Question: ( iv ) The provision for bad debts should be adjusted to 5 % of the closing trade receivables ( v ) Depreciation of non

iv The provision for bad debts should be adjusted to of the closing trade receivables

v Depreciation of noncurrent assets is to be provided for as follows:

Premises: per annum on cost Straight Line

Equipment: per annum on cost Straight Line

Requirement:

a Prepare the Income Statement for Mikey for the year ending December

b Prepare a Statement of Financial Position as at December

c Identify four different user groups of financial accounting information and briefly explain

why cach group would be interested in such information, QUESTION

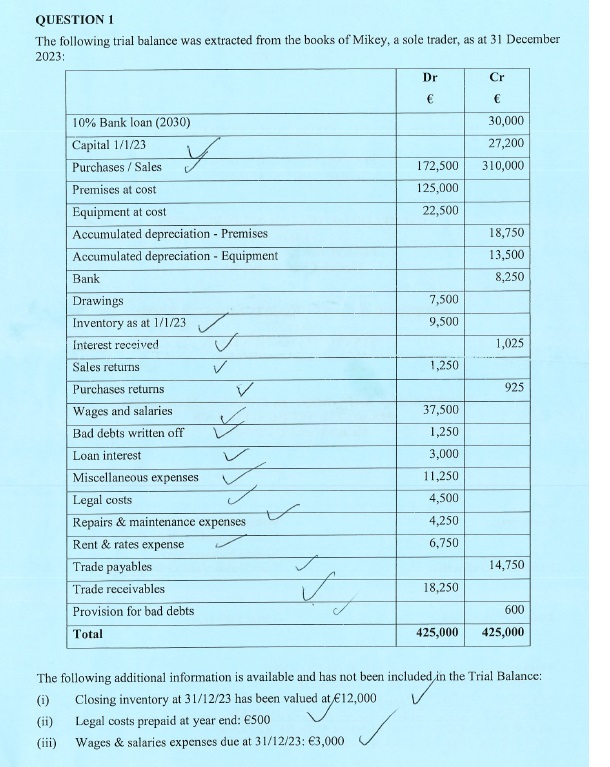

The following trial balance was extracted from the books of Mikey, a sole trader, as at December

:

The following additional information is available and has not been included in the Trial Balance:

i Closing inventory at has been valued at

ii Legal costs prepaid at year end:

iii Wages & salaries expenses due at :

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock