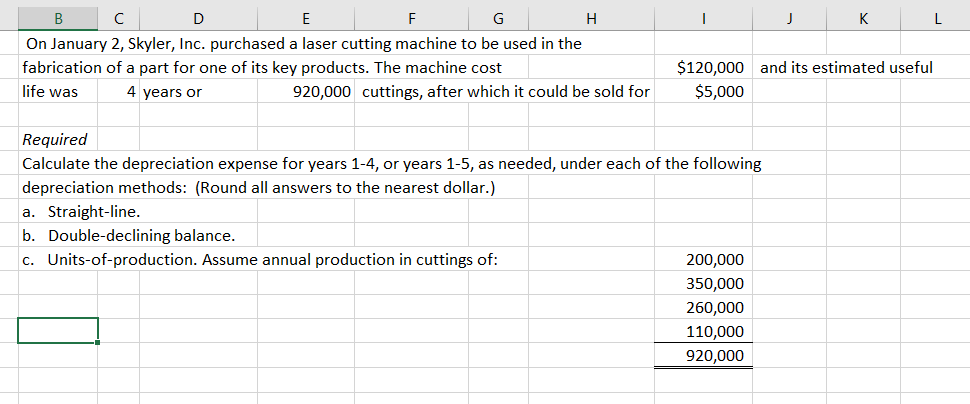

Question: - J K L B D E F G H On January 2, Skyler, Inc. purchased a laser cutting machine to be used in the

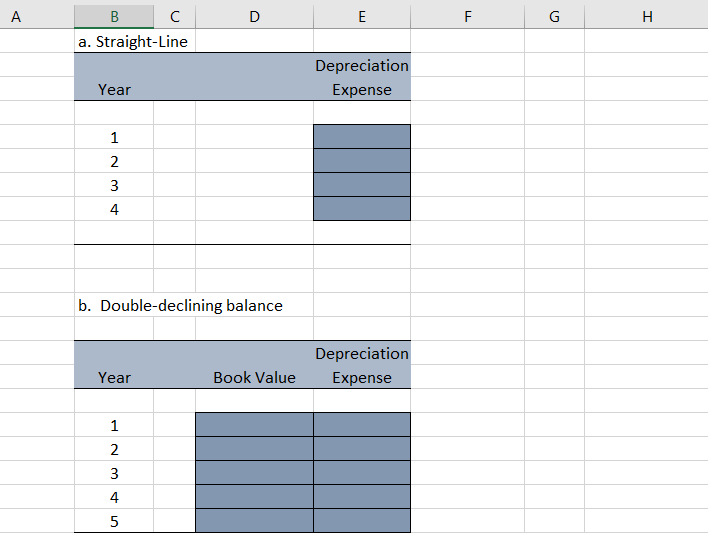

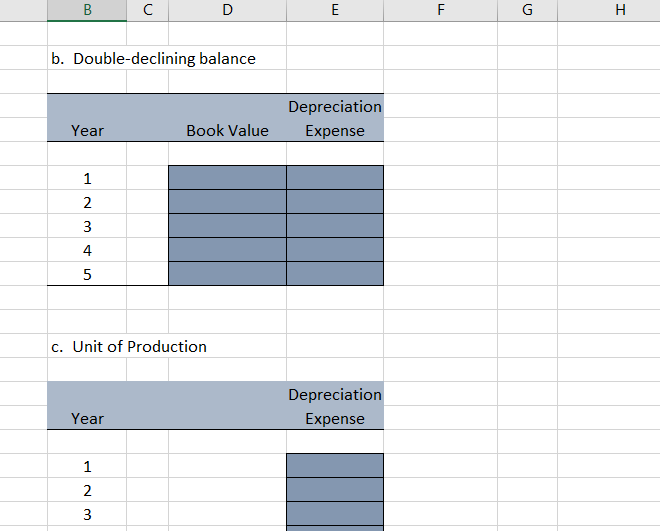

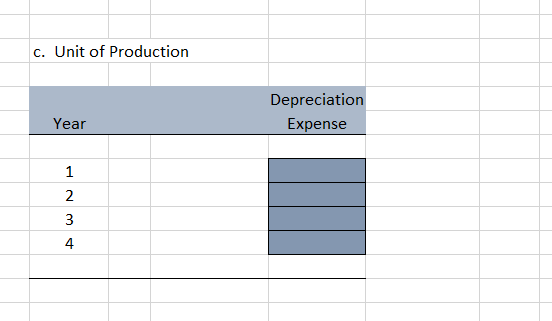

- J K L B D E F G H On January 2, Skyler, Inc. purchased a laser cutting machine to be used in the fabrication of a part for one of its key products. The machine cost 4 years or 920,000 cuttings, after which it could be sold for $120,000 and its estimated useful $5,000 life was Required Calculate the depreciation expense for years 1-4, or years 1-5, as needed, under each of the following depreciation methods: (Round all answers to the nearest dollar.) a. Straight-line. b. Double-declining balance. c. Units-of-production. Assume annual production in cuttings of: 200,000 350,000 260,000 110,000 920,000 E F G H B a. Straight-Line Depreciation Expense Year 1 2 3 4 b. Double-declining balance Depreciation Expense Year Book Value 1 2 3 4 5 B D E F G . b. Double-declining balance Depreciation Expense Year Book Value 1 2 3 4. 5 c. Unit of Production Depreciation Expense Year 1 2 3 c. Unit of Production Depreciation Expense Year 1 N 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts