Question: JALEULATORS FULL SCREEN PRINTER VERSIONS BACK NEXT Brief Exercise 21A-20 On December 31, 2016, Carla Vista Company leased machinery from Terminator Corporation for an agreed

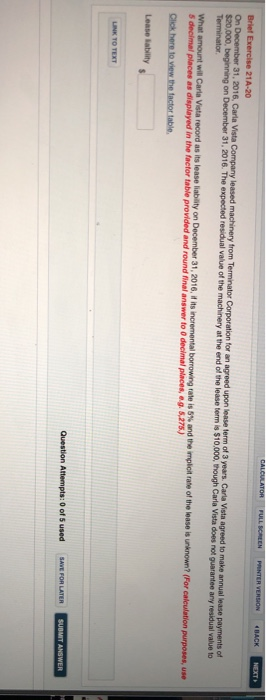

JALEULATORS FULL SCREEN PRINTER VERSIONS BACK NEXT Brief Exercise 21A-20 On December 31, 2016, Carla Vista Company leased machinery from Terminator Corporation for an agreed upon lease term of 3 years. Carla Vista agreed to make annual lease payments of $20,000, beginning on December 31, 2016. The expected residual value of the machinery at the end of the lease term is $10,000, though Carla Vista does not guarantee any residual value to Terminator What amount will Carla Vista record as its lease liability on December 31, 2016, if its incremental borrowing rate is 5% and the implicit rate of the lease is unknown? (For caleulation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal places, eg. 5,275) Click here to view the factor table. Lease lability LINK TO TEXT Question Attempts: 0 of 5 used SAVE FOR LATER SUBMIT ANSWER JALEULATORS FULL SCREEN PRINTER VERSIONS BACK NEXT Brief Exercise 21A-20 On December 31, 2016, Carla Vista Company leased machinery from Terminator Corporation for an agreed upon lease term of 3 years. Carla Vista agreed to make annual lease payments of $20,000, beginning on December 31, 2016. The expected residual value of the machinery at the end of the lease term is $10,000, though Carla Vista does not guarantee any residual value to Terminator What amount will Carla Vista record as its lease liability on December 31, 2016, if its incremental borrowing rate is 5% and the implicit rate of the lease is unknown? (For caleulation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal places, eg. 5,275) Click here to view the factor table. Lease lability LINK TO TEXT Question Attempts: 0 of 5 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts