Question: I've been working on this poison pill assignment for over 10 hours now, and many of my numbers still don't make sense to me. I

I've been working on this poison pill assignment for over 10 hours now, and many of my numbers still don't make sense to me. I would like to double check whether my answers are correct or not. Thank you for all your help!!

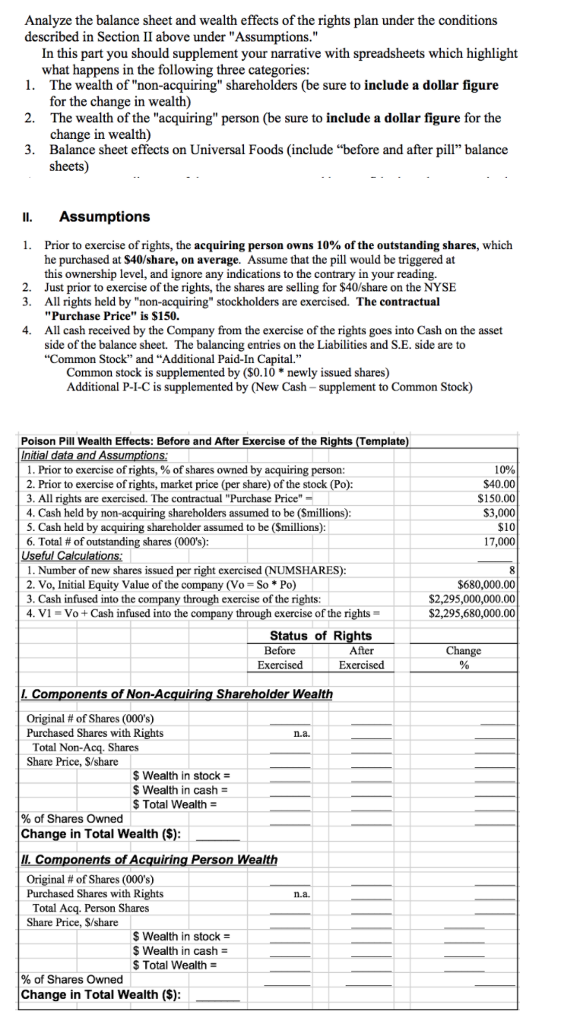

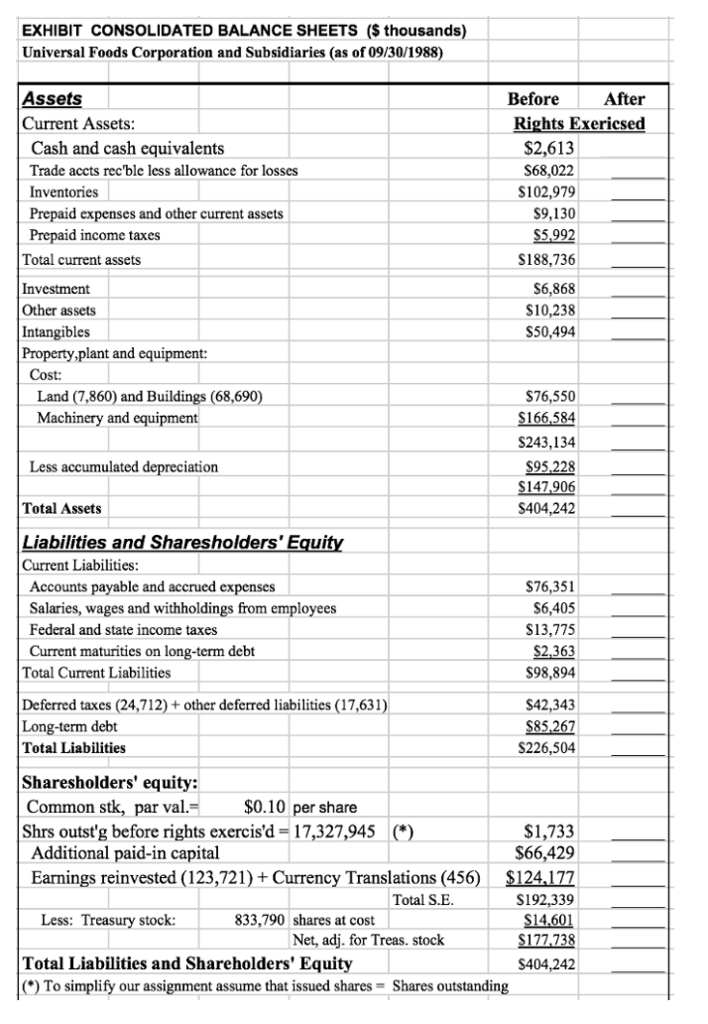

Analyze the balance sheet and wealth effects of the rights plan under the conditions described in Section II above under "Assumptions." In this part you should supplement your narrative with spreadsheets which highlight what happens in the following three categories The wealth of "non-acquiring" shareholders (be sure to include a dollar figure for the change in wealth) The wealth of the "acquiring" person (be sure to include a dollar figure for the change in wealth) Balance sheet effects on Universal Foods (include "before and after pill" balance sheets) 1. 2. 3. I Assumptions I. Prior to exercise of rights, the acquiring person owns 10% of the outstanding shares, which he purchased at $40/share, on average. Assume that the pill would be triggered at this ownership level, and ignore any indications to the contrary in your reading. Just prior to exercise of the rights, the shares are selling for $40/share on the NYSE All rights held by "non-acquiring" stockholders are exercised. The contractual "Purchase Price" is $150. All cash received by the Company from the exercise of the rights goes into Cash on the asset side of the balance sheet. The balancing entries on the Liabilities and S.E. side are to "Common Stock" and Additional Paid-In Capital." 2. 3. 4. Common stock is supplemented by ($0.10 newly issued shares) Additional P-I-C is supplemented by (New Cash-supplement to Common Stock) Poison Pill Wealth Effects: Before and After Exercise of the Ri emplate Prior to exercise of rights, % of shares owned by acquiring person; 2 Prior to exercise of rights, market price (per share) of the stock (Po): All rights are exercised. The contractual "Purchase Price" 4. Cash held by non-acquiring shareholders assumed to be (Smillions) S. Cash held by acquiring shareholder assumed to be (Smillions): 6, Total # of outstanding shares (000's): 10% $40.00 $150.00 $3,000 $10 17,000 1. Number of new shares issued per right exercised NUMSHARES): 2.Vo, Initial Equity Value of the company (Vo = So * Po) 3. Cash infused into the company through exercise of the rights: 4.VI-Vo + Cash infused into the company through exercise of the rights- $680,000.00 2,295,000,000.00 2,295,680,000.00 Status of Rights After Change Before Exercised Exercised Sha Original # of Shares (000's) Purchased Shares with Rights Total Non-Acq. Shares Share Price, S/share n.a $ Wealth in stock = $ Wealth in cash = Total Wealth % of Shares Owned Change in Total Wealth(S) Original # of Shares (000's) Purchased Shares with Rights Total Acq. Person Shares Share Price, S/share na Wealth in stock $ Wealth in cash $ Total Wealth % of Shares Owned Change in Total Wealth ($) Analyze the balance sheet and wealth effects of the rights plan under the conditions described in Section II above under "Assumptions." In this part you should supplement your narrative with spreadsheets which highlight what happens in the following three categories The wealth of "non-acquiring" shareholders (be sure to include a dollar figure for the change in wealth) The wealth of the "acquiring" person (be sure to include a dollar figure for the change in wealth) Balance sheet effects on Universal Foods (include "before and after pill" balance sheets) 1. 2. 3. I Assumptions I. Prior to exercise of rights, the acquiring person owns 10% of the outstanding shares, which he purchased at $40/share, on average. Assume that the pill would be triggered at this ownership level, and ignore any indications to the contrary in your reading. Just prior to exercise of the rights, the shares are selling for $40/share on the NYSE All rights held by "non-acquiring" stockholders are exercised. The contractual "Purchase Price" is $150. All cash received by the Company from the exercise of the rights goes into Cash on the asset side of the balance sheet. The balancing entries on the Liabilities and S.E. side are to "Common Stock" and Additional Paid-In Capital." 2. 3. 4. Common stock is supplemented by ($0.10 newly issued shares) Additional P-I-C is supplemented by (New Cash-supplement to Common Stock) Poison Pill Wealth Effects: Before and After Exercise of the Ri emplate Prior to exercise of rights, % of shares owned by acquiring person; 2 Prior to exercise of rights, market price (per share) of the stock (Po): All rights are exercised. The contractual "Purchase Price" 4. Cash held by non-acquiring shareholders assumed to be (Smillions) S. Cash held by acquiring shareholder assumed to be (Smillions): 6, Total # of outstanding shares (000's): 10% $40.00 $150.00 $3,000 $10 17,000 1. Number of new shares issued per right exercised NUMSHARES): 2.Vo, Initial Equity Value of the company (Vo = So * Po) 3. Cash infused into the company through exercise of the rights: 4.VI-Vo + Cash infused into the company through exercise of the rights- $680,000.00 2,295,000,000.00 2,295,680,000.00 Status of Rights After Change Before Exercised Exercised Sha Original # of Shares (000's) Purchased Shares with Rights Total Non-Acq. Shares Share Price, S/share n.a $ Wealth in stock = $ Wealth in cash = Total Wealth % of Shares Owned Change in Total Wealth(S) Original # of Shares (000's) Purchased Shares with Rights Total Acq. Person Shares Share Price, S/share na Wealth in stock $ Wealth in cash $ Total Wealth % of Shares Owned Change in Total Wealth ($)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts