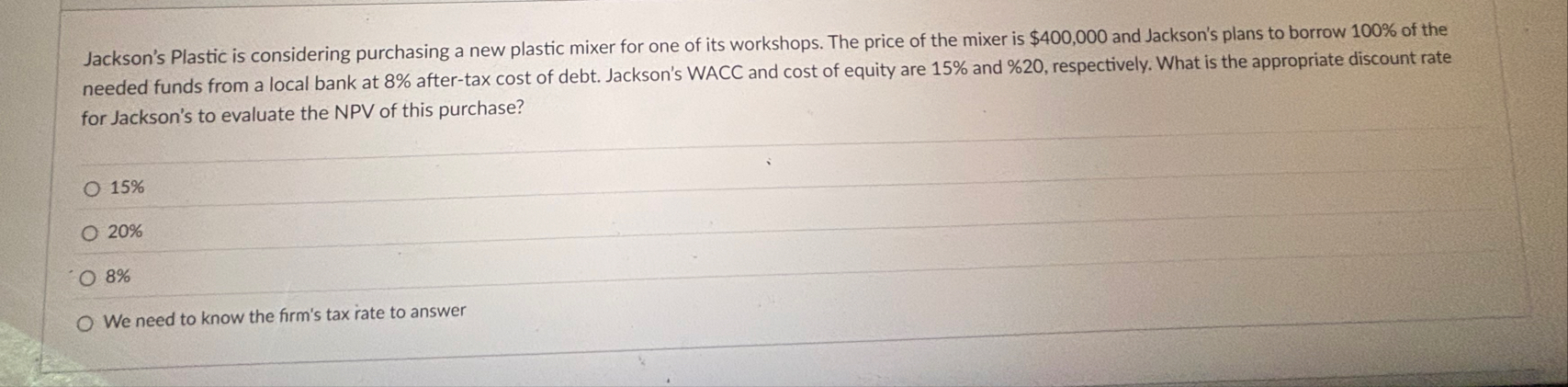

Question: Jackson's Plastic is considering purchasing a new plastic mixer for one of its workshops. The price of the mixer is $ 4 0 0 ,

Jackson's Plastic is considering purchasing a new plastic mixer for one of its workshops. The price of the mixer is $ and Jackson's plans to borrow of the needed funds from a local bank at aftertax cost of debt. Jackson's WACC and cost of equity are and respectively. What is the appropriate discount rate for Jackson's to evaluate the NPV of this purchase?

We need to know the firm's tax rate to answer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock