Question: I've recieved the same wrong answer for this question, please do not submit the same work as before. Thank you. (1 pt) Suppose three assets

I've recieved the same wrong answer for this question, please do not submit the same work as before. Thank you.

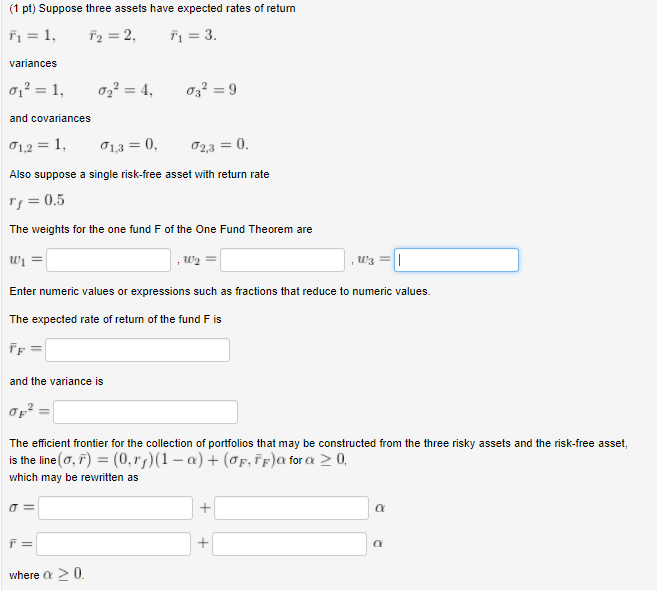

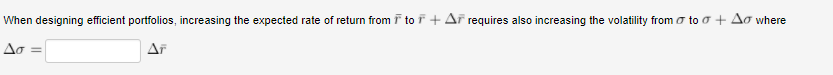

(1 pt) Suppose three assets have expected rates of return fl = 1 -1 = 3 variances and covariances 1,2 = 1. Also suppose a single risk-free asset with return rate rr 0.5 The weights for the one fund F of the One Fund Theorem are 1.3 = 0 W2 Enter numeric values or expressions such as fractions that reduce to numeric values The expected rate of return of the fund F is and the variance is The efficient frontier for the collection of portfolios that may be constructed from the three risky assets and the risk-free asset, is the line(. (0.rj) (1-a) + (F.rF)a fora > 0. which may be rewritten as where a0 (1 pt) Suppose three assets have expected rates of return fl = 1 -1 = 3 variances and covariances 1,2 = 1. Also suppose a single risk-free asset with return rate rr 0.5 The weights for the one fund F of the One Fund Theorem are 1.3 = 0 W2 Enter numeric values or expressions such as fractions that reduce to numeric values The expected rate of return of the fund F is and the variance is The efficient frontier for the collection of portfolios that may be constructed from the three risky assets and the risk-free asset, is the line(. (0.rj) (1-a) + (F.rF)a fora > 0. which may be rewritten as where a0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts