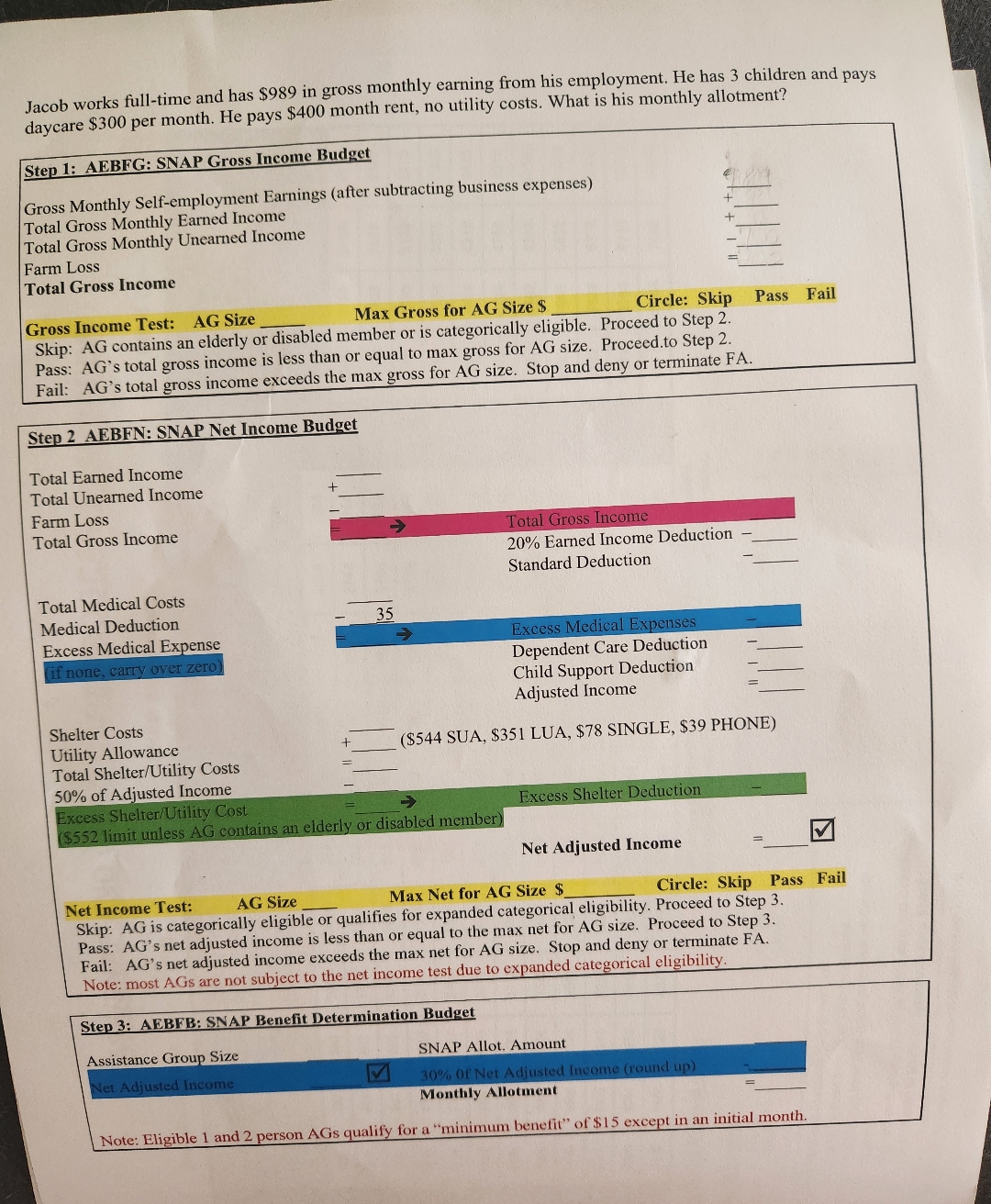

Question: Jacob works full - time and has $ 9 8 9 in groSS monthly carnng from his employment. He has 3 children and paysdavcare $

Jacob works fulltime and has $ in groSS monthly carnng from his employment. He has children and paysdavcare $ per month. He pays $ month rent, no utility costs. What is his monthly allotmentStep : AEBFG: SNAP Gross Income BudgetGross Monthly Selfemployment Earnings after subtracting business expensesTotal Gross Monthly Earned IncomeTotal Gross Monthly Unearned IncomeFarm LOSSTotal Gross IncomeCircle: SkipMax Gross for AG SizeSSkip: AG contains an elderly or disabled member or is categorically eligible. Proceed to Step Pass: AG's total gross income is less than or equal to max gross for AG size. Proceed.to Step Gross Income Test: AG SizeStep AEBEN: SNAP Net Income BudgetTotal Earned IncomeTotal Unearned IncomeFarm LoSsTotal Gross IncomeTotal Medical CostsMedical DeductionExcess Medical Expensef none. carry over zeroShelter CostsUtility AllowanceTotal ShelterUtility Costs of Adjusted IncomeExcess ShelterUtility Cost$ limt unless AG contains an elderly or disabled memberAG SizeAssistance Group SizeNet Adiusted InconeTotal Gross IncomeStep : AEBFB: SNAP Benefit Determination Budget Earmed Income DeductionStandard DeductionExcess Medical ExpcnsesDependent Care DeductionChild Support DeductionAdjusted IncomeS SUA, S LUA, $ SINGLE, $ PHONEExcess Shelter DeductionNet Adjusted IncomeMax Net for AG Size $Circle: SkipNet Income Test:Skip: AG is categorical ly eligible or qualifies for expanded categorical eligibility. Proceed to Step Pass: AG's net adjusted income is less than or equal to the max net for AG size. Proceed to Step Fail: AG's net adjusted income exceeds the max net for AG size. Stop and deny or terminate FANote: most AGs are not subject to the net income test due to expanded categorical eligibility.Pass FailSNAP Allot. AmountfNet Adjusted Income round upMonthly AllotmentPass FailNote: Eligible and person AGs qualify for a "minimum benefit" of $ except in an initial month.Fail: AG's total gross income exceeds the max gross for AG size. Stop and deny or terminate FA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock