Question: I've attached the excel screenshot below and the same has to be worked on. NO MANUAL or HAND WORK PLEASE Rembrandt Hotel & Casino is

I've attached the excel screenshot below and the same has to be worked on. NO MANUAL or HAND WORK PLEASE

Rembrandt Hotel & Casino is situated on the beautiful Lake Tahoe, in Nevada. The complex includes a 300-room hotel, a casino, and a restaurant. As Rembrandts new controller, you are asked to recommend the basis to be used for allocating fixed overhead costs to the three divisions in 2011. Download the Rembrandt calculations to access the information:

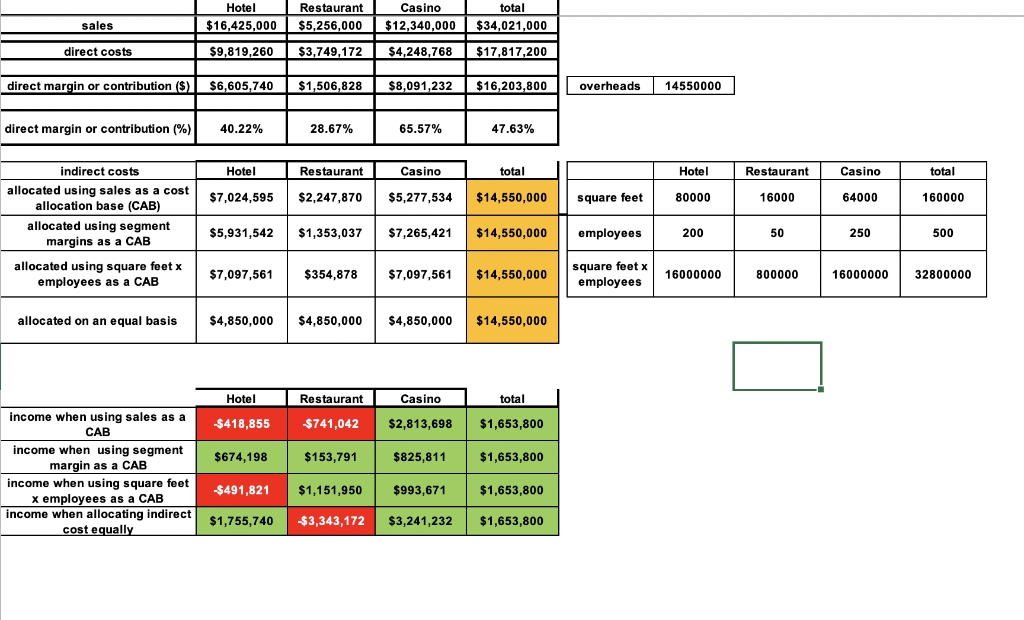

You may choose to allocate indirect costs using 4 different cost allocation bases: sales, segment margins, square feet x number of employees, and equal allocation. Total fixed overheads for 2010 amounted to $14,550,000. The Excel file presents the profitability calculations according to the 4 cost allocation bases aforementioned

1-

Choose one or several options among the following. Would you:

| Shut the hotel | ||

| Shut the restaurant | ||

| Shut de Casino | ||

| Keep all the activities | ||

| We don't have enough information | ||

| None of the above |

Do you think there are synergies between the 3 activities?

| Yes | ||

| No | ||

| We don't have enough information |

Usually, the overheads in a company are rather:

| variable | ||

| fixed |

| Yes | ||

| No | ||

| We don't have enough information |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts