Question: ive provided examples of how the question is solved all previous responses have been in correct A $15,000 bond redeemable et par on December 19,

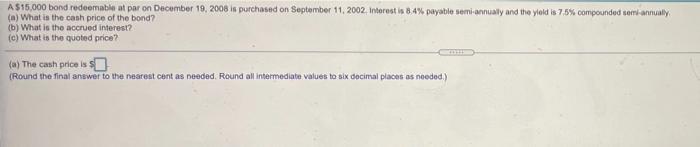

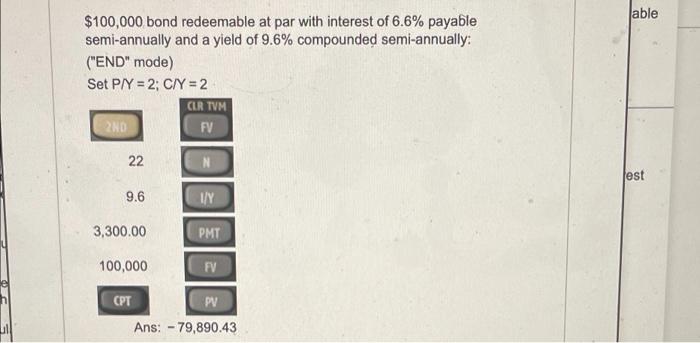

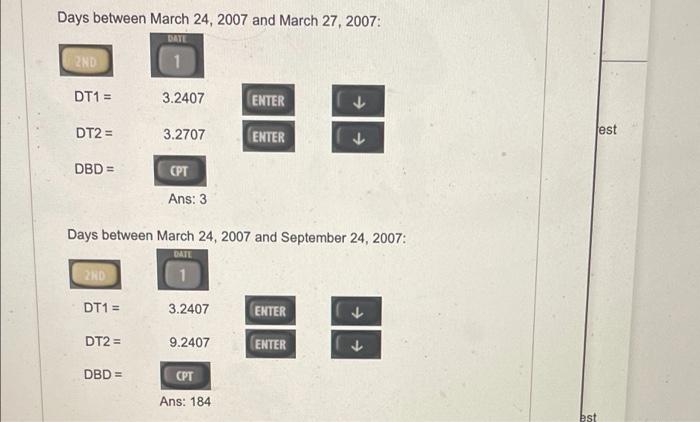

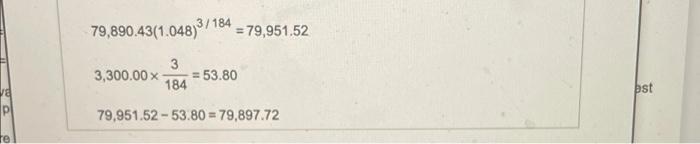

A $15,000 bond redeemable et par on December 19, 2008 is purchased on September 11, 2002. Interest in 8.4% payable semi-annually and the yield is 7.8% compounded somi-annually (a) What is the cash price of the bond? (b) What is the accrued interest? (c) What is the quoted price? (a) The cash price is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Jable $100,000 bond redeemable at par with interest of 6.6% payable semi-annually and a yield of 9.6% compounded semi-annually: ("END" mode) Set PAY = 2; C/Y = 2 CA M 2ND FV 22 N est 9.6 I/Y 3,300.00 XI PMT 100,000 FV CPT PV Ans: - 79,890.43 ull Days between March 24, 2007 and March 27, 2007: DATE 2ND DT1 = 3.2407 ENTER DT2 = 3.2707 est ENTER DBD = CPT Ans: 3 Days between March 24, 2007 and September 24, 2007: DATE 20 DT1 = 3.2407 ENTER DT2 = 9.2407 ENTER DBD = CPT Ans: 184 bst 13/184 79,890.43(1.048) = 79,951.52 3 3,300.00 x 184 :53.80 bst 8 PI 79.951.52-53.80 = 79,897.72 re

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts