Question: Jacob's Widgets Inc. has successfully expanded its operations following the analysis and recommendations provided earlier. As a result, the company's financial landscape has evolved.

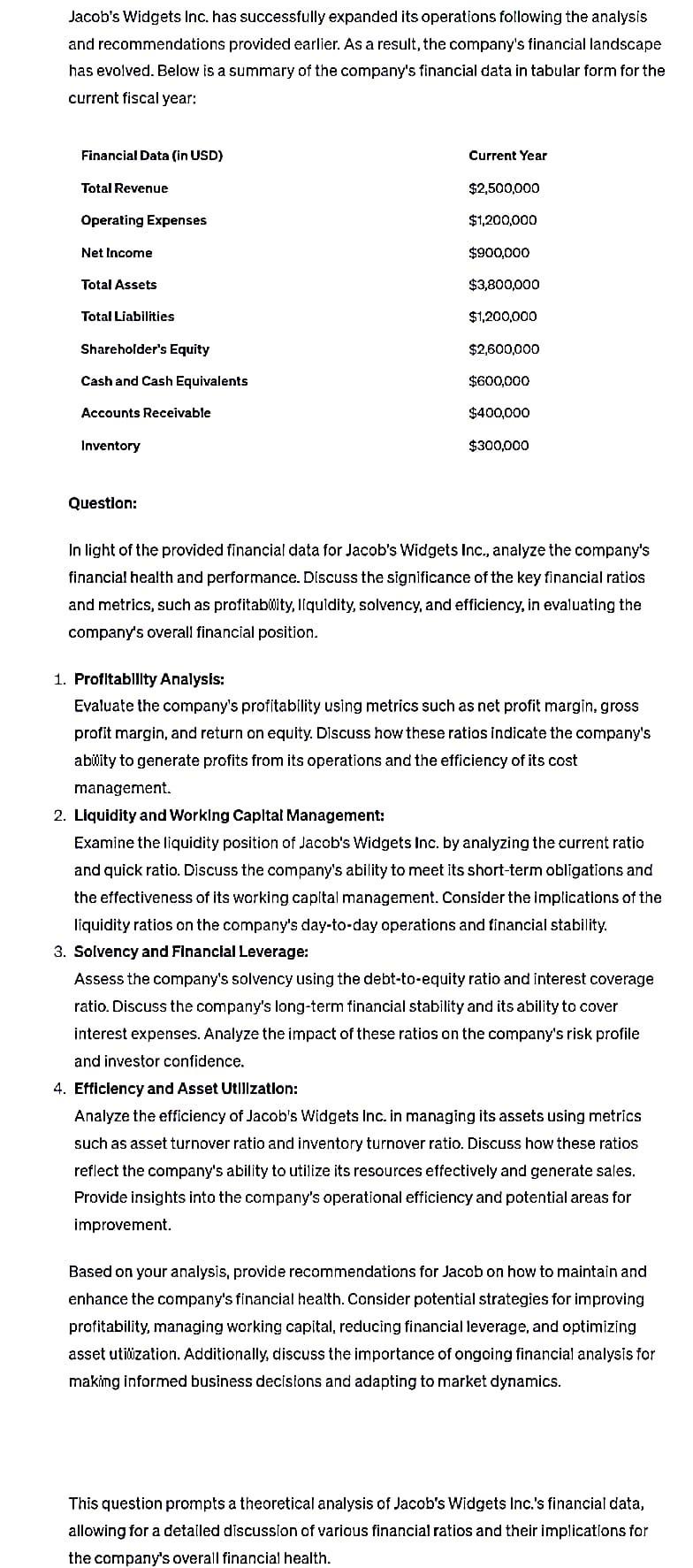

Jacob's Widgets Inc. has successfully expanded its operations following the analysis and recommendations provided earlier. As a result, the company's financial landscape has evolved. Below is a summary of the company's financial data in tabular form for the current fiscal year: Financial Data (in USD) Total Revenue Operating Expenses Net Income Total Assets Total Liabilities Shareholder's Equity Cash and Cash Equivalents Accounts Receivable Inventory Question: Current Year $2,500,000 $1,200,000 $900,000 $3,800,000 $1,200,000 $2,600,000 $600,000 $400,000 $300,000 In light of the provided financial data for Jacob's Widgets Inc., analyze the company's financial health and performance. Discuss the significance of the key financial ratios and metrics, such as profitability, liquidity, solvency, and efficiency, in evaluating the company's overall financial position. 1. Profitability Analysis: Evaluate the company's profitability using metrics such as net profit margin, gross profit margin, and return on equity. Discuss how these ratios indicate the company's ability to generate profits from its operations and the efficiency of its cost management. 2. Liquidity and Working Capital Management: Examine the liquidity position of Jacob's Widgets Inc. by analyzing the current ratio and quick ratio. Discuss the company's ability to meet its short-term obligations and the effectiveness of its working capital management. Consider the implications of the liquidity ratios on the company's day-to-day operations and financial stability. 3. Solvency and Financial Leverage: Assess the company's solvency using the debt-to-equity ratio and interest coverage ratio. Discuss the company's long-term financial stability and its ability to cover interest expenses. Analyze the impact of these ratios on the company's risk profile and investor confidence. 4. Efficiency and Asset Utilization: Analyze the efficiency of Jacob's Widgets Inc. in managing its assets using metrics such as asset turnover ratio and inventory turnover ratio. Discuss how these ratios reflect the company's ability to utilize its resources effectively and generate sales. Provide insights into the company's operational efficiency and potential areas for improvement. Based on your analysis, provide recommendations for Jacob on how to maintain and enhance the company's financial health. Consider potential strategies for improving profitability, managing working capital, reducing financial leverage, and optimizing asset utilization. Additionally, discuss the importance of ongoing financial analysis for making informed business decisions and adapting to market dynamics. This question prompts a theoretical analysis of Jacob's Widgets Inc.'s financial data, allowing for a detailed discussion of various financial ratios and their implications for the company's overall financial health.

Step by Step Solution

There are 3 Steps involved in it

analysis of Jacobs Widgets Incs financial data based on the information provided 1 Profitability Analysis Net Profit Margin The companys net profit ma... View full answer

Get step-by-step solutions from verified subject matter experts