Question: I've already started on it and I'm not sure if it's right please help!! Predicting net income. Abbreviated income statements for Starbucks are in the

I've already started on it and I'm not sure if it's right please help!!

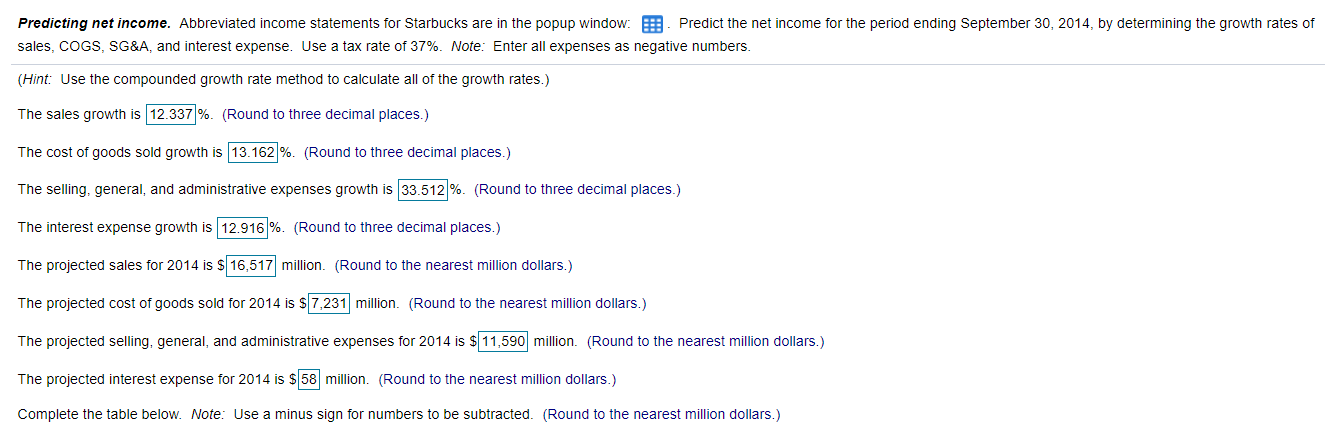

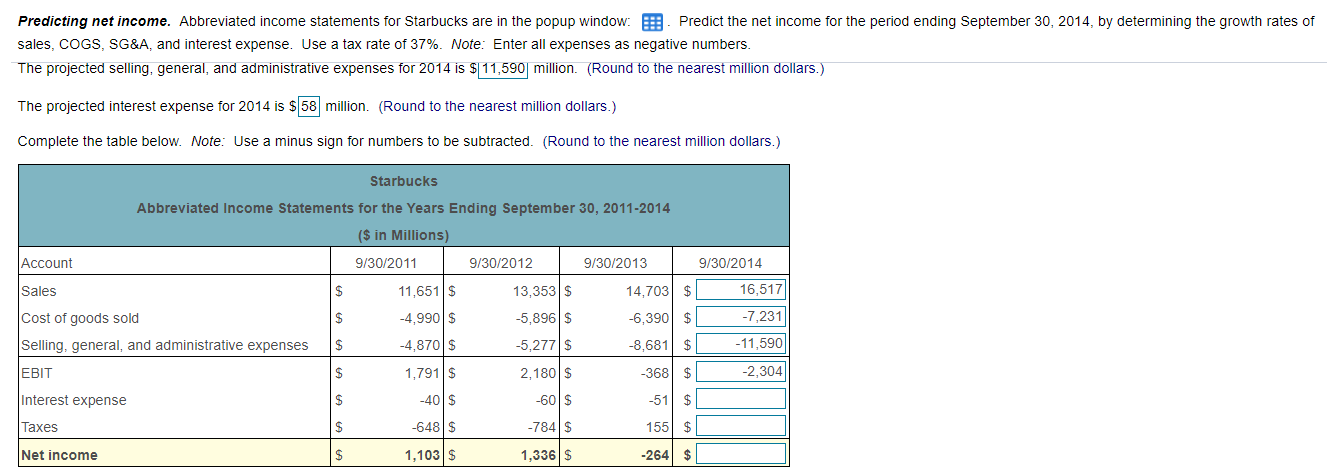

Predicting net income. Abbreviated income statements for Starbucks are in the popup window: Predict the net income for the period ending September 30, 2014, by determining the growth rates of sales, COGS, SG&A, and interest expense. Use a tax rate of 37%. Note: Enter all expenses as negative numbers. (Hint: Use the compounded growth rate method to calculate all of the growth rates.) The sales growth is 12.337%. (Round to three decimal places.) The cost of goods sold growth is 13.162 %. (Round to three decimal places.) The selling, general, and administrative expenses growth is 33.512 %. (Round to three decimal places.) The interest expense growth is 12.916 %. (Round to three decimal places.) The projected sales for 2014 is $ 16,517 million. (Round to the nearest million dollars.) The projected cost of goods sold for 2014 is S 7,231 million. (Round to the nearest million dollars.) The projected selling, general, and administrative expenses for 2014 is $ 11,590 million. (Round to the nearest million dollars.) The projected interest expense for 2014 is $ 58 million. (Round to the nearest million dollars.) Complete the table below. Note: Use a minus sign for numbers to be subtracted. (Round to the nearest million dollars.) Predicting net income. Abbreviated income statements for Starbucks are in the popup window. E Predict the net income for the period ending September 30, 2014, by determining the growth rates of sales, COGS, SG&A, and interest expense. Use a tax rate of 37%. Note: Enter all expenses as negative numbers. The projected selling, general, and administrative expenses for 2014 is $ 11,590 million. (Round to the nearest million dollars.) The projected interest expense for 2014 is $58 million. (Round to the nearest million dollars.) Complete the table below. Note: Use a minus sign for numbers to be subtracted. (Round to the nearest million dollars.) Starbucks Abbreviated Income Statements for the Years Ending September 30, 2011-2014 ($ in Millions) Account 9/30/2011 9/30/2012 9/30/2013 9/30/2014 Sales S 11,651 $ 13,353 $ 14,703 $ 16,517 -7,231 S -4,990$ -5,896 $ Cost of goods sold Selling, general, and administrative expenses $ -4,870 $ -5,277 $ -11.5901 EBIT S 1,791 $ 2,180$ -6,390 $ -8,681 $ -368 $ -51 $ 155 $ -2,304 Interest expense $ -40$ -60$ Taxes $ -648$ -784 $ Net income $ 1,103 $ 1,336 $ -264 $ Predicting net income. Abbreviated income statements for Starbucks are in the popup window: Predict the net income for the period ending September 30, 2014, by determining the growth rates of sales, COGS, SG&A, and interest expense. Use a tax rate of 37%. Note: Enter all expenses as negative numbers. (Hint: Use the compounded growth rate method to calculate all of the growth rates.) The sales growth is 12.337%. (Round to three decimal places.) The cost of goods sold growth is 13.162 %. (Round to three decimal places.) The selling, general, and administrative expenses growth is 33.512 %. (Round to three decimal places.) The interest expense growth is 12.916 %. (Round to three decimal places.) The projected sales for 2014 is $ 16,517 million. (Round to the nearest million dollars.) The projected cost of goods sold for 2014 is S 7,231 million. (Round to the nearest million dollars.) The projected selling, general, and administrative expenses for 2014 is $ 11,590 million. (Round to the nearest million dollars.) The projected interest expense for 2014 is $ 58 million. (Round to the nearest million dollars.) Complete the table below. Note: Use a minus sign for numbers to be subtracted. (Round to the nearest million dollars.) Predicting net income. Abbreviated income statements for Starbucks are in the popup window. E Predict the net income for the period ending September 30, 2014, by determining the growth rates of sales, COGS, SG&A, and interest expense. Use a tax rate of 37%. Note: Enter all expenses as negative numbers. The projected selling, general, and administrative expenses for 2014 is $ 11,590 million. (Round to the nearest million dollars.) The projected interest expense for 2014 is $58 million. (Round to the nearest million dollars.) Complete the table below. Note: Use a minus sign for numbers to be subtracted. (Round to the nearest million dollars.) Starbucks Abbreviated Income Statements for the Years Ending September 30, 2011-2014 ($ in Millions) Account 9/30/2011 9/30/2012 9/30/2013 9/30/2014 Sales S 11,651 $ 13,353 $ 14,703 $ 16,517 -7,231 S -4,990$ -5,896 $ Cost of goods sold Selling, general, and administrative expenses $ -4,870 $ -5,277 $ -11.5901 EBIT S 1,791 $ 2,180$ -6,390 $ -8,681 $ -368 $ -51 $ 155 $ -2,304 Interest expense $ -40$ -60$ Taxes $ -648$ -784 $ Net income $ 1,103 $ 1,336 $ -264 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts