Question: Shan Trading Company conducted the following transactions during May, 2020:- a) Sold merchandise to Rehmat Brothers at Rs. 50,000 on 05 May 2020 terms

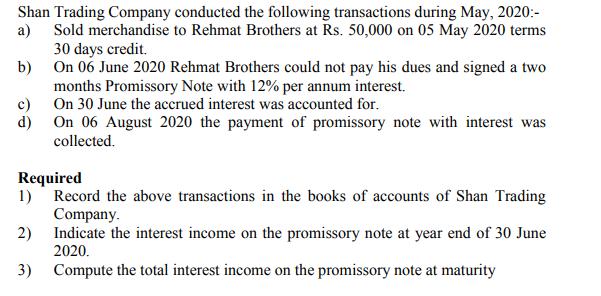

Shan Trading Company conducted the following transactions during May, 2020:- a) Sold merchandise to Rehmat Brothers at Rs. 50,000 on 05 May 2020 terms 30 days credit. b) On 06 June 2020 Rehmat Brothers could not pay his dues and signed a two months Promissory Note with 12% per annum interest. On 30 June the accrued interest was accounted for. c) d) On 06 August 2020 the payment of promissory note with interest was collected. Required 1) 2) 3) Record the above transactions in the books of accounts of Shan Trading Company. Indicate the interest income on the promissory note at year end of 30 June 2020. Compute the total interest income on the promissory note at maturity

Step by Step Solution

3.30 Rating (162 Votes )

There are 3 Steps involved in it

1 Sh an Trading Company May 05 2020 Re h mat Brothers Account Rece ivable 50 000 To Sales 50 000 Bei... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635db6a71bae3_178237.pdf

180 KBs PDF File

635db6a71bae3_178237.docx

120 KBs Word File