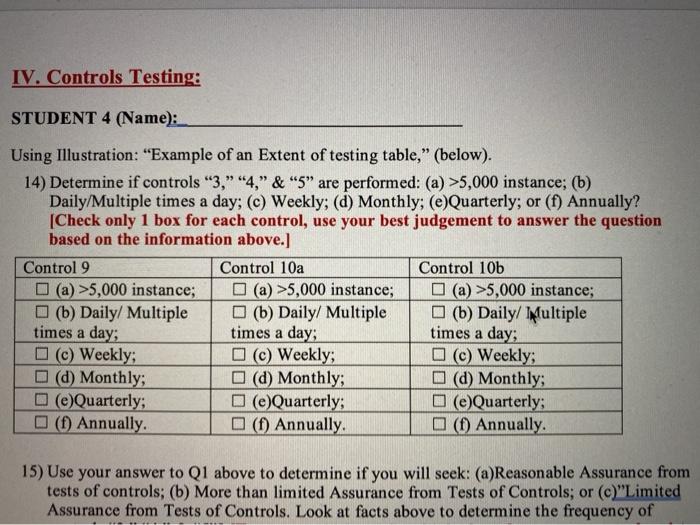

Question: IV. Controls Testing: STUDENT 4 (Name): Using Illustration: Example of an Extent of testing table, (below). 14) Determine if controls 3, 4, & 5 are

![the information above.] Control 9 Control 10a Control 10b (a) >5,000 instance;](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6703dbe8719ff_1516703dbe7f4097.jpg)

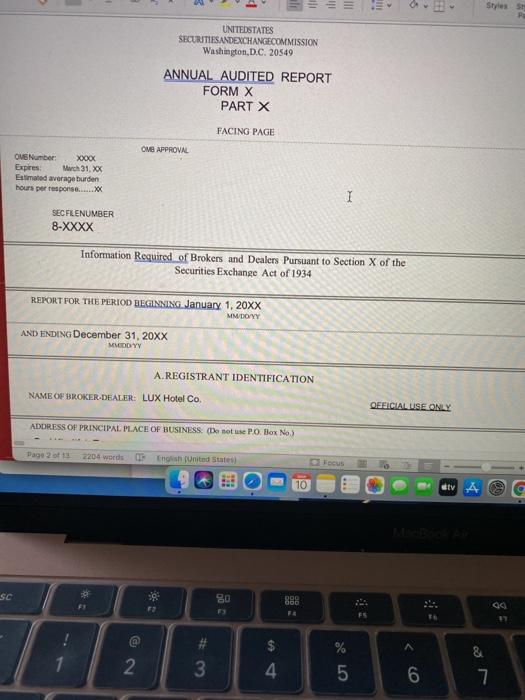

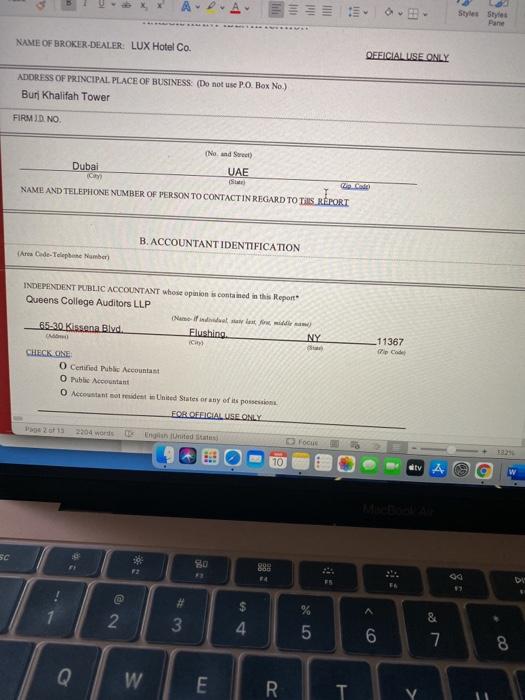

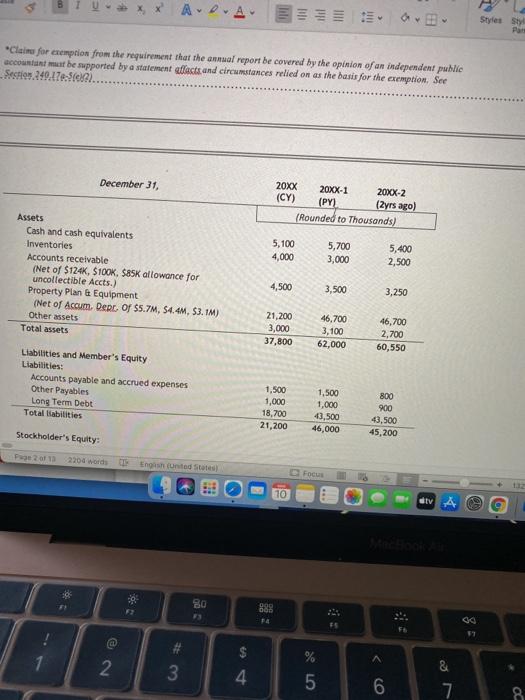

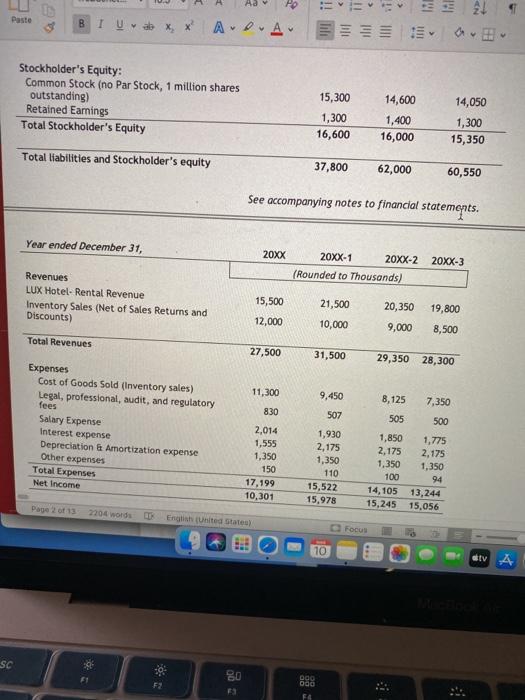

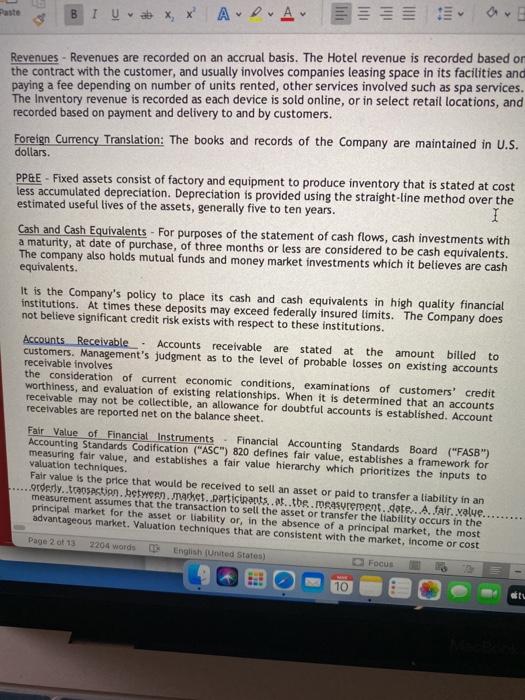

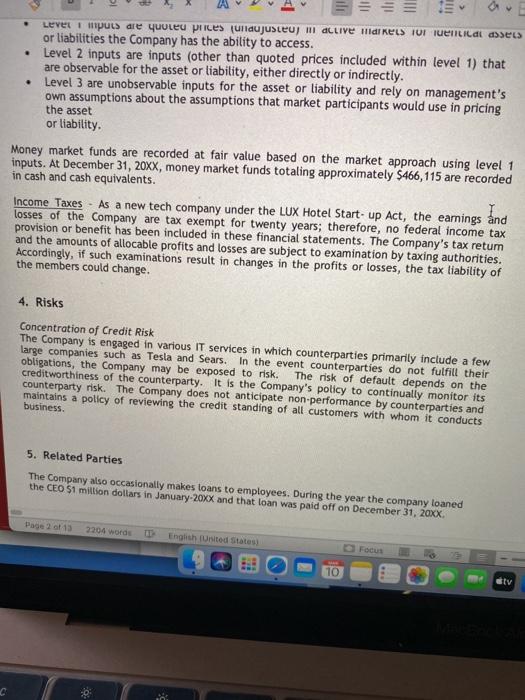

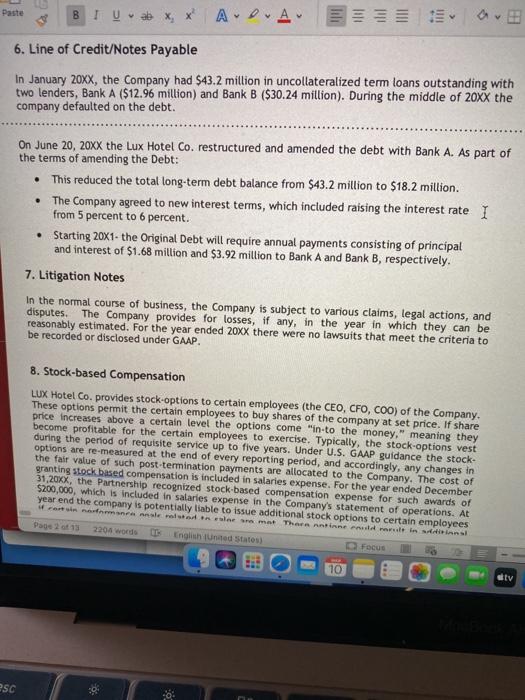

IV. Controls Testing: STUDENT 4 (Name): Using Illustration: "Example of an Extent of testing table," (below). 14) Determine if controls "3, 4, & 5 are performed: (a) >5,000 instance; (b) Daily/Multiple times a day; (c) Weekly; (d) Monthly; (e)Quarterly; or (f) Annually? [Check only 1 box for each control, use your best judgement to answer the question based on the information above.] Control 9 Control 10a Control 10b (a) >5,000 instance; (a) >5,000 instance; (a) >5,000 instance; (b) Daily/ Multiple (b) Daily/ Multiple (b) Daily/ Multiple times a day; times a day; times a day; (c) Weekly; c) Weekly; (c) Weekly (d) Monthly; (d) Monthly; (d) Monthly; (e)Quarterly; (e)Quarterly; (e)Quarterly: (1) Annually. (1) Annually. (1) Annually. 15) Use your answer to Q1 above to determine if you will seek: (a)Reasonable Assurance from tests of controls; (b) More than limited Assurance from Tests of Controls; or (c)"Limited Assurance from Tests of Controls. Look at facts above to determine the frequency of Styles UNITEDSTATES SECURITIESANDEXCHANGECOMMISSION Washington, D.C. 20549 ANNUAL AUDITED REPORT FORM X PART X FACING PAGE OMS APPROVAL OM Number: xoox Expires March 31. XX Estimated average burden hours per response......XX I SECFLENUMBER 8-XXXX Information Required of Brokers and Dealers Pursuant to Section X of the Securities Exchange Act of 1934 REPORT FOR THE PERIOD BEGINNING January 1, 20XX MM/DD/YY AND ENDING December 31, 20XX MODYY A REGISTRANT IDENTIFICATION NAME OF BROKER DEALER: LUX Hotel Co. QEFICIAL LISE ONLY ADDRESS OF PRINCIPAL PLACE OF BUSINESS: (De not PO Box No.) Dago 21 2204 words English (United States) 10 tv TO SC BO 000 oog ES % 2 3 4 5 6 7 A Styles Style Pane NAME OF BROKER DEALER: LUX Hotel Co. OFFICIAL USE ONLY ADDRESS OF PRINCIPAL PLACE OF BUSINESS (Do not use PO Box No.) Burj Khalifah Tower FIRM JD NO No and Sorel Dubai UAE NAME AND TELEPHONE NUMBER OF PERSON TO CONTACTIN REGARD TO THIS REPORT IS Cate) B. ACCOUNTANT IDENTIFICATION (Area Cade-Telephone Number INDEPENDENT PUBLIC ACCOUNTANT bose opinion contained in the Report Queens College Auditors LLP 65-30 Kissena Blvd. Flushing NY 11367 Code CHECK ONE O Certified Public Accountant Ob Moot O Accountant stresident United States or any of its possession EOREOFFICIAL USE ONLY 2204 words fecs 10 atv A 398 og DV @ $ N & 3 4 88 6 7 8 Q W E R T. AD Styles PE *Claim for exemption from the requirement that the annual report be covered by the opinion of an independent public account must be supported by a statement atfacts and circumstances relied on as the basis for the exemption. See Section 240.17: 32). December 31, 20XX 20XX-1 20XX-2 (CY) (PY) (2yrs ago) (Rounded to Thousands) 5,100 4,000 5,700 3,000 5,400 2,500 Assets Cash and cash equivalents Inventories Accounts receivable (Net of $124K, $100K $85K allowance for uncollectible Accts.) Property Plan & Equipment (Net of Accum. Dec. of $5.7M, 54.4M, $3.TM) Other assets Total assets 4,500 3,500 3,250 21,200 3,000 37,800 46.700 3,100 62,000 46,700 2,700 60,550 Liabilities and Member's Equity Liabilities: Accounts payable and accrued expenses Other Payables Long Term Debt Total liabilities 1.500 1,000 18,700 21,200 1,500 1,000 43,500 46,000 800 900 43,500 45,200 Stockholder's Equity Egih unted States) 10 80 888 go 1 Ne # 3 $ 4 % 5 6 7 8 1 B IU Stockholder's Equity: Common Stock (no Par Stock, 1 million shares outstanding) Retained Earnings Total Stockholder's Equity 14,050 15,300 1,300 16,600 14,600 1,400 16,000 1,300 15,350 Total liabilities and Stockholder's equity 37,800 62,000 60,550 See accompanying notes to financial statements. Year ended December 31, 20xx 20XX-1 20XX-2 20XX-3 (Rounded to Thousands) Revenues LUX Hotel- Rental Revenue Inventory Sales (Net of Sales Returns and Discounts) 21,500 15,500 12,000 20,350 19,800 10,000 9,000 8,500 Total Revenues 27,500 31,500 29,350 28,300 11,300 9,450 8,125 7,350 830 507 Expenses Cost of Goods Sold (Inventory sales) Legal, professional, audit, and regulatory fees Salary Expense Interest expense Depreciation & Amortization expense Other expenses Total Expenses Net Income 505 500 2,014 1,555 1,350 150 17,199 10,301 1,930 2,175 1,350 110 15,522 15,978 1,850 2,175 1,350 100 14,105 15,245 1,775 2,175 1,350 94 13,244 15,056 Page 2 of 13 2204 words O Focus ty SC F1 0 DOO Odo F2 FE Commo n Stock TOTAL Retaine d Earnings $1,400 Balance at December 31, 20XX-1 $14,600 $16,000 Common Stock 700 700 Dividends (10,401) 1 Net Income (10,401) 10,301 $15,300 $1,300 Balance at December 31, 20XX 10,301 $16,600 See accompanying notes to financial statements. 1. Organization and Nature of Business LUX Hotel Co. (the "Company"), a subsidiary of Global LUX Hotel Co. (the "Parent"), was organized in December 1999 in the State of Delaware. A certain number of shares are traded on the NYSE and the company is registered with the SEC. The Company operates luxury hotel properties. The company is head quartered in Dubai, and its main hotel is operated on the Palm Island in Dubai. The company seeks tourists from around the world (Rental Revenue). The company also has another division that sells pictures, vases, home dcor, furniture from the middle east (Inventory Division). 2. Summary of Significant Accounting Policies Use of Estimates - The preparation of the financial statements in conformity with U.S. generally accepted accounting principles ("GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from Page 21 2204 words English (United States) Focus ty 80 000 DOO F2 FA BIUab X, X ADA Revenues - Revenues are recorded on an accrual basis. The Hotel revenue is recorded based on the contract with the customer, and usually involves companies leasing space in its facilities and paying a fee depending on number of units rented, other services involved such as spa services. The Inventory revenue is recorded as each device is sold online, or in select retail locations, and recorded based on payment and delivery to and by customers. Foreign Currency Translation: The books and records of the Company are maintained in U.S. dollars. PP&E - Fixed assets consist of factory and equipment to produce inventory that is stated at cost less accumulated depreciation. Depreciation is provided using the straight-line method over the estimated useful lives of the assets, generally five to ten years. I Cash and Cash Equivalents - For purposes of the statement of cash flows, cash investments with a maturity, at date of purchase, of three months or less are considered to be cash equivalents. The company also holds mutual funds and money market investments which it believes are cash equivalents. It is the Company's policy to place its cash and cash equivalents in high quality financial institutions. At times these deposits may exceed federally insured limits. The Company does not believe significant credit risk exists with respect to these institutions. Accounts Receivable Accounts receivable are stated at the amount billed to customers. Management's judgment as to the level of probable losses on existing accounts receivable involves the consideration of current economic conditions, examinations of customers' credit worthiness, and evaluation of existing relationships. When it is determined that an accounts receivable may not be collectible, an allowance for doubtful accounts is established. Account receivables are reported net on the balance sheet. Fair Value of Financial Instruments Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 820 defines fair value, establishes a framework for measuring fair value, and establishes a fair value hierarchy which prioritizes the inputs to valuation techniques. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly action between.market..participants....tbs.measurement.date. A fair..value. measurement assumes that the transaction to sell the asset or transfer the liability occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market. Valuation techniques that are consistent with the market, income or cost Page 2 of 13 2204 words English (United States) Focus 10 JE LEVEL Impuls are quoted prices fuldjusteu I al live HdKees 101 ventilai des or liabilities the Company has the ability to access. Level 2 inputs are inputs (other than quoted prices included within level 1) that are observable for the asset or liability, either directly or indirectly. Level 3 are unobservable inputs for the asset or liability and rely on management's own assumptions about the assumptions that market participants would use in pricing the asset or liability. . Money market funds are recorded at fair value based on the market approach using level 1 inputs. At December 31, 20XX, money market funds totaling approximately $466,115 are recorded in cash and cash equivalents. Income Taxes - As a new tech company under the LUX Hotel Start-up Act, the earnings and losses of the Company are tax exempt for twenty years; therefore, no federal income tax provision or benefit has been included in these financial statements. The Company's tax retum and the amounts of allocable profits and losses are subject to examination by taxing authorities. Accordingly, if such examinations result in changes in the profits or losses, the tax liability of the members could change. 4. Risks Concentration of Credit Risk The Company is engaged in various IT services in which counterparties primarily include a few large companies such as Tesla and Sears. In the event counterparties do not fulfill their obligations, the Company may be exposed to risk. The risk of default depends on the creditworthiness of the counterparty. It is the Company's policy to continually monitor its counterparty risk. The Company does not anticipate non performance by counterparties and maintains a policy of reviewing the credit standing of all customers with whom it conducts business. 5. Related Parties The Company also occasionally makes loans to employees. During the year the company loaned the CEO $1 million dollars in January 20xx and that loan was paid off on December 31, 20XX Page 2915 2204 words English (United States) 10 Ety Paste BIUab x ADA lili ilil v 6. Line of Credit/Notes Payable In January 20XX, the Company had $43.2 million in uncollateralized term loans outstanding with two lenders, Bank A ($12.96 million) and Bank B ($30.24 million). During the middle of 20XX the company defaulted on the debt. . On June 20, 20XX the Lux Hotel Co. restructured and amended the debt with Bank A. As part of the terms of amending the Debt: This reduced the total long-term debt balance from $43.2 million to $18.2 million. . The Company agreed to new interest terms, which included raising the interest rate I from 5 percent to 6 percent. Starting 20X1- the Original Debt will require annual payments consisting of principal and interest of $1.68 million and $3.92 million to Bank A and Bank B, respectively. 7. Litigation Notes In the normal course of business, the company is subject to various claims, legal actions, and disputes. The Company provides for losses, if any, in the year in which they can be reasonably estimated. For the year ended 20xx there were no lawsuits that meet the criteria to be recorded or disclosed under GAAP. 8. Stock-based Compensation LUX Hotel Co. provides stock options to certain employees (the CEO, CFO, COO) of the Company, These options permit the certain employees to buy shares of the company at set price. If share price increases above a certain level the options come "in-to the money," meaning they become profitable for the certain employees to exercise. Typically, the stock-options vest during the period of requisite service up to five years. Under U.S. GAAP guidance the stock options are re-measured at the end of every reporting period, and accordingly, any changes in the fair value of such post-termination payments are allocated to the Company. The cost of granting stock based compensation is included in salaries expense. For the year ended December 31,20XX, the Partnership recognized stock-based compensation expense for such awards of $200,000, which is included in salaries expense in the Company's statement of operations. At year end the company is potentially liable to issue additional stock options to certain employees si no se moralamat Thorntinn erst martinians Dag 2013 English (United States) 10 av 25C Trebuchet... 10.5 ' ' A to B 1 0 v x x Av. Av 2 Paste LUX Hotel Co. provides stock options to certain employees (the CEO, CFO, COO) of the Company. These options permit the certain employees to buy shares of the company at set price. If share price increases above a certain level the options come "in-to the money," meaning they become profitable for the certain employees to exercise. Typically, the stock options vest during the period of requisite service up to five years. Under U.S. GAAP guidance the stock- options are re-measured at the end of every reporting period, and accordingly, any changes in the fair value of such post-termination payments are allocated to the Company. The cost of granting stock based compensation is included in salaries expense. For the year ended December 31,20XX, the Partnership recognized stock-based compensation expense for such awards of $200,000, which is included in salaries expense in the Company's statement of operations. At year end the company is potentially liable to issue additional stock options to certain employees if certain performance goals related to sales are met. These options could result in additional salaries expense of up to $1million dollars. 9. Subsequent Event Management has evaluated subsequent events through December 31, 20XX which is the date that the financial statements were available for issuance, and has determined that there are no other subsequent events to be reported. Last Page Left Blank Intentionally Page 2 of 13 English (United States) 10 v sc IV. Controls Testing: STUDENT 4 (Name): Using Illustration: "Example of an Extent of testing table," (below). 14) Determine if controls "3, 4, & 5 are performed: (a) >5,000 instance; (b) Daily/Multiple times a day; (c) Weekly; (d) Monthly; (e)Quarterly; or (f) Annually? [Check only 1 box for each control, use your best judgement to answer the question based on the information above.] Control 9 Control 10a Control 10b (a) >5,000 instance; (a) >5,000 instance; (a) >5,000 instance; (b) Daily/ Multiple (b) Daily/ Multiple (b) Daily/ Multiple times a day; times a day; times a day; (c) Weekly; c) Weekly; (c) Weekly (d) Monthly; (d) Monthly; (d) Monthly; (e)Quarterly; (e)Quarterly; (e)Quarterly: (1) Annually. (1) Annually. (1) Annually. 15) Use your answer to Q1 above to determine if you will seek: (a)Reasonable Assurance from tests of controls; (b) More than limited Assurance from Tests of Controls; or (c)"Limited Assurance from Tests of Controls. Look at facts above to determine the frequency of Styles UNITEDSTATES SECURITIESANDEXCHANGECOMMISSION Washington, D.C. 20549 ANNUAL AUDITED REPORT FORM X PART X FACING PAGE OMS APPROVAL OM Number: xoox Expires March 31. XX Estimated average burden hours per response......XX I SECFLENUMBER 8-XXXX Information Required of Brokers and Dealers Pursuant to Section X of the Securities Exchange Act of 1934 REPORT FOR THE PERIOD BEGINNING January 1, 20XX MM/DD/YY AND ENDING December 31, 20XX MODYY A REGISTRANT IDENTIFICATION NAME OF BROKER DEALER: LUX Hotel Co. QEFICIAL LISE ONLY ADDRESS OF PRINCIPAL PLACE OF BUSINESS: (De not PO Box No.) Dago 21 2204 words English (United States) 10 tv TO SC BO 000 oog ES % 2 3 4 5 6 7 A Styles Style Pane NAME OF BROKER DEALER: LUX Hotel Co. OFFICIAL USE ONLY ADDRESS OF PRINCIPAL PLACE OF BUSINESS (Do not use PO Box No.) Burj Khalifah Tower FIRM JD NO No and Sorel Dubai UAE NAME AND TELEPHONE NUMBER OF PERSON TO CONTACTIN REGARD TO THIS REPORT IS Cate) B. ACCOUNTANT IDENTIFICATION (Area Cade-Telephone Number INDEPENDENT PUBLIC ACCOUNTANT bose opinion contained in the Report Queens College Auditors LLP 65-30 Kissena Blvd. Flushing NY 11367 Code CHECK ONE O Certified Public Accountant Ob Moot O Accountant stresident United States or any of its possession EOREOFFICIAL USE ONLY 2204 words fecs 10 atv A 398 og DV @ $ N & 3 4 88 6 7 8 Q W E R T. AD Styles PE *Claim for exemption from the requirement that the annual report be covered by the opinion of an independent public account must be supported by a statement atfacts and circumstances relied on as the basis for the exemption. See Section 240.17: 32). December 31, 20XX 20XX-1 20XX-2 (CY) (PY) (2yrs ago) (Rounded to Thousands) 5,100 4,000 5,700 3,000 5,400 2,500 Assets Cash and cash equivalents Inventories Accounts receivable (Net of $124K, $100K $85K allowance for uncollectible Accts.) Property Plan & Equipment (Net of Accum. Dec. of $5.7M, 54.4M, $3.TM) Other assets Total assets 4,500 3,500 3,250 21,200 3,000 37,800 46.700 3,100 62,000 46,700 2,700 60,550 Liabilities and Member's Equity Liabilities: Accounts payable and accrued expenses Other Payables Long Term Debt Total liabilities 1.500 1,000 18,700 21,200 1,500 1,000 43,500 46,000 800 900 43,500 45,200 Stockholder's Equity Egih unted States) 10 80 888 go 1 Ne # 3 $ 4 % 5 6 7 8 1 B IU Stockholder's Equity: Common Stock (no Par Stock, 1 million shares outstanding) Retained Earnings Total Stockholder's Equity 14,050 15,300 1,300 16,600 14,600 1,400 16,000 1,300 15,350 Total liabilities and Stockholder's equity 37,800 62,000 60,550 See accompanying notes to financial statements. Year ended December 31, 20xx 20XX-1 20XX-2 20XX-3 (Rounded to Thousands) Revenues LUX Hotel- Rental Revenue Inventory Sales (Net of Sales Returns and Discounts) 21,500 15,500 12,000 20,350 19,800 10,000 9,000 8,500 Total Revenues 27,500 31,500 29,350 28,300 11,300 9,450 8,125 7,350 830 507 Expenses Cost of Goods Sold (Inventory sales) Legal, professional, audit, and regulatory fees Salary Expense Interest expense Depreciation & Amortization expense Other expenses Total Expenses Net Income 505 500 2,014 1,555 1,350 150 17,199 10,301 1,930 2,175 1,350 110 15,522 15,978 1,850 2,175 1,350 100 14,105 15,245 1,775 2,175 1,350 94 13,244 15,056 Page 2 of 13 2204 words O Focus ty SC F1 0 DOO Odo F2 FE Commo n Stock TOTAL Retaine d Earnings $1,400 Balance at December 31, 20XX-1 $14,600 $16,000 Common Stock 700 700 Dividends (10,401) 1 Net Income (10,401) 10,301 $15,300 $1,300 Balance at December 31, 20XX 10,301 $16,600 See accompanying notes to financial statements. 1. Organization and Nature of Business LUX Hotel Co. (the "Company"), a subsidiary of Global LUX Hotel Co. (the "Parent"), was organized in December 1999 in the State of Delaware. A certain number of shares are traded on the NYSE and the company is registered with the SEC. The Company operates luxury hotel properties. The company is head quartered in Dubai, and its main hotel is operated on the Palm Island in Dubai. The company seeks tourists from around the world (Rental Revenue). The company also has another division that sells pictures, vases, home dcor, furniture from the middle east (Inventory Division). 2. Summary of Significant Accounting Policies Use of Estimates - The preparation of the financial statements in conformity with U.S. generally accepted accounting principles ("GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from Page 21 2204 words English (United States) Focus ty 80 000 DOO F2 FA BIUab X, X ADA Revenues - Revenues are recorded on an accrual basis. The Hotel revenue is recorded based on the contract with the customer, and usually involves companies leasing space in its facilities and paying a fee depending on number of units rented, other services involved such as spa services. The Inventory revenue is recorded as each device is sold online, or in select retail locations, and recorded based on payment and delivery to and by customers. Foreign Currency Translation: The books and records of the Company are maintained in U.S. dollars. PP&E - Fixed assets consist of factory and equipment to produce inventory that is stated at cost less accumulated depreciation. Depreciation is provided using the straight-line method over the estimated useful lives of the assets, generally five to ten years. I Cash and Cash Equivalents - For purposes of the statement of cash flows, cash investments with a maturity, at date of purchase, of three months or less are considered to be cash equivalents. The company also holds mutual funds and money market investments which it believes are cash equivalents. It is the Company's policy to place its cash and cash equivalents in high quality financial institutions. At times these deposits may exceed federally insured limits. The Company does not believe significant credit risk exists with respect to these institutions. Accounts Receivable Accounts receivable are stated at the amount billed to customers. Management's judgment as to the level of probable losses on existing accounts receivable involves the consideration of current economic conditions, examinations of customers' credit worthiness, and evaluation of existing relationships. When it is determined that an accounts receivable may not be collectible, an allowance for doubtful accounts is established. Account receivables are reported net on the balance sheet. Fair Value of Financial Instruments Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 820 defines fair value, establishes a framework for measuring fair value, and establishes a fair value hierarchy which prioritizes the inputs to valuation techniques. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly action between.market..participants....tbs.measurement.date. A fair..value. measurement assumes that the transaction to sell the asset or transfer the liability occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market. Valuation techniques that are consistent with the market, income or cost Page 2 of 13 2204 words English (United States) Focus 10 JE LEVEL Impuls are quoted prices fuldjusteu I al live HdKees 101 ventilai des or liabilities the Company has the ability to access. Level 2 inputs are inputs (other than quoted prices included within level 1) that are observable for the asset or liability, either directly or indirectly. Level 3 are unobservable inputs for the asset or liability and rely on management's own assumptions about the assumptions that market participants would use in pricing the asset or liability. . Money market funds are recorded at fair value based on the market approach using level 1 inputs. At December 31, 20XX, money market funds totaling approximately $466,115 are recorded in cash and cash equivalents. Income Taxes - As a new tech company under the LUX Hotel Start-up Act, the earnings and losses of the Company are tax exempt for twenty years; therefore, no federal income tax provision or benefit has been included in these financial statements. The Company's tax retum and the amounts of allocable profits and losses are subject to examination by taxing authorities. Accordingly, if such examinations result in changes in the profits or losses, the tax liability of the members could change. 4. Risks Concentration of Credit Risk The Company is engaged in various IT services in which counterparties primarily include a few large companies such as Tesla and Sears. In the event counterparties do not fulfill their obligations, the Company may be exposed to risk. The risk of default depends on the creditworthiness of the counterparty. It is the Company's policy to continually monitor its counterparty risk. The Company does not anticipate non performance by counterparties and maintains a policy of reviewing the credit standing of all customers with whom it conducts business. 5. Related Parties The Company also occasionally makes loans to employees. During the year the company loaned the CEO $1 million dollars in January 20xx and that loan was paid off on December 31, 20XX Page 2915 2204 words English (United States) 10 Ety Paste BIUab x ADA lili ilil v 6. Line of Credit/Notes Payable In January 20XX, the Company had $43.2 million in uncollateralized term loans outstanding with two lenders, Bank A ($12.96 million) and Bank B ($30.24 million). During the middle of 20XX the company defaulted on the debt. . On June 20, 20XX the Lux Hotel Co. restructured and amended the debt with Bank A. As part of the terms of amending the Debt: This reduced the total long-term debt balance from $43.2 million to $18.2 million. . The Company agreed to new interest terms, which included raising the interest rate I from 5 percent to 6 percent. Starting 20X1- the Original Debt will require annual payments consisting of principal and interest of $1.68 million and $3.92 million to Bank A and Bank B, respectively. 7. Litigation Notes In the normal course of business, the company is subject to various claims, legal actions, and disputes. The Company provides for losses, if any, in the year in which they can be reasonably estimated. For the year ended 20xx there were no lawsuits that meet the criteria to be recorded or disclosed under GAAP. 8. Stock-based Compensation LUX Hotel Co. provides stock options to certain employees (the CEO, CFO, COO) of the Company, These options permit the certain employees to buy shares of the company at set price. If share price increases above a certain level the options come "in-to the money," meaning they become profitable for the certain employees to exercise. Typically, the stock-options vest during the period of requisite service up to five years. Under U.S. GAAP guidance the stock options are re-measured at the end of every reporting period, and accordingly, any changes in the fair value of such post-termination payments are allocated to the Company. The cost of granting stock based compensation is included in salaries expense. For the year ended December 31,20XX, the Partnership recognized stock-based compensation expense for such awards of $200,000, which is included in salaries expense in the Company's statement of operations. At year end the company is potentially liable to issue additional stock options to certain employees si no se moralamat Thorntinn erst martinians Dag 2013 English (United States) 10 av 25C Trebuchet... 10.5 ' ' A to B 1 0 v x x Av. Av 2 Paste LUX Hotel Co. provides stock options to certain employees (the CEO, CFO, COO) of the Company. These options permit the certain employees to buy shares of the company at set price. If share price increases above a certain level the options come "in-to the money," meaning they become profitable for the certain employees to exercise. Typically, the stock options vest during the period of requisite service up to five years. Under U.S. GAAP guidance the stock- options are re-measured at the end of every reporting period, and accordingly, any changes in the fair value of such post-termination payments are allocated to the Company. The cost of granting stock based compensation is included in salaries expense. For the year ended December 31,20XX, the Partnership recognized stock-based compensation expense for such awards of $200,000, which is included in salaries expense in the Company's statement of operations. At year end the company is potentially liable to issue additional stock options to certain employees if certain performance goals related to sales are met. These options could result in additional salaries expense of up to $1million dollars. 9. Subsequent Event Management has evaluated subsequent events through December 31, 20XX which is the date that the financial statements were available for issuance, and has determined that there are no other subsequent events to be reported. Last Page Left Blank Intentionally Page 2 of 13 English (United States) 10 v sc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts