Question: Ivanhoe Hand Trucks has a preferred share issue outstanding that pays a dividend of $1.30 per year. The current cost of preferred equity for Ivanhoe

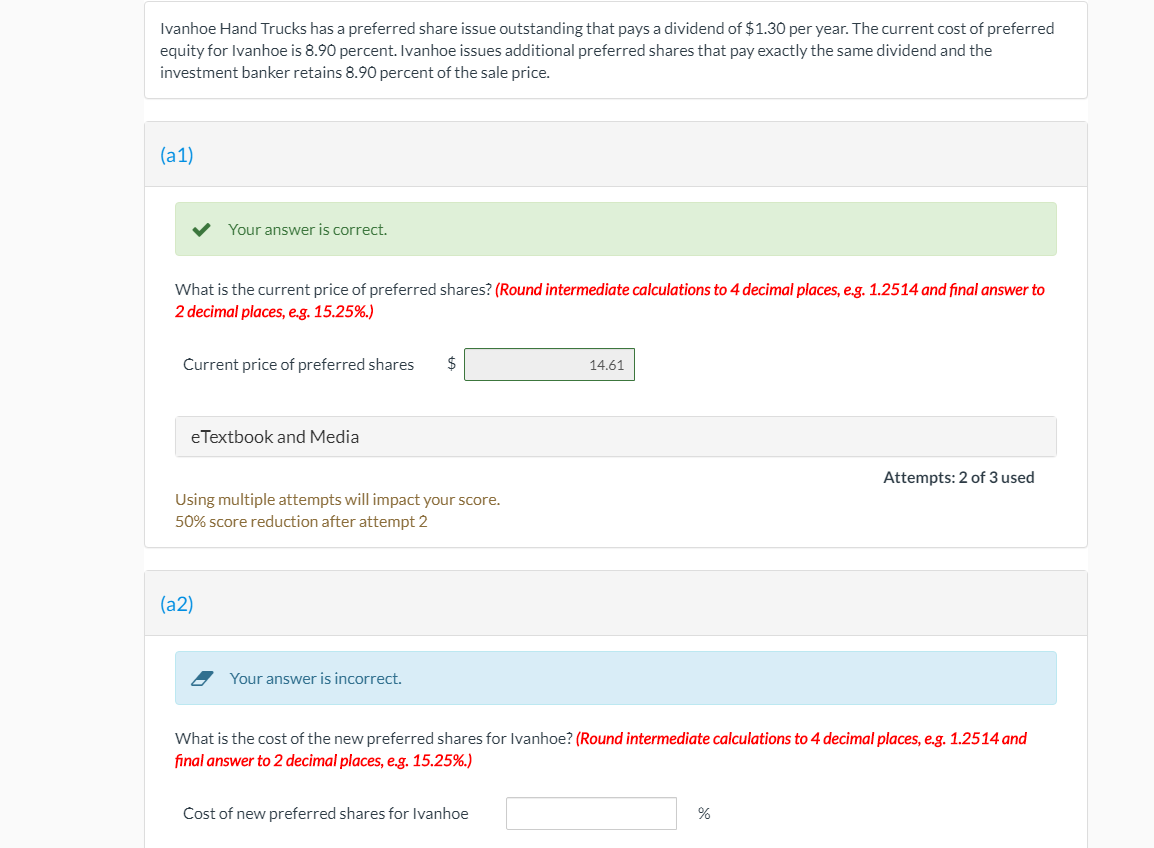

Ivanhoe Hand Trucks has a preferred share issue outstanding that pays a dividend of $1.30 per year. The current cost of preferred equity for Ivanhoe is 8.90 percent. Ivanhoe issues additional preferred shares that pay exactly the same dividend and the investment banker retains 8.90 percent of the sale price. (a1) Your answer is correct. What is the current price of preferred shares? (Round intermediate calculations to 4 decimal places, eg. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.) Current price of preferred shares $ 14.61 e Textbook and Media Attempts: 2 of 3 used Using multiple attempts will impact your score. 50% score reduction after attempt 2 (a2) Your answer is incorrect. What is the cost of the new preferred shares for Ivanhoe? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.) Cost of new preferred shares for Ivanhoe %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts