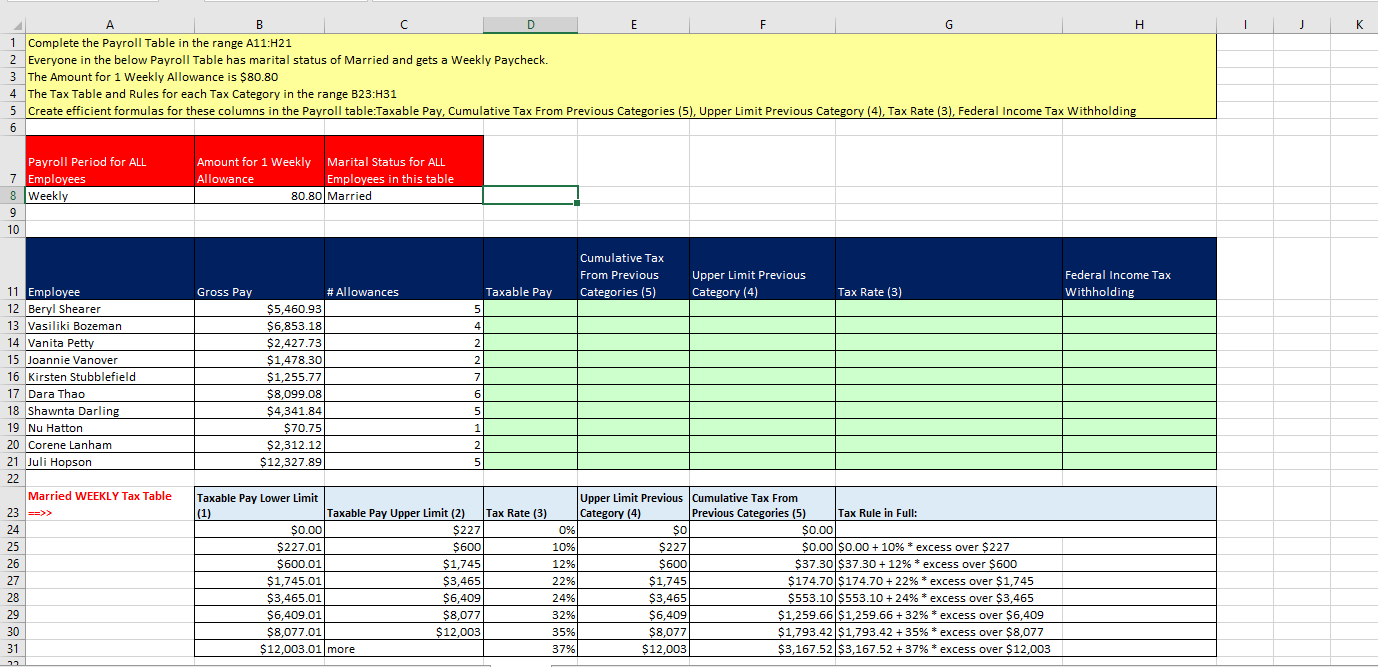

Question: J B C D E F G H 1 Complete the Payroll Table in the range A11:H21 2 Everyone in the below Payroll Table has

J B C D E F G H 1 Complete the Payroll Table in the range A11:H21 2 Everyone in the below Payroll Table has marital status of Married and gets a Weekly Paycheck. 3 The Amount for 1 Weekly Allowance is $80.80 4 The Tax Table and Rules for each Tax Category in the range B23:H31 5 Create efficient formulas for these columns in the Payroll table:Taxable Pay, Cumulative Tax From Previous Categories (5), Upper Limit Previous Category (4), Tax Rate (3), Federal Income Tax Withholding 6 Payroll Period for ALL 7 Employees 8 Weekly 9 10 Amount for 1 Weekly Marital Status for ALL Allowance Employees in this table 80.80 Married Cumulative Tax From Previous Categories (5) Upper Limit Previous Category (4) Federal Income Tax Withholding Gross Pay # Allowances Taxable Pay 5 Tax Rate (3) 4 2 2 7 $5,460.93 $6,853.18 $2,427.73 $1,478.30 $1,255.77 $8,099.08 $4,341.84 $ 70.75 $2,312.12 $12,327.89 6 5 1 11 Employee 12 Beryl Shearer 13 Vasiliki Bozeman 14 Vanita Petty 15 Joannie Vanover 16 Kirsten Stubblefield 17 Dara Thao 18 Shawnta Darling 19 Nu Hatton 20 Corene Lanham 21 Juli Hopson 22 Married WEEKLY Tax Table 23 => 24 25 26 27 28 29 30 31 2 5 Taxable Pay Lower Limit Upper Limit Previous Cumulative Tax From (1) Taxable Pay Upper Limit (2) Tax Rate (3) Category (4) Previous Categories (5) Tax Rule in Full: $0.00 $227 0% $0 $0.00 $227.01 $600 10% $227 $0.00 $0.00 + 10% * excess over $227 $600.01 $1,745 12% $600 $37.30 $37.30 +12% * excess over $600 $1,745.01 $3,465 22% $1,745 $174.70 $174.70 + 22% * excess over $1,745 $3,465.01 $6,409 24% $3,465 $553.10 $553.10 + 24% * excess over $3,465 $6,409.01 $8,077 32%) $6,409 $1,259.66 $1,259.66 + 32% * excess over $6,409 $8,077.01 $12,003 35% $8,077 $1,793.42 $1,793.42 + 35% * excess over $8,077 $12,003.01 more 37% $12,003 $3,167.52 $3,167.52 + 37% * excess over $12,003 J B C D E F G H 1 Complete the Payroll Table in the range A11:H21 2 Everyone in the below Payroll Table has marital status of Married and gets a Weekly Paycheck. 3 The Amount for 1 Weekly Allowance is $80.80 4 The Tax Table and Rules for each Tax Category in the range B23:H31 5 Create efficient formulas for these columns in the Payroll table:Taxable Pay, Cumulative Tax From Previous Categories (5), Upper Limit Previous Category (4), Tax Rate (3), Federal Income Tax Withholding 6 Payroll Period for ALL 7 Employees 8 Weekly 9 10 Amount for 1 Weekly Marital Status for ALL Allowance Employees in this table 80.80 Married Cumulative Tax From Previous Categories (5) Upper Limit Previous Category (4) Federal Income Tax Withholding Gross Pay # Allowances Taxable Pay 5 Tax Rate (3) 4 2 2 7 $5,460.93 $6,853.18 $2,427.73 $1,478.30 $1,255.77 $8,099.08 $4,341.84 $ 70.75 $2,312.12 $12,327.89 6 5 1 11 Employee 12 Beryl Shearer 13 Vasiliki Bozeman 14 Vanita Petty 15 Joannie Vanover 16 Kirsten Stubblefield 17 Dara Thao 18 Shawnta Darling 19 Nu Hatton 20 Corene Lanham 21 Juli Hopson 22 Married WEEKLY Tax Table 23 => 24 25 26 27 28 29 30 31 2 5 Taxable Pay Lower Limit Upper Limit Previous Cumulative Tax From (1) Taxable Pay Upper Limit (2) Tax Rate (3) Category (4) Previous Categories (5) Tax Rule in Full: $0.00 $227 0% $0 $0.00 $227.01 $600 10% $227 $0.00 $0.00 + 10% * excess over $227 $600.01 $1,745 12% $600 $37.30 $37.30 +12% * excess over $600 $1,745.01 $3,465 22% $1,745 $174.70 $174.70 + 22% * excess over $1,745 $3,465.01 $6,409 24% $3,465 $553.10 $553.10 + 24% * excess over $3,465 $6,409.01 $8,077 32%) $6,409 $1,259.66 $1,259.66 + 32% * excess over $6,409 $8,077.01 $12,003 35% $8,077 $1,793.42 $1,793.42 + 35% * excess over $8,077 $12,003.01 more 37% $12,003 $3,167.52 $3,167.52 + 37% * excess over $12,003

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts