Question: Jack Daniels Inc. wants to replace its current distillery which is listed in its balance sheet with a book value of $5 million, with new

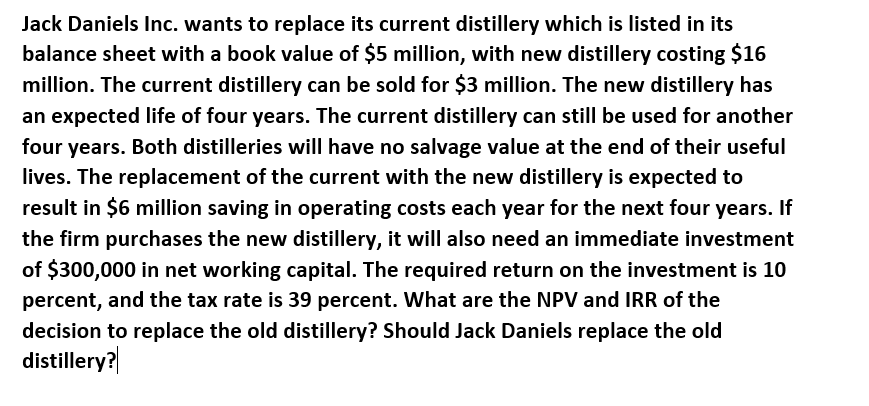

Jack Daniels Inc. wants to replace its current distillery which is listed in its balance sheet with a book value of $5 million, with new distillery costing $16 million. The current distillery can be sold for $3 million. The new distillery has an expected life of four years. The current distillery can still be used for another four years. Both distilleries will have no salvage value at the end of their useful lives. The replacement of the current with the new distillery is expected to result in $6 million saving in operating costs each year for the next four years. If the firm purchases the new distillery, it will also need an immediate investment of $300,000 in net working capital. The required return on the investment is 10 percent, and the tax rate is 39 percent. What are the NPV and IRR of the decision to replace the old distillery? Should Jack Daniels replace the old distillery

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts