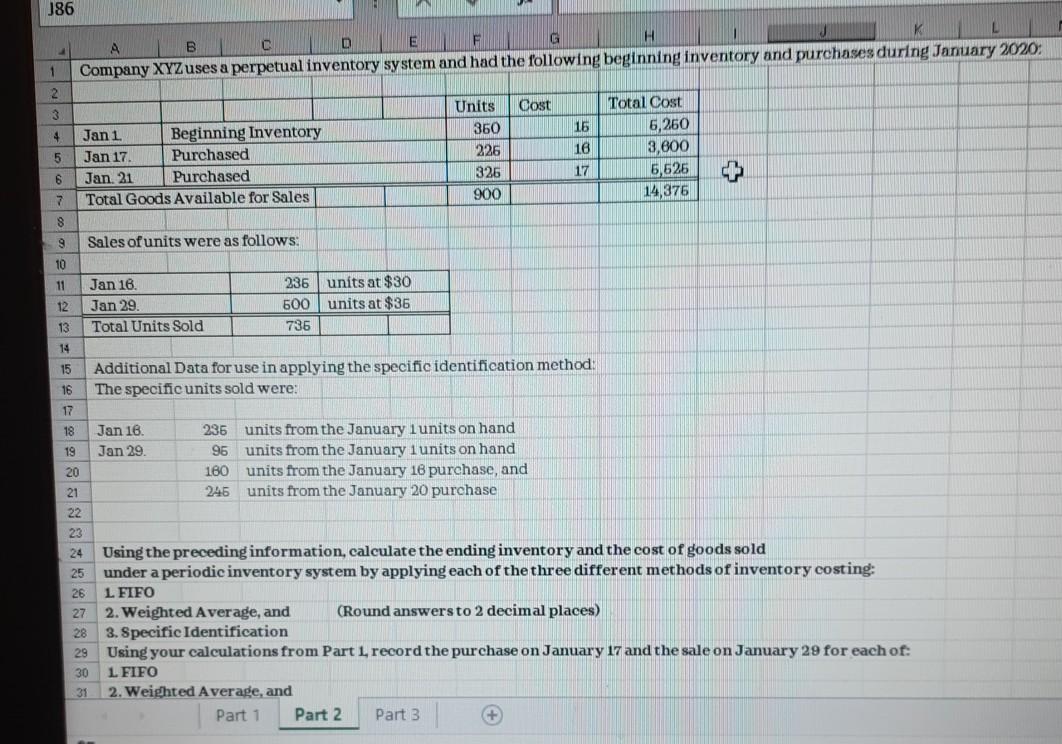

Question: J86 4 A B C D E G H L Company XYZ uses a perpetual inventory system and had the following beginning inventory and purchases

J86 4 A B C D E G H L Company XYZ uses a perpetual inventory system and had the following beginning inventory and purchases during January 2020: 1 2 Units Cost 3 360 15 4 18 Jan 1 Beginning Inventory Jan 17 Purchased Jan 21 Purchased Total Goods Available for Sales 5 Total Cost 6,260 3,800 6,625 14,376 226 326 900 17 6 7 8 9 Sales of units were as follows: 10 11 12 Jan 16 Jan 29. Total Units Sold 236 units at $30 600 units at $36 736 13 14 15 Additional Data for use in applying the specific identification method: The specific units sold were: 16 17 18 Jan 16 Jan 29. 19 235 units from the January 1 units on hand 96 units from the January 1units on hand 180 units from the January 16 purchase, and 245 units from the January 20 purchase 20 22 23 24 25 26 27 28 Using the preceding information, calculate the ending inventory and the cost of goods sold under a periodic inventory system by applying each of the three different methods of inventory costing: L FIFO 2. Weighted Average, and (Round answers to 2 decimal places) 3. Specific Identification Using your calculations from Part 1, record the purchase on January 17 and the sale on January 29 for each of: 1 FIFO 2. Weighted Average, and Part 1 Part 2 Part 3 29 30 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts