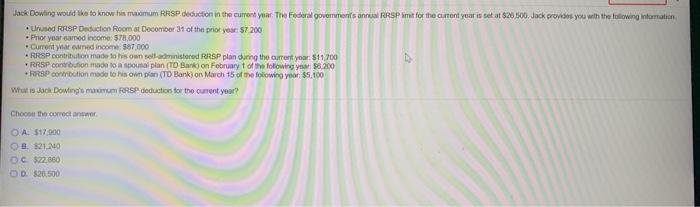

Question: Jack Dowing would like to know a maximum RRSP deduction in the current year. The Federal government's an RSP it for the current year is

Jack Dowing would like to know a maximum RRSP deduction in the current year. The Federal government's an RSP it for the current year is set at $26.500, Jack provides you with the following information Unused RRSP Deduction Room at December 31 of the prior your $7.200 . Prior year comod income: 578,000 Current par une income $87 000 RRSP contribution made to his own administered RRSP plan during the current year: 511700 RRSP Cortion made to a spousal plan (TD Bank) on February of the following year $6.200 RRSP contribution made to his own plan (TO Bank) on March 15 of the following year $5.100 What is Jack Dowing mamum FRSP deduction to the current year? Choose the correct answer O. A $17.000 8. 2120 BH 1000 OD. $20.500 Jack Dowing would like to know a maximum RRSP deduction in the current year. The Federal government's an RSP it for the current year is set at $26.500, Jack provides you with the following information Unused RRSP Deduction Room at December 31 of the prior your $7.200 . Prior year comod income: 578,000 Current par une income $87 000 RRSP contribution made to his own administered RRSP plan during the current year: 511700 RRSP Cortion made to a spousal plan (TD Bank) on February of the following year $6.200 RRSP contribution made to his own plan (TO Bank) on March 15 of the following year $5.100 What is Jack Dowing mamum FRSP deduction to the current year? Choose the correct answer O. A $17.000 8. 2120 BH 1000 OD. $20.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts