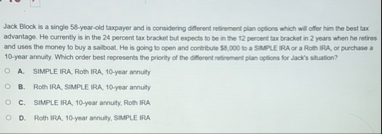

Question: Jack Block is a single 5 8 - year - old taxpayer and is considering different retrement plan options which will offer him the best

Jack Block is a single yearold taxpayer and is considering different retrement plan options which will offer him the best tax advantage. He currently is in the percent tax bracket but expects to be in the percent lax bracket in years when he retires and uses the money to buy a salboat. He is going to open and contribute $ to a SMPLE IRA or a Roth IRA or purchase a year annully. Which order best represents the priority of the offerent refrement plan opfions for Jack's stuation?

A SIMPLE IRA Roth IRA year annuity

B Roth IRA SMPLE IRA, year annuity

C SIMPLE IRA, year arnuity, Roth IRA

D Poth IRA, year annity, SMAPLE IRA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock