Question: Ivanhoe Rook Candies received a bank statement for the month of August 2014, which showed a balance per bank of $6,964. The company's cash

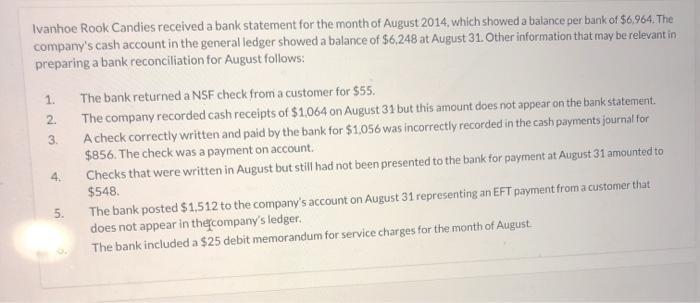

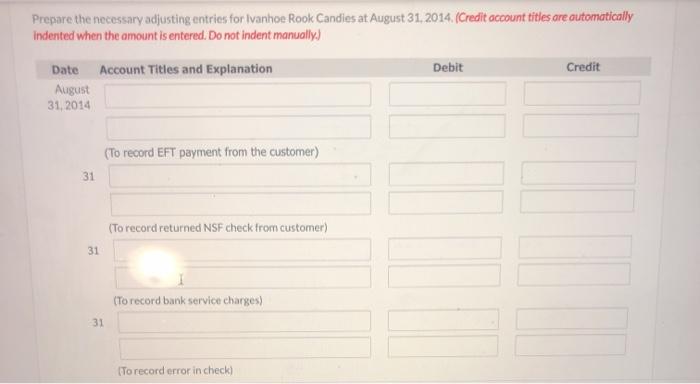

Ivanhoe Rook Candies received a bank statement for the month of August 2014, which showed a balance per bank of $6,964. The company's cash account in the general ledger showed a balance of $6,248 at August 31. Other information that may be relevant in preparing a bank reconciliation for August follows: 1. The bank returned a NSF check from a customer for $55. The company recorded cash receipts of $1.064 on August 31 but this amount does not appear on the bank statement. Acheck correctly written and paid by the bank for $1,056 was incorrectly recorded in the cash payments journal for $856. The check was a payment on account. 2. 3. Checks that were written in August but still had not been presented to the bank for payment at August 31 amounted to $548. 4. The bank posted $1,512 to the company's account on August 31 representing an EFT payment froma customer that does not appear in the company's ledger. 5. The bank included a $25 debit memorandum for service charges for the month of August Prepare the necessary adjusting entries for Ivanhoe Rook Candies at August 31, 2014. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit August 31, 2014 (To record EFT payment from the customer) 31 (To record returned NSF check from customer) 31 (To record bank service charges) 31 (To record error in check)

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Answer Explanation Bank Reconciliation Aug... View full answer

Get step-by-step solutions from verified subject matter experts