Question: Jackson Co is a large manufacturing entity specializing in the construction of solar panels. Historically, the company has used only performance measures to assess

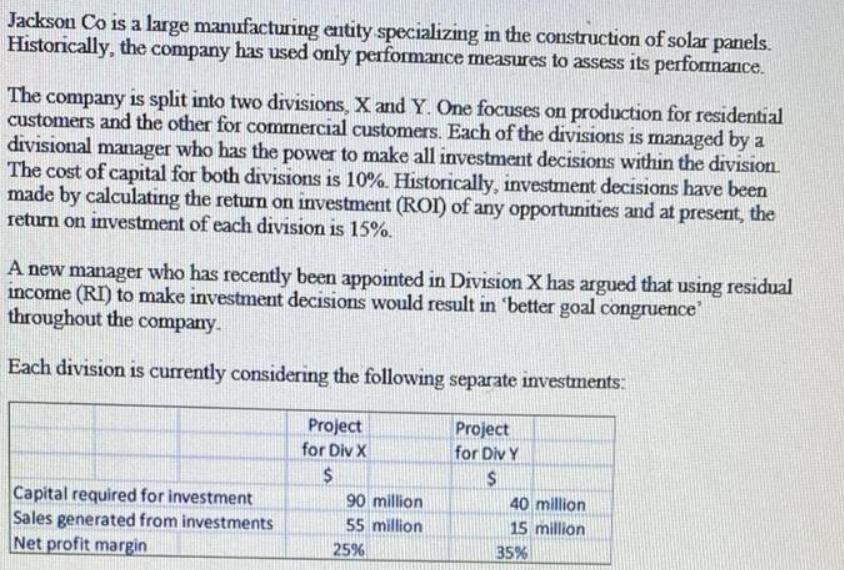

Jackson Co is a large manufacturing entity specializing in the construction of solar panels. Historically, the company has used only performance measures to assess its performance. The company is split into two divisions, X and Y. One focuses on production for residential customers and the other for commercial customers. Each of the divisions is managed by a divisional manager who has the power to make all investment decisions within the division. The cost of capital for both divisions is 10%. Historically, investment decisions have been made by calculating the return on investment (RO) of any opportunities and at present, the return on investment of each division is 15%. A new manager who has recently been appointed in Division X has argued that using residual income (RI) to make investment decisions would result in 'better goal congruence' throughout the company. Each division is currently considering the following separate investments: Project for Div X Project for Div Y Capital required for investment Sales generated from investments Net profit margin 90 million 55 million 40 million 15 million 25% 35%

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Question on Jackson Co ROI versus Residual income ROI and residual income for both the proposals are calculated below Residual income measures income ... View full answer

Get step-by-step solutions from verified subject matter experts