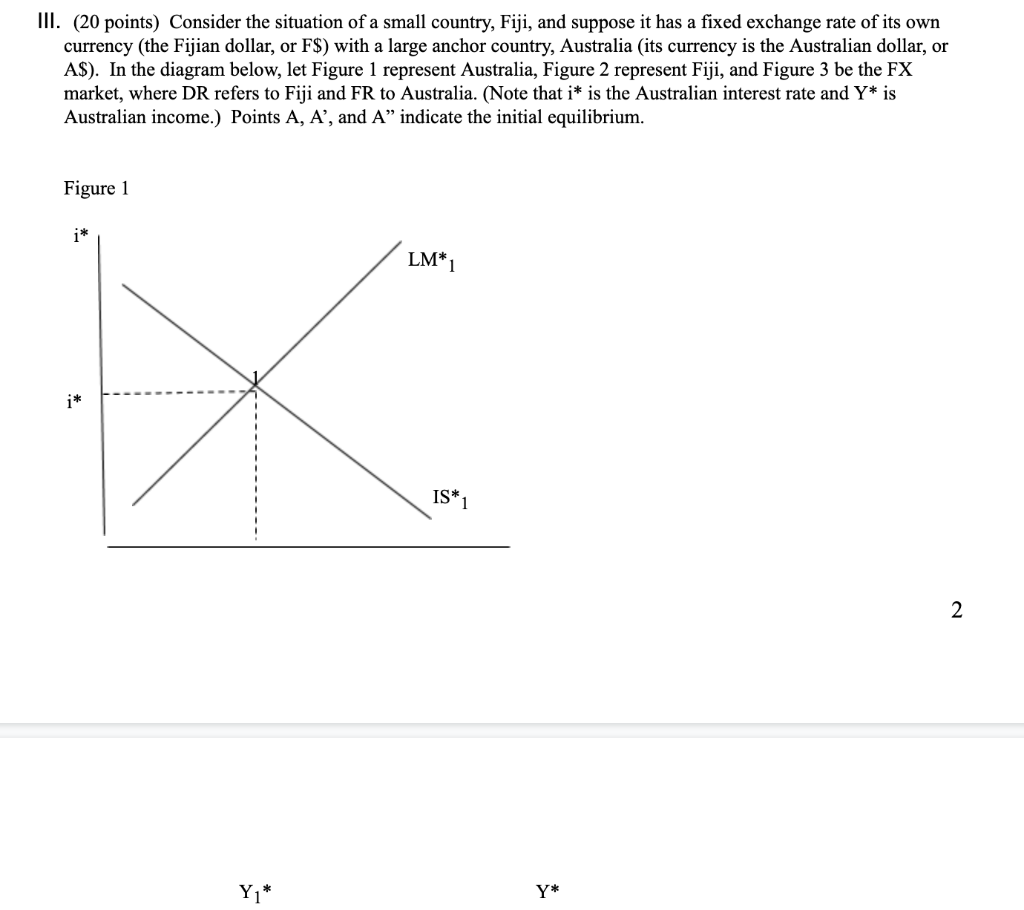

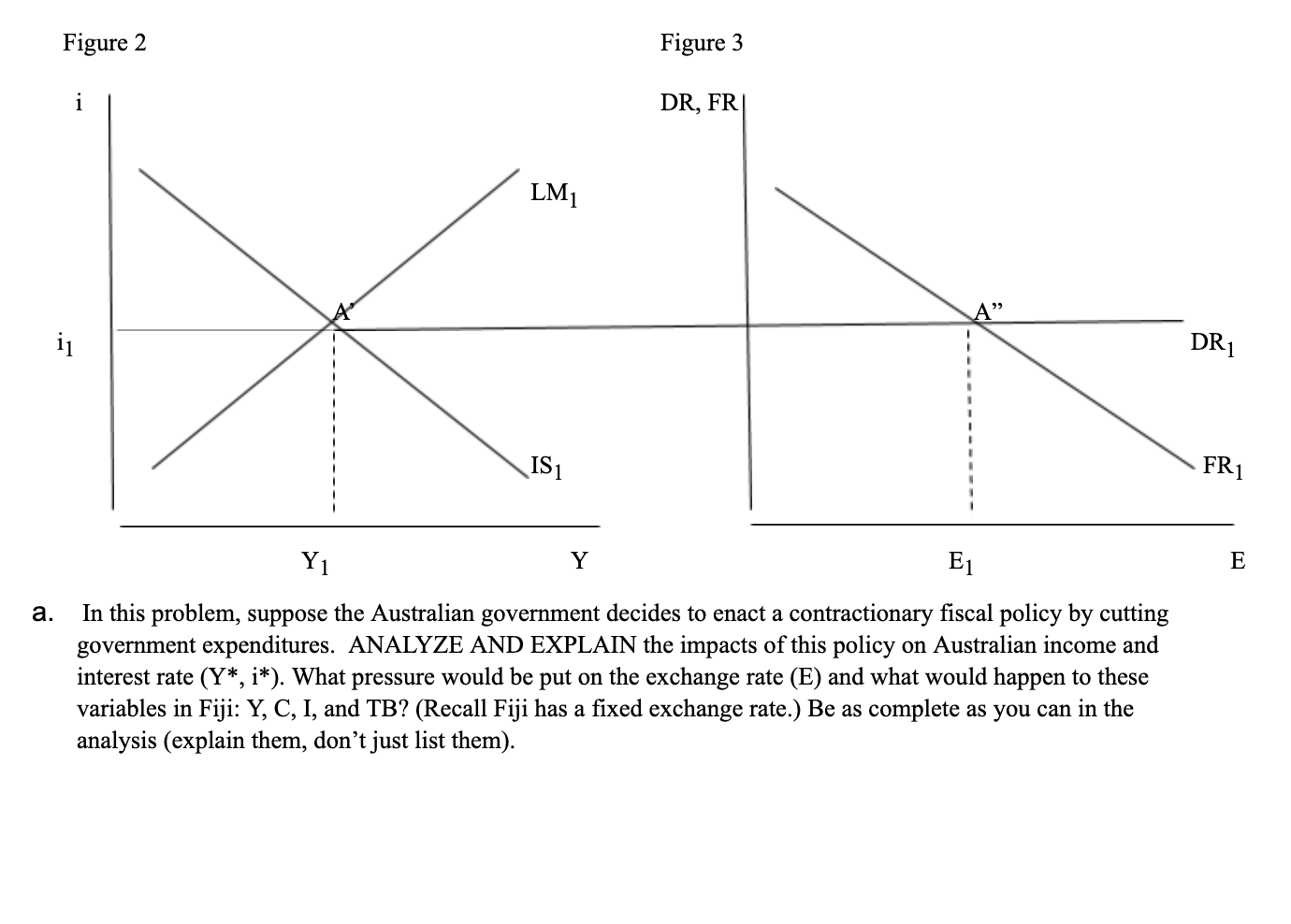

IV. (8 points) EXPLAIN FULLY why, for a home country linked to the world through the FX market, home monetary policy is completely ineffective at expanding home output under a fixed exchange rate but fiscal policy is highly effective under a fixed exchange rate. III. (20 points) Consider the situation of a small country, Fiji, and suppose it has a fixed exchange rate of its own currency (the Fijian dollar, or F$) with a large anchor country, Australia (its currency is the Australian dollar, or A$). In the diagram below, let Figure 1 represent Australia, Figure 2 represent Fiji, and Figure 3 be the FX market, where DR refers to Fiji and FR to Australia. (Note that i* is the Australian interest rate and Y* is Australian income.) Points A, A', and A indicate the initial equilibrium. Figure 1 i* LM* IS1 Y1* Y* Figure 2 Figure 3 DR, FR| LM1 DR1 Y 1 E1 E a. In this problem, suppose the Australian government decides to enact a contractionary fiscal policy by cutting government expenditures. ANALYZE AND EXPLAIN the impacts of this policy on Australian income and interest rate (Y*, i*). What pressure would be put on the exchange rate (E) and what would happen to these variables in Fiji: Y, C, I, and TB? (Recall Fiji has a fixed exchange rate.) Be as complete as you can in the analysis (explain them, don't just list them). b. Now suppose the Australian central bank chooses to return Australian income to its initial level Y * through stabilization policy. DISCUSS what the Australian central bank would do to achieve this income stabilization and EXPLAIN the effects on i* (Australian interest rate) and on Y, i, E, C, I, and TB (Fijian variables). c. EXPLAIN how this situation demonstrates that Fiji's macroeconomic situation is highly dependent on Australian policy. Explain reasons why Fiji might choose to have this kind of fixed exchange rate policy. IV. (8 points) EXPLAIN FULLY why, for a home country linked to the world through the FX market, home monetary policy is completely ineffective at expanding home output under a fixed exchange rate but fiscal policy is highly effective under a fixed exchange rate. III. (20 points) Consider the situation of a small country, Fiji, and suppose it has a fixed exchange rate of its own currency (the Fijian dollar, or F$) with a large anchor country, Australia (its currency is the Australian dollar, or A$). In the diagram below, let Figure 1 represent Australia, Figure 2 represent Fiji, and Figure 3 be the FX market, where DR refers to Fiji and FR to Australia. (Note that i* is the Australian interest rate and Y* is Australian income.) Points A, A', and A indicate the initial equilibrium. Figure 1 i* LM* IS1 Y1* Y* Figure 2 Figure 3 DR, FR| LM1 DR1 Y 1 E1 E a. In this problem, suppose the Australian government decides to enact a contractionary fiscal policy by cutting government expenditures. ANALYZE AND EXPLAIN the impacts of this policy on Australian income and interest rate (Y*, i*). What pressure would be put on the exchange rate (E) and what would happen to these variables in Fiji: Y, C, I, and TB? (Recall Fiji has a fixed exchange rate.) Be as complete as you can in the analysis (explain them, don't just list them). b. Now suppose the Australian central bank chooses to return Australian income to its initial level Y * through stabilization policy. DISCUSS what the Australian central bank would do to achieve this income stabilization and EXPLAIN the effects on i* (Australian interest rate) and on Y, i, E, C, I, and TB (Fijian variables). c. EXPLAIN how this situation demonstrates that Fiji's macroeconomic situation is highly dependent on Australian policy. Explain reasons why Fiji might choose to have this kind of fixed exchange rate policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts