Question: I've been really struggling to calculate the Net Present Value for this question. Help/the steps to achieve this are greatly appreciated! The Biological Insect Control

I've been really struggling to calculate the Net Present Value for this question. Help/the steps to achieve this are greatly appreciated!

I've been really struggling to calculate the Net Present Value for this question. Help/the steps to achieve this are greatly appreciated!

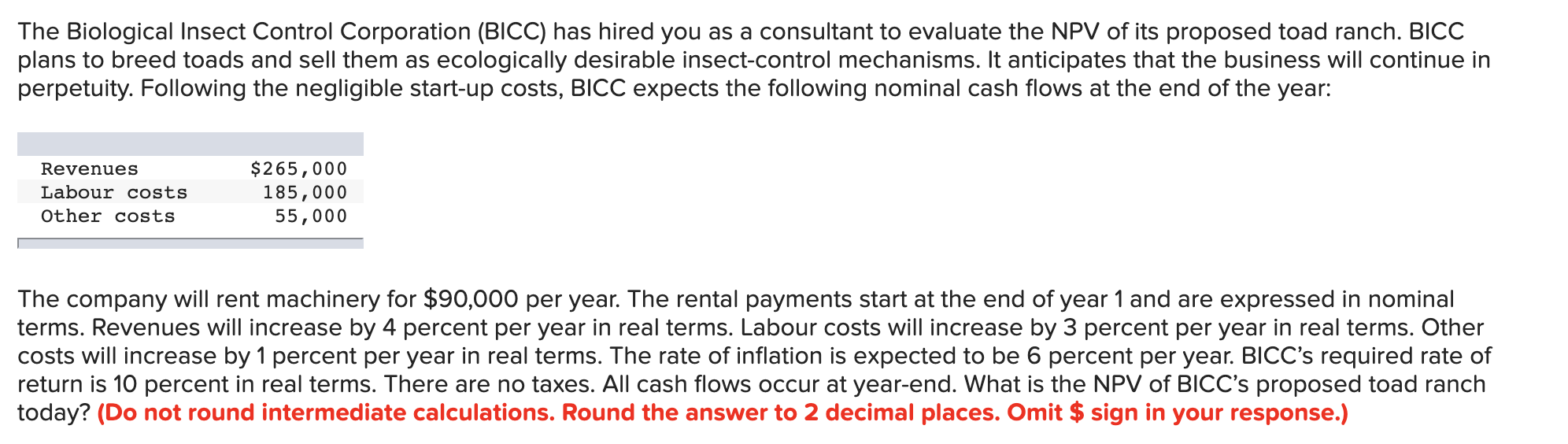

The Biological Insect Control Corporation (BICC) has hired you as a consultant to evaluate the NPV of its proposed toad ranch. BICC plans to breed toads and sell them as ecologically desirable insect-control mechanisms. It anticipates that the business will continue in perpetuity. Following the negligible start-up costs, BICC expects the following nominal cash flows at the end of the year: Revenues Labour costs Other costs $265,000 185,000 55,000 The company will rent machinery for $90,000 per year. The rental payments start at the end of year 1 and are expressed in nominal terms. Revenues will increase by 4 percent per year in real terms. Labour costs will increase by 3 percent per year in real terms. Other costs will increase by 1 percent per year in real terms. The rate of inflation is expected to be 6 percent per year. BICC's required rate of return is 10 percent in real terms. There are no taxes. All cash flows occur at year-end. What is the NPV of BICC's proposed toad ranch today? (Do not round intermediate calculations. Round the answer to 2 decimal places. Omit $ sign in your response.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts