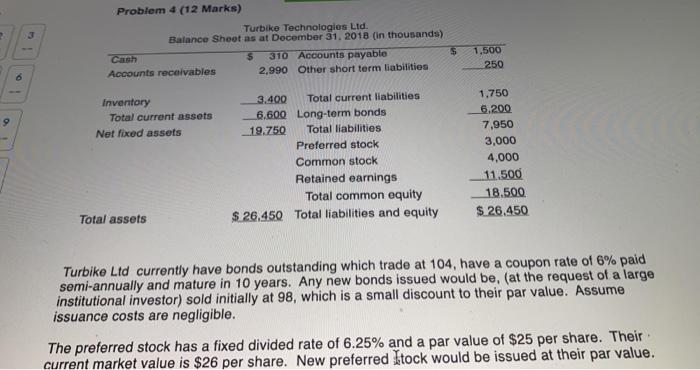

Question: J Problem 4 (12 Marks) Turbike Technologies Ltd. Balance Sheet as at December 31, 2018 (in thousands) Cash 310 Accounts payable Accounts receivables 2,990 Other

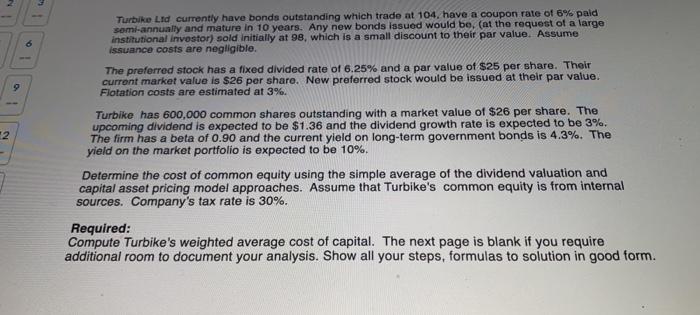

J Problem 4 (12 Marks) Turbike Technologies Ltd. Balance Sheet as at December 31, 2018 (in thousands) Cash 310 Accounts payable Accounts receivables 2,990 Other short term liabilities $ 1,500 250 9 Inventory Total current assets Net fixed assets 3.400 Total current liabilities 6.600 Long-term bonds 19.750 Total liabilities Preferred stock Common stock Retained earnings Total common equity $ 26,450 Total liabilities and equity 1.750 6.200 7,950 3,000 4,000 11.500 18.500 $ 26,450 Total assets Turbike Ltd currently have bonds outstanding which trade at 104, have a coupon rate of 6% paid semi-annually and mature in 10 years. Any new bonds issued would be, (at the request of a large institutional investor) sold initially at 98, which is a small discount to their par value. Assume issuance costs are negligible. The preferred stock has a fixed divided rate of 6.25% and a par value of $25 per share. Their current market value is $26 per share. New preferred Itock would be issued at their par value. 6 9 Turbike Lid currently have bonds outstanding which trade at 104. have a coupon rate of 6% paid semi-annually and mature in 10 years. Any new bonds issued would be, (at the request of a large institutional investor) sold Initially at 98, which is a small discount to their par value. Assume issuance costs are negligible. The preferred stock has a fixed divided rate of 6.25% and a par value of $25 per share. Their current market value is $26 per share. New preferred stock would be issued at their par value. Flotation costs are estimated at 3%. Turbike has 600,000 common shares outstanding with a market value of $26 per share. The upcoming dividend is expected to be $1.36 and the dividend growth rate is expected to be 3%. The firm has a beta of 0.90 and the current yield on long-term government bonds is 4.3%. The yield on the market portfolio is expected to be 10% Determine the cost of common equity using the simple average of the dividend valuation and capital asset pricing model approaches. Assume that Turbike's common equity is from internal sources. Company's tax rate is 30%. 12 Required: Compute Turbike's weighted average cost of capital. The next page is blank if you require additional room to document your analysis. Show all your steps, formulas to solution in good form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts