Question: I've solved for operating cash flow, and my final question for this project is: Inflation is estimated to be 2.00 percent. What is the real

I've solved for operating cash flow, and my final question for this project is: Inflation is estimated to be 2.00 percent. What is the real return on this project?

I've solved for operating cash flow, and my final question for this project is: Inflation is estimated to be 2.00 percent. What is the real return on this project?

Would you please walk me through how to calculate that, step-by-step?

P.S. The answer is 13.03, I just would like to know how. Thank you!

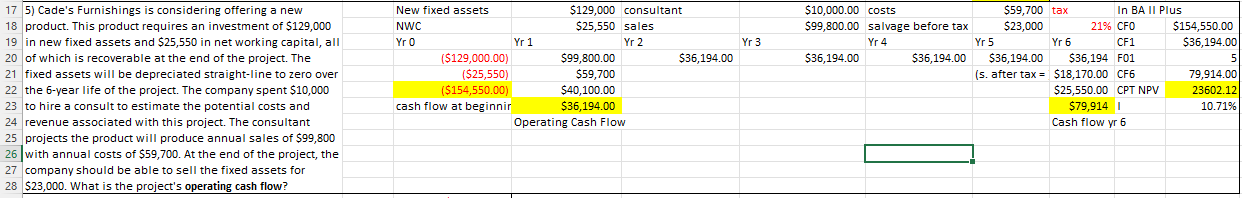

Yr 3 17 5) Cade's Furnishings is considering offering a new 18 product. This product requires an investment of $129,000 19 in new fixed assets and $25,550 in net working capital, all 20 of which is recoverable at the end of the project. The 21 fixed assets will be depreciated straight-line to zero over .. 22 the 6-year life of the project. The company spent $10,000 . 23 to hire a consult to estimate the potential costs and ulte the potential 24 revenue associated with this project. The consultant 25 projects the product will produce annual sales of $99,800 26 with annual costs of $59,700. At the end of the project, the 27 company should be able to sell the fixed assets for 28 $23,000. What is the project's operating cash flow? New fixed assets $129,000 consultant NWC $25,550 sales Yr 0 Yr 1 Yr 2 ($129,000.00) $99,800.00 $36,194.00 ($25,550) $59,700 ($154,550.00) $40,100.00 cash flow at beginnir $36,194.00 Operating Cash Flow $10,000.00 costs $59,700 tax In BA II Plus $99,800.00 salvage before tax $23,000 21% CFO $154,550.00 Yr 4 Yr 5 Yr 6 CF1 $36,194.00 $36,194.00 $36,194.00 $36,194.00 $36,194 F01 5 (s. after tax = $18,170.00 CF6 79,914.00 $25,550.00 CPT NPV 23602.12 $79,914 10.71% Cash flow yr 6 Yr 3 17 5) Cade's Furnishings is considering offering a new 18 product. This product requires an investment of $129,000 19 in new fixed assets and $25,550 in net working capital, all 20 of which is recoverable at the end of the project. The 21 fixed assets will be depreciated straight-line to zero over .. 22 the 6-year life of the project. The company spent $10,000 . 23 to hire a consult to estimate the potential costs and ulte the potential 24 revenue associated with this project. The consultant 25 projects the product will produce annual sales of $99,800 26 with annual costs of $59,700. At the end of the project, the 27 company should be able to sell the fixed assets for 28 $23,000. What is the project's operating cash flow? New fixed assets $129,000 consultant NWC $25,550 sales Yr 0 Yr 1 Yr 2 ($129,000.00) $99,800.00 $36,194.00 ($25,550) $59,700 ($154,550.00) $40,100.00 cash flow at beginnir $36,194.00 Operating Cash Flow $10,000.00 costs $59,700 tax In BA II Plus $99,800.00 salvage before tax $23,000 21% CFO $154,550.00 Yr 4 Yr 5 Yr 6 CF1 $36,194.00 $36,194.00 $36,194.00 $36,194.00 $36,194 F01 5 (s. after tax = $18,170.00 CF6 79,914.00 $25,550.00 CPT NPV 23602.12 $79,914 10.71% Cash flow yr 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts