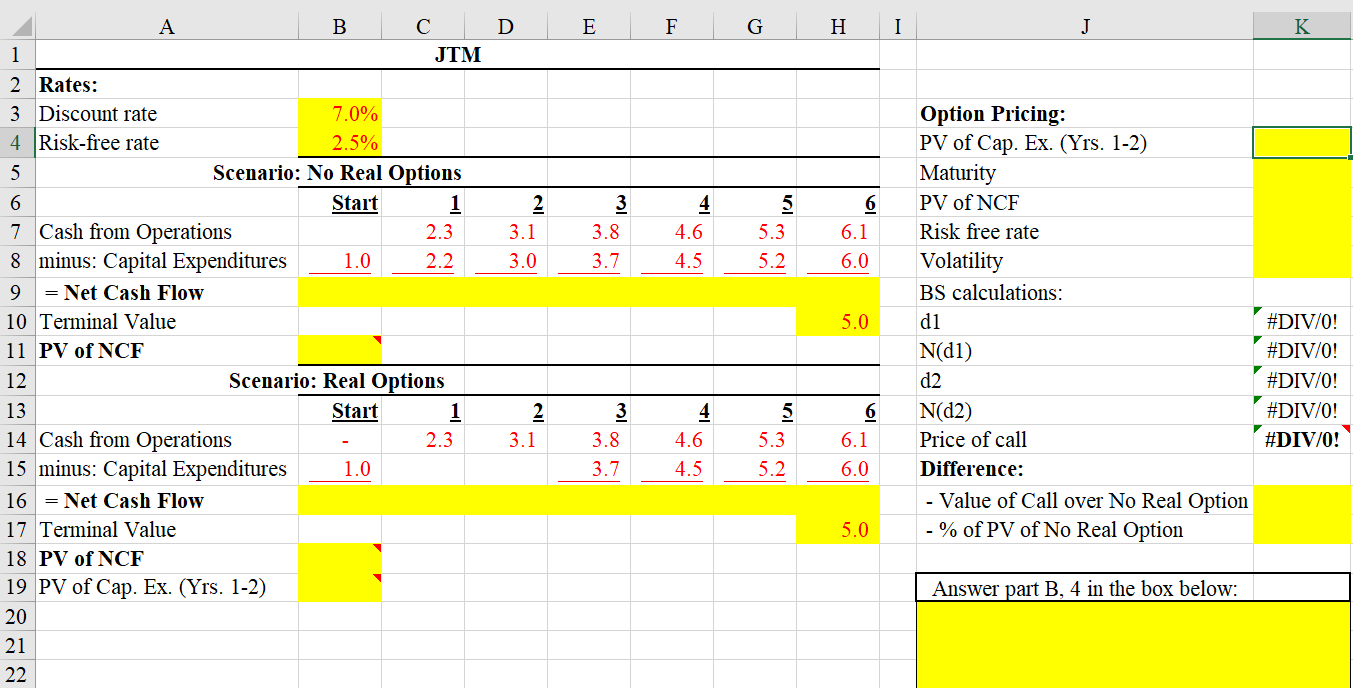

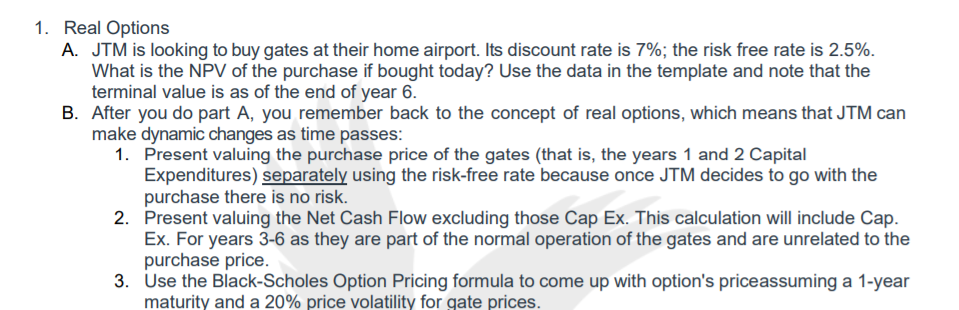

Question: I've changed the numbers on excel so I understand the idea a little better and it is fresher, I did not understand the assignment and

I've changed the numbers on excel so I understand the idea a little better and it is fresher, I did not understand the assignment and ended up doing badly. I need some help understanding before my midterm. My professor didn't really explain well but I really would like help and how to do the functions as formulas in the excel sheet. I know it seems like a lot, but I really need help understanding because I do not know where to start.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts