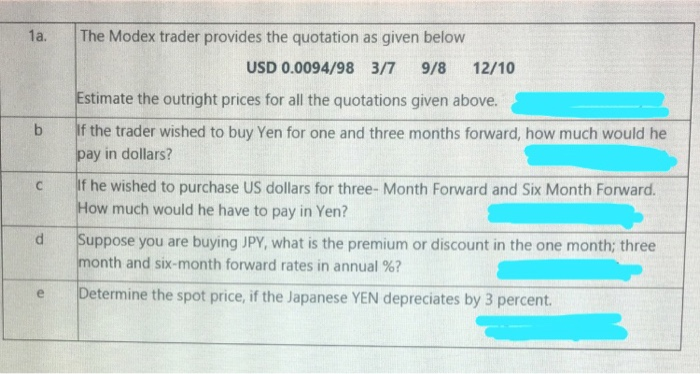

Question: Ja The Modex trader provides the quotation as given below USD 0.0094/98 3/7 9/8 12/10 .Estimate the outright prices for all the quotations given above

Ja The Modex trader provides the quotation as given below USD 0.0094/98 3/7 9/8 12/10 .Estimate the outright prices for all the quotations given above If the trader wished to buy Yen for one and three months forward, how much would he pay in dollars If he wished to purchase US dollars for three- Month Forward and Six Month Forward. How ?much would he have to pay in Yen Suppose you are buying JPY, what is the premium or discount in the one month; three month ?% and six-month forward rates in annual .Determine the spot price, if the Japanese YEN depreciates by 3 percent 1a. The Modex trader provides the quotation as given below USD 0.0094/98 3/7 9/8 12/10 Estimate the outright prices for all the quotations given above. b If the trader wished to buy Yen for one and three months forward, how much would he pay in dollars? d If he wished to purchase US dollars for three- Month Forward and Six Month Forward. How much would he have to pay in Yen? Suppose you are buying JPY, what is the premium or discount in the one month; three month and six-month forward rates in annual %? Determine the spot price, if the Japanese YEN depreciates by 3 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts