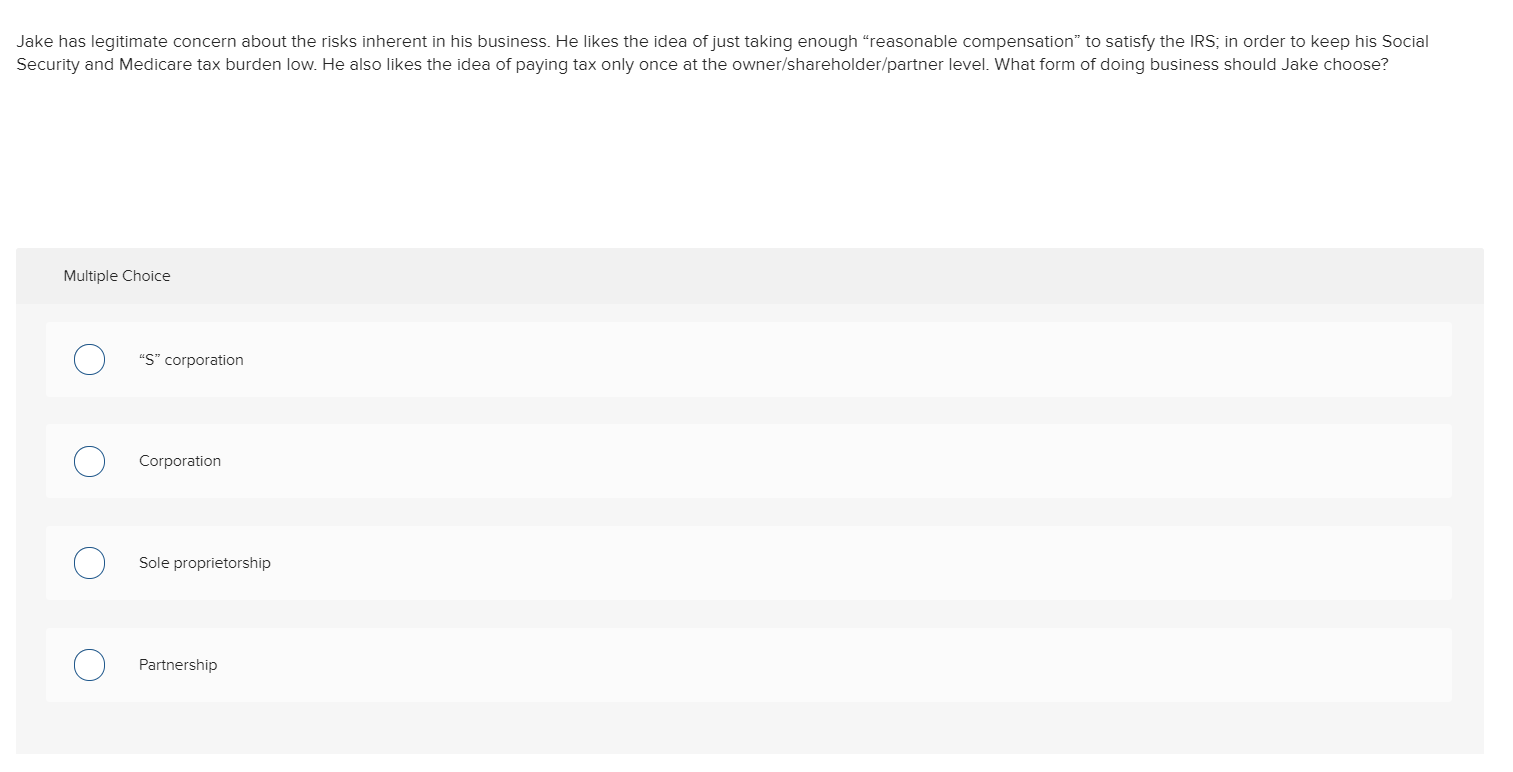

Question: Jake has legitimate concern about the risks inherent in his business. He likes the idea of just taking enough reasonable compensation to satisfy the IRS,

Jake has legitimate concern about the risks inherent in his business. He likes the idea of just taking enough "reasonable compensation" to satisfy the IRS, in order to keep his Social Security and Medicare tax burden low. He also likes the idea of paying tax only once at the owner/shareholder/partner level. What form of doing business should Jake choose? Multiple Choice 0 "S" corporation 0 Corporation Corporation 0 Sole proprietorship o Partnership Partnership

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock