Question: I've been working on this tax problem for 2 days and I need assistance with my figures. COMPREHENSIVE PROBLEM Dan M. and Cheryl A. Peters

I've been working on this tax problem for 2 days and I need assistance with my figures.

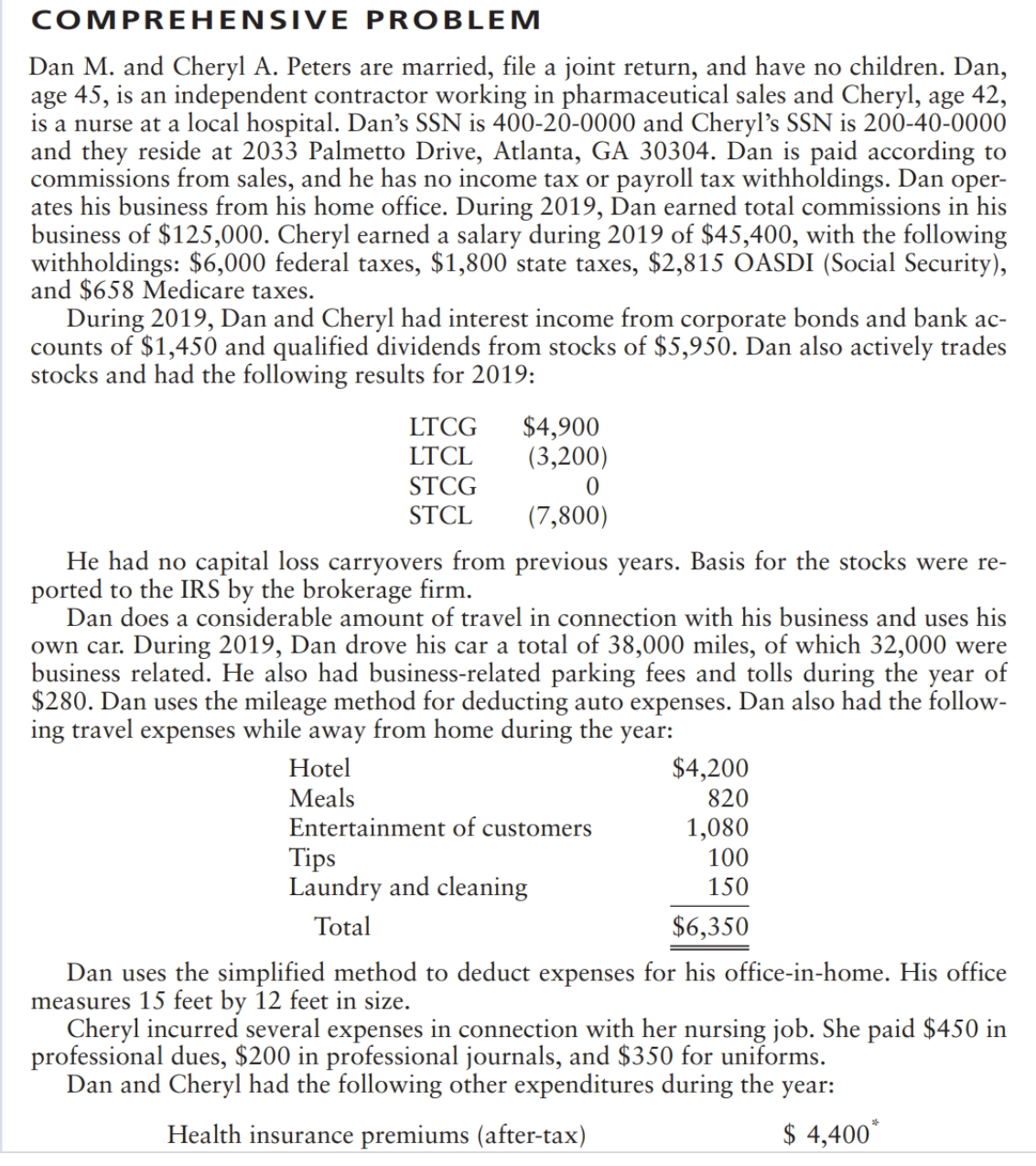

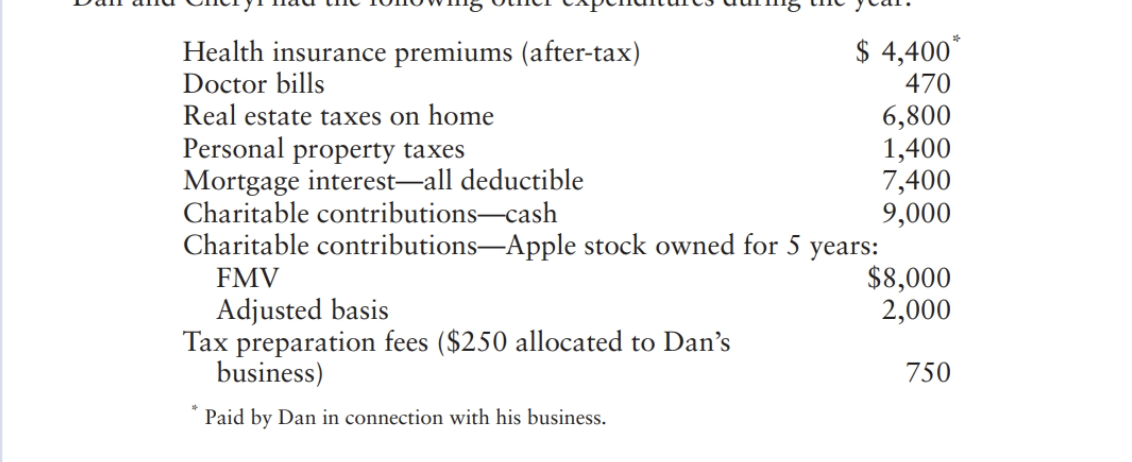

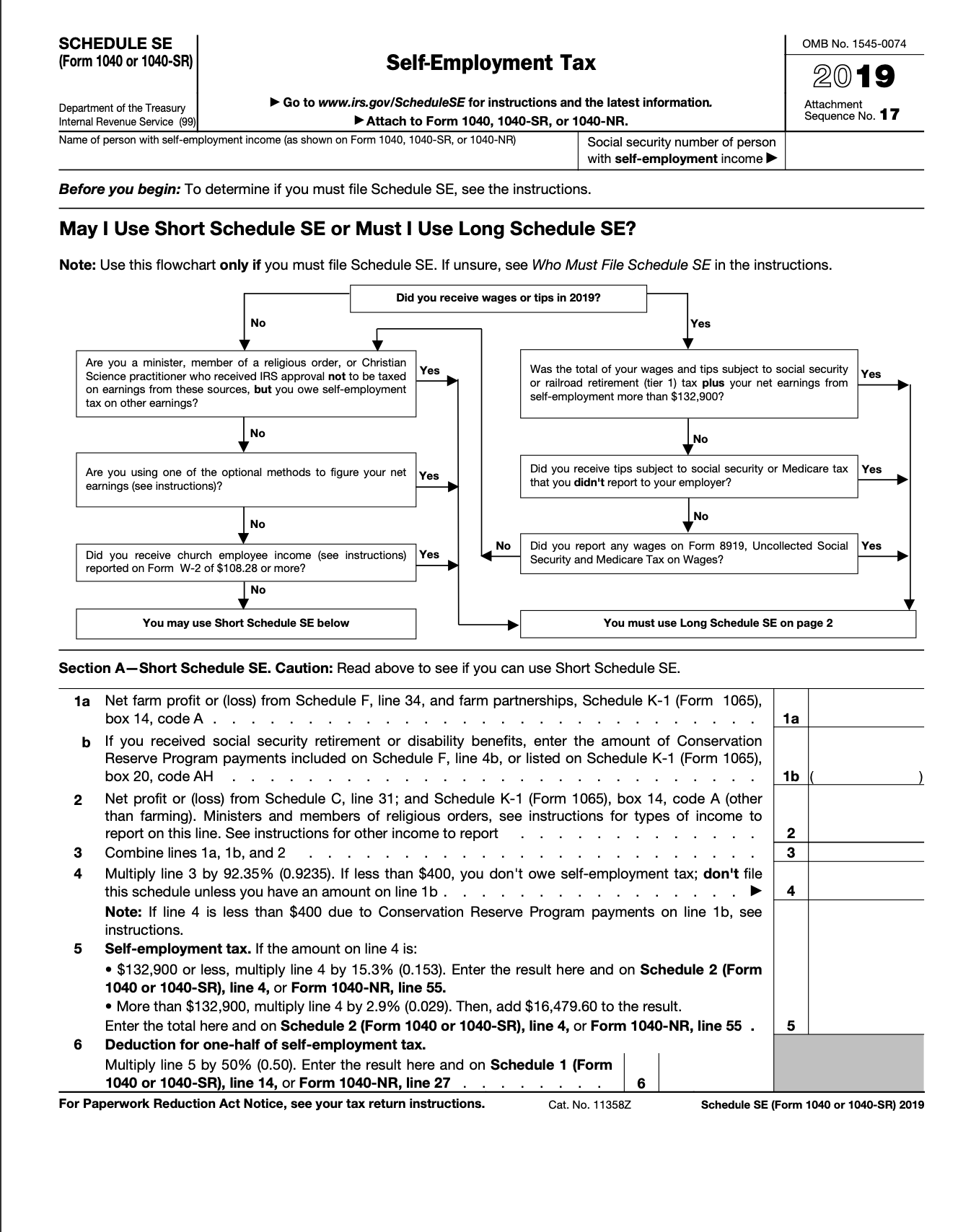

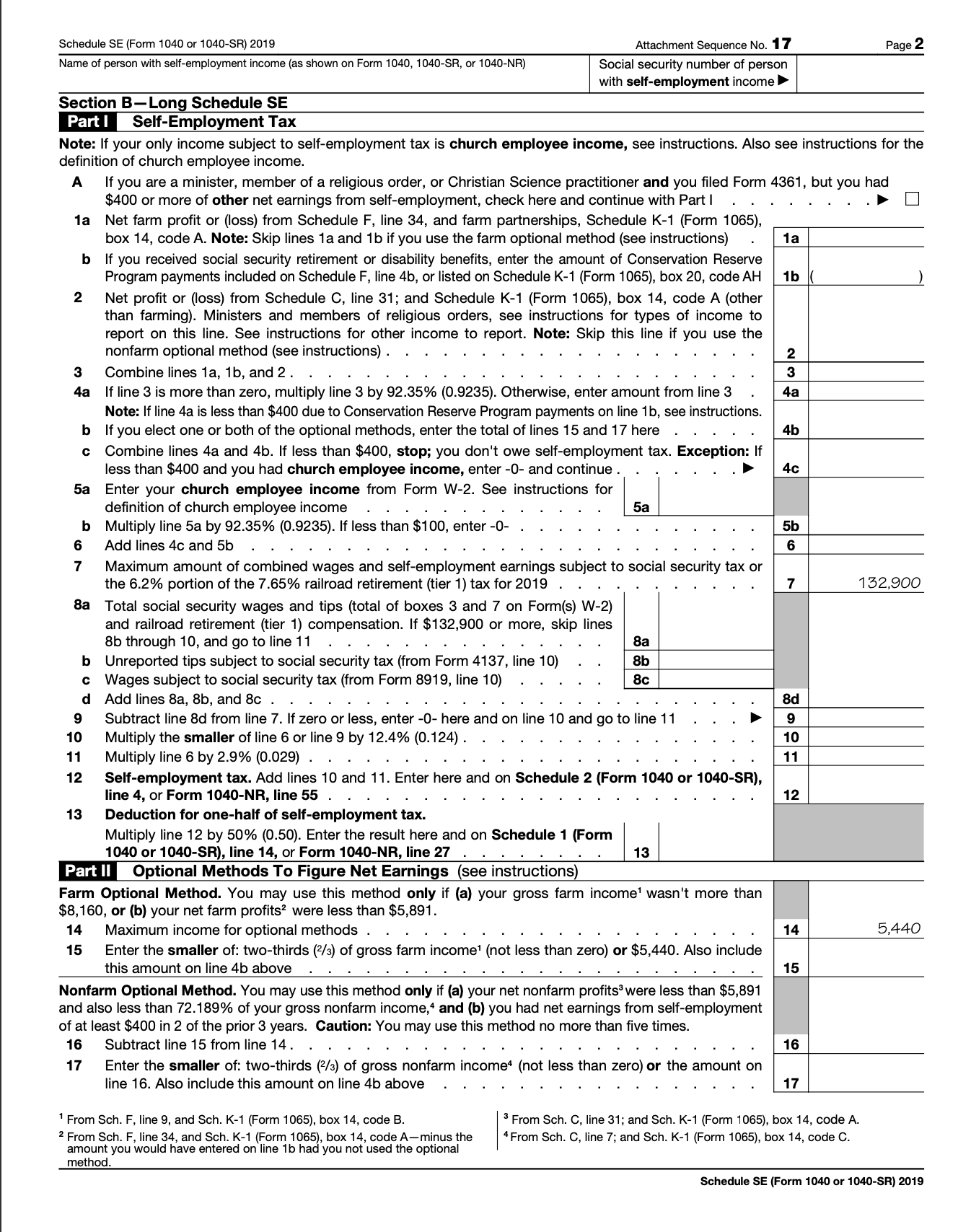

COMPREHENSIVE PROBLEM Dan M. and Cheryl A. Peters are married, file a joint return, and have no children. Dan, age 45, is an independent contractor working in pharmaceutical sales and Cheryl, age 42, is a nurse at a local hospital. Dan's SSN is 400-20-0000 and Cheryl's SSN is 200-40-0000 and they reside at 2033 Palmetto Drive, Atlanta, GA 30304. Dan is paid according to commissions from sales, and he has no income tax or payroll tax withholdings. Dan oper- ates his business from his home office. During 2019, Dan earned total commissions in his business of $125,000. Cheryl earned a salary during 2019 of $45,400, with the following withholdings: $6,000 federal taxes, $1,800 state taxes, $2,815 OASDI (Social Security), and $658 Medicare taxes. During 2019, Dan and Cheryl had interest income from corporate bonds and bank ac- counts of $1,450 and qualified dividends from stocks of $5,950. Dan also actively trades stocks and had the following results for 2019: LTCG $4,900 LTCL (3,200) STCG STCL (7,800) He had no capital loss carryovers from previous years. Basis for the stocks were re- ported to the IRS by the brokerage firm. Dan does a considerable amount of travel in connection with his business and uses his own car. During 2019, Dan drove his car a total of 38,000 miles, of which 32,000 were business related. He also had business-related parking fees and tolls during the year of $280. Dan uses the mileage method for deducting auto expenses. Dan also had the follow- ing travel expenses while away from home during the year: Hotel $4,200 Meals 820 Entertainment of customers 1,080 Tips 100 Laundry and cleaning 150 Total $6,350 Dan uses the simplified method to deduct expenses for his office-in-home. His office measures 15 feet by 12 feet in size. Cheryl incurred several expenses in connection with her nursing job. She paid $450 in professional dues, $200 in professional journals, and $350 for uniforms. Dan and Cheryl had the following other expenditures during the year: Health insurance premiums (after-tax) $ 4,400*Health insurance premiums (after-tax) $ 4,400 Doctor bills 470 Real estate taxes on home 6,800 Personal property taxes 1,400 Mortgage interest-all deductible 7,400 Charitable contributions-cash 9,000 Charitable contributions-Apple stock owned for 5 years: FMV $8,000 Adjusted basis 2,000 Tax preparation fees ($250 allocated to Dan's business) 750 * Paid by Dan in connection with his business.SCHEDULE SE OMB No. 15450074 (Form 1040 or 1040-60 Self-Em ployment Tax 2 1 9 D ment mm Treasury P Go to wwarsgo'VISchedUIeSE tor Instructions and the latest ln'lormatlon. gmcmznha 1 1 Internal Revenue Service [99] FAttac-h to Form 1040, 1 (HO-SR, or \"MO-NR. equ ' Name of person with self-employment income (as shown on Form 1040, 1040-39, or 1040-NR) Social security number of person with self-employment income 5 Before you begin: To determine if you must le Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this owchart only if you must le Schedule SE. If unsure, see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2019? No Yes Are you a minister, member of a religious order, or Christian Science practitioner who received IFtS approval not to be taxed Y\" on earnings from these sources, but you owe self-employment tax on other eemings? Me Are you using one of the optional methods to gure your net Yes earnings (see instmctions)? No Did you receive church employee income (see instmctions) Yes reported on Form W2 of $106.28 or more?I No You may use Short Schedule SE below I You must use Long Schedule SE on page 2 Section AShort Schedule SE. Caution: Read above to see if you can use Short Schedule SE. Was the total of your wages and tips subject to social security or railroad retirement (tier 1) tax plus your net eemings from sell-employment more than $132,900? Yes Did you receive tips subject to social security or Medicare tax that you didn't report to your employer? No Did you report any wages on Form 6919. Uncollected Social Yes Security and Medicare Tax on Wages? 1a Net farm profit or (loss) from Schedule Fl line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A . b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box20,codeAH............................ 2 Net prot or (loss) from Schedule 0, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than taming). Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report Combinelinesta,1b,and2 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file thisscheduleunlessyou haveanamounton line1b. . . . . . . . . . . . . . . . P Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5 Self-employment tax. If the amount on line 4 is: 0 $132,900 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NFI, line 55. - More than $132,900, multiply line 4 by 2.9% (0.029). Then, add $16,479.60 to the result. Enter the total here and on Schedule 2 {Form 1040 or 1040-SR), line 4, or Form 1040-NFI, line 55 . 6 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 {Form 1040 or 1040-SR), line 14, or Form 1040-NFI, line 27 For Paperwork Reduction Act Notice, see your tax return Instructions. Cat. No. 113532 Schedule SE {Farm 1040 or 1040-53) 2019 IF\" Schedule SE {Form 1040 or 1040SR) 2019 Name of person with selfemployment income {as shown on Form 1040, 104093, or 1D40NR) Attachment Sequence No. 'I 7 Socral securrty number of person wrth self-employment Income P Page 2 Section BLon Schedule SE IEII Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions. Also see instructions for the denition of church employee income. If you are a minister, member of a religious order, or Christian Science practitioner and you led Form 4361, but you had A 1a no- a\" b c d 9 10 11 12 13 $400 or more of other net earnings from self-employment, check here and continue with Part I . . Net farm prot or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. Note: Skip lines 1a and 1b if you use the farm optional method (see instructions) If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH Net prot or (loss) from Schedule C, line 31; and Schedule K1 (Form 1065), box 14, code A (other than taming). Ministers and members of religious orders, see instructions for types of income to report on this line. See insthctJ'ons for other income to report. Note: Skip this line if you use the nonfarm optional method (see instructions) . Combine lines 1a, 1b, and 2.. If line 3' Is more than zero, multiply line 3 by 92. 35% (0. 9235). Otherwise, enter amount from line 3 Note: If line 4a Is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. If you elect one or both of the optional methods, enter the total of lines 15 and 17 here . Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception. If less than $400 and you had church employee' Income, enter -0- and continue. . . . . . . > Enter your church employee income from Form W-2. See instmctions for denition of church employee' Income . . . . . . . 5a Multiply line 5a by 92. 35% (0.9235). If less than $100, enter -0- . Addlines4cand5b Maximum amount of combined wages and self-employment earnings subiect to social security tax or the 6. 2% portion of the 7. 65% railroad retirement (tier 1) tax for 2019 . Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $132, 900 or more, skip lines 8b through 10, and go to line 11 Unreported tips subject to social security tax (from Form 4137, line 10) Wages subject to social security tax (from Form 8919, line 10) AddiinesBaHSbandSc. . . . . . . . . . Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 Multiply the smaller of line 6 or line 9 by 12.4% (0.124) . Multiply line 6 by 2. 9% (0.029).. Self- -employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040 or 1040- -SFI), line4,,orFonn1040-anine55. . Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040 or 1040-SR), line 14, or Form 1040-NFI, line 27 . . . . . . 13 V. II Part II Optional Methods To Fi. _ure Net Eaminq -5 see instructions Farm Optional Method. You may use this method only if (a) your gross farm income1 wasn't more than $8,160, or (b) your net farm prots2 were less titan $5,391 . 14 15 Maximum Income for optional methods . . . . . . . . . . . . . . . Enter the smaller of: two-thirds (Zia) of gross farm income1 (not less than zero) or $5, 440. Also include this amount on line 4b above Nonfann Optional Method. You may use this method only if (a) your net nonfarm protsawere less than $5, 391 and also less than 72.189% of your gross nonfarm' Income, and (b) you had net earnings from self- -employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than ve times. 16 17 ' From Sch. F, line 9, and Sch. K-1 (Form 1065), box 14, code B. Subtract line 15 from line 14. Enter the smaller of: two-thirds (2/3) of gross nonfarm income4 (not less than zero) or the amount on line 16. Also include this amount on line 4b above 7 .>|:| A ur 152,900 5,440 3 From Sch. C, line 31; and Sch. K1 (Form 1065), box 14, code A. 2 From Sch. F, line 34, and Sch. K1 (Form 106 , box 14, code Aminus the 'From Sch. C, line 7; and Sch. K1 {Form 1065), box 14, code C. amount you would have entered on line 1b ha you not used the optional method. Schedule 5: [Form1040 or 1040-58,) 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts