Question: Jack and Ann will file a joint return for the year ended December 31, 2021, on which they report taxable income of $130,900 which includes

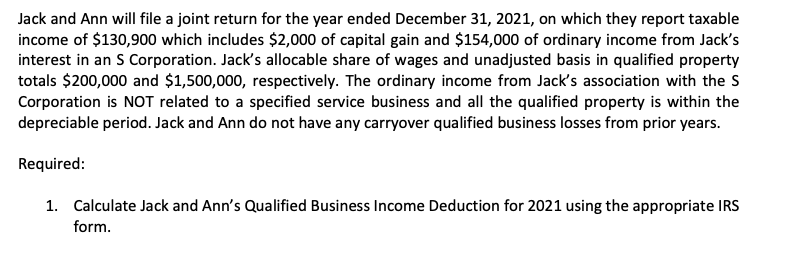

Jack and Ann will file a joint return for the year ended December 31, 2021, on which they report taxable income of $130,900 which includes $2,000 of capital gain and $154,000 of ordinary income from Jack's interest in an S Corporation. Jack's allocable share of wages and unadjusted basis in qualified property totals $200,000 and $1,500,000, respectively. The ordinary income from Jack's association with the S Corporation is NOT related to a specified service business and all the qualified property is within the depreciable period. Jack and Ann do not have any carryover qualified business losses from prior years. Required: 1. Calculate Jack and Ann's Qualified Business Income Deduction for 2021 using the appropriate IRS form. Jack and Ann will file a joint return for the year ended December 31, 2021, on which they report taxable income of $130,900 which includes $2,000 of capital gain and $154,000 of ordinary income from Jack's interest in an S Corporation. Jack's allocable share of wages and unadjusted basis in qualified property totals $200,000 and $1,500,000, respectively. The ordinary income from Jack's association with the S Corporation is NOT related to a specified service business and all the qualified property is within the depreciable period. Jack and Ann do not have any carryover qualified business losses from prior years. Required: 1. Calculate Jack and Ann's Qualified Business Income Deduction for 2021 using the appropriate IRS form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts