Question: Jamal Nasir is a business loan processing officer at a bank in Alor Setar. In the past month, he has received loan applications from two

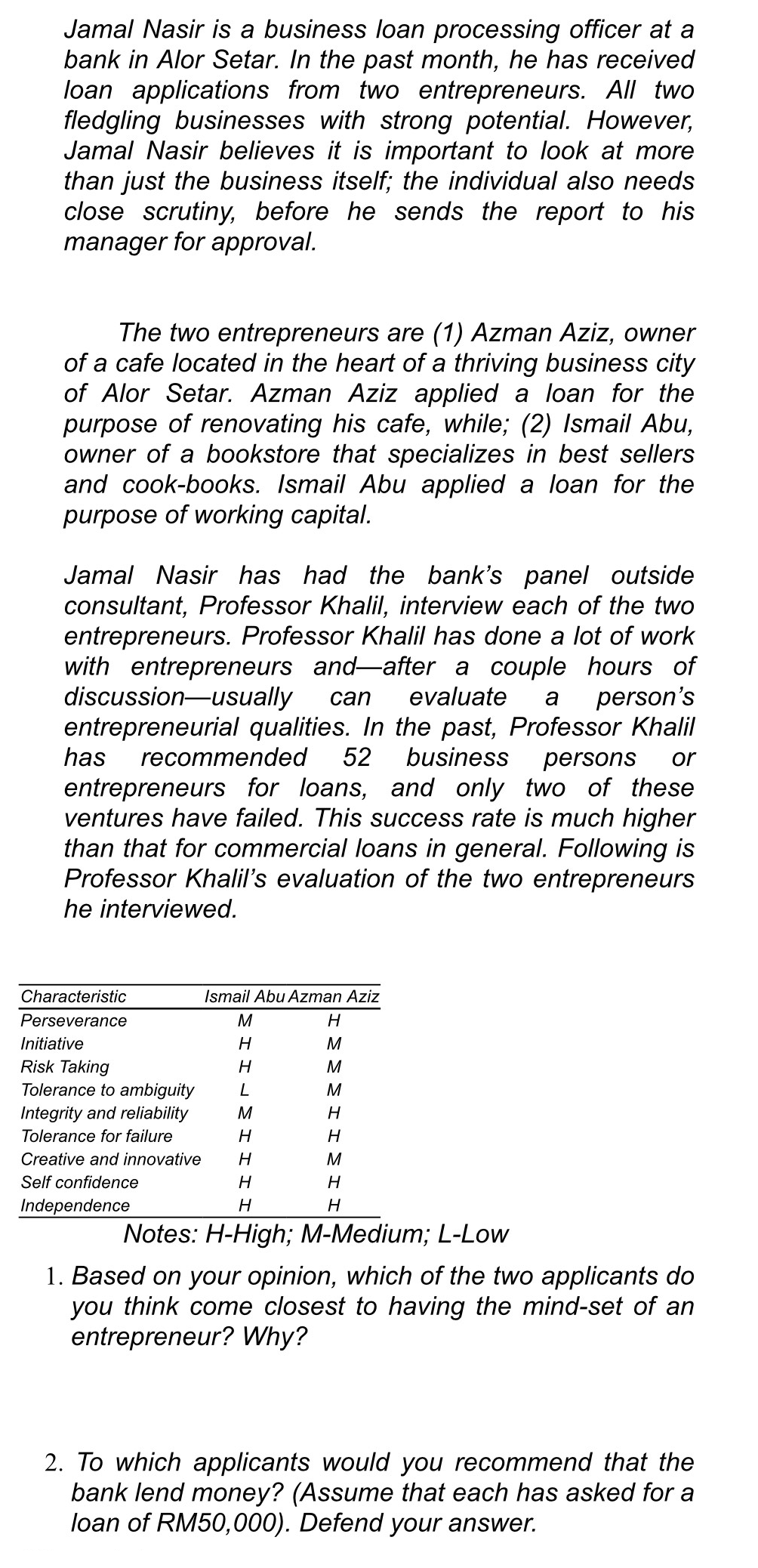

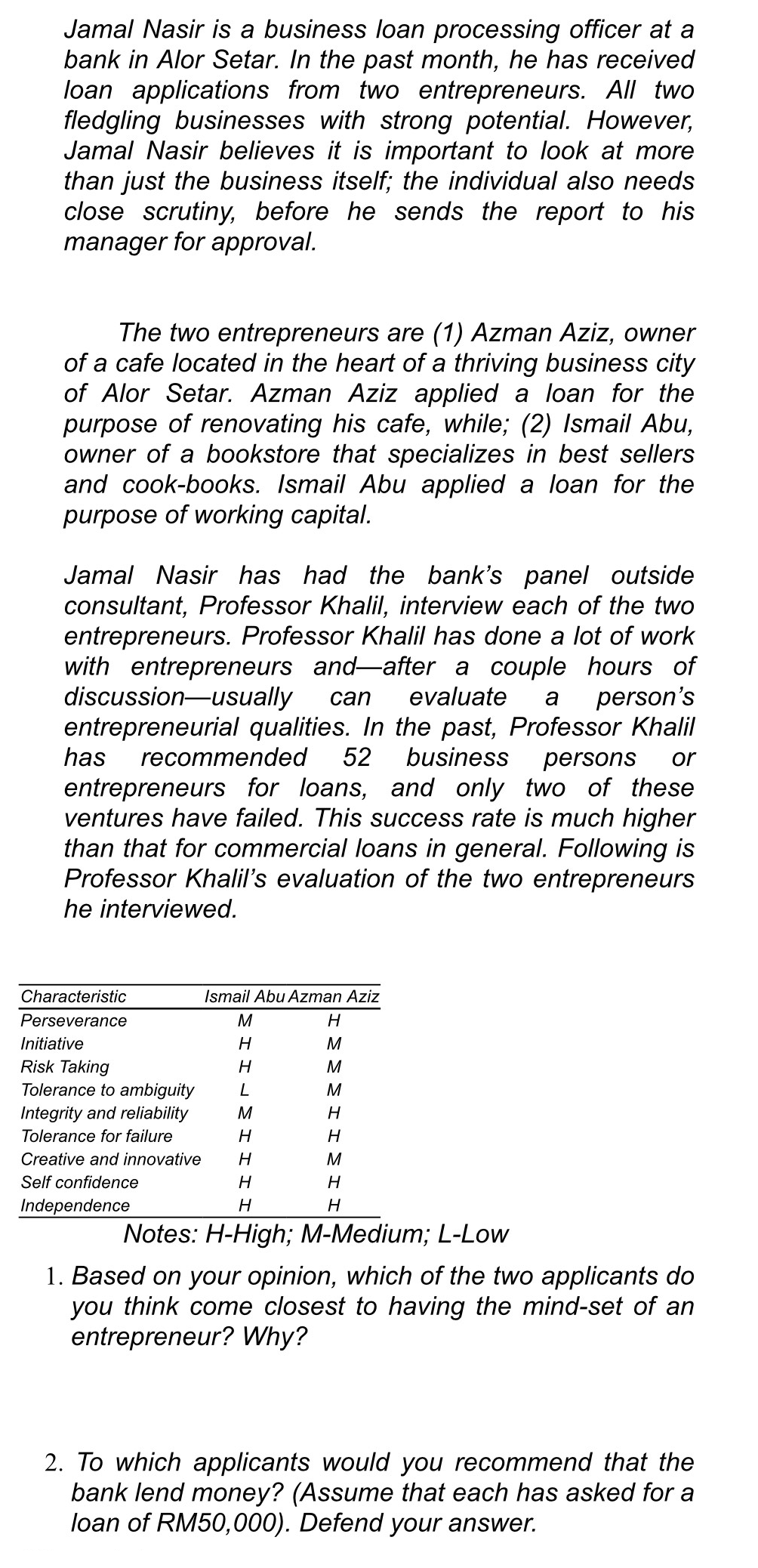

Jamal Nasir is a business loan processing officer at a bank in Alor Setar. In the past month, he has received loan applications from two entrepreneurs. All two fledgling businesses with strong potential. However, Jamal Nasir believes it is important to look at more than just the business itself; the individual also needs close scrutiny, before he sends the report to his manager for approval. The two entrepreneurs are (1) Azman Aziz, owner of a cafe located in the heart of a thriving business city of Alor Setar. Azman Aziz applied a loan for the purpose of renovating his cafe, while; (2) Ismail Abu, owner of a bookstore that specializes in best sellers and cook-books. Ismail Abu applied a loan for the purpose of working capital. can a Jamal Nasir has had the bank's panel outside consultant, Professor Khalil, interview each of the two entrepreneurs. Professor Khalil has done a lot of work with entrepreneurs and after a couple hours of discussionusually evaluate person's entrepreneurial qualities. In the past, Professor Khalil has recommended 52 business persons entrepreneurs for loans, and only two of these ventures have failed. This success rate is much higher than that for commercial loans in general. Following is Professor Khalil's evaluation of the two entrepreneurs he interviewed. or Characteristic Ismail Abu Azman Aziz Perseverance M H Initiative H M Risk Taking H M Tolerance to ambiguity L M Integrity and reliability M H Tolerance for failure H H Creative and innovative H . Self confidence H H Independence H H Notes: H-High; M-Medium; L-Low 1. Based on your opinion, which of the two applicants do you think come closest to having the mind-set of an entrepreneur? Why? 2. To which applicants would you recommend that the bank lend money? (Assume that each has asked for a loan of RM50,000). Defend your answer. Jamal Nasir is a business loan processing officer at a bank in Alor Setar. In the past month, he has received loan applications from two entrepreneurs. All two fledgling businesses with strong potential. However, Jamal Nasir believes it is important to look at more than just the business itself; the individual also needs close scrutiny, before he sends the report to his manager for approval. The two entrepreneurs are (1) Azman Aziz, owner of a cafe located in the heart of a thriving business city of Alor Setar. Azman Aziz applied a loan for the purpose of renovating his cafe, while; (2) Ismail Abu, owner of a bookstore that specializes in best sellers and cook-books. Ismail Abu applied a loan for the purpose of working capital. can a Jamal Nasir has had the bank's panel outside consultant, Professor Khalil, interview each of the two entrepreneurs. Professor Khalil has done a lot of work with entrepreneurs and after a couple hours of discussionusually evaluate person's entrepreneurial qualities. In the past, Professor Khalil has recommended 52 business persons entrepreneurs for loans, and only two of these ventures have failed. This success rate is much higher than that for commercial loans in general. Following is Professor Khalil's evaluation of the two entrepreneurs he interviewed. or Characteristic Ismail Abu Azman Aziz Perseverance M H Initiative H M Risk Taking H M Tolerance to ambiguity L M Integrity and reliability M H Tolerance for failure H H Creative and innovative H . Self confidence H H Independence H H Notes: H-High; M-Medium; L-Low 1. Based on your opinion, which of the two applicants do you think come closest to having the mind-set of an entrepreneur? Why? 2. To which applicants would you recommend that the bank lend money? (Assume that each has asked for a loan of RM50,000). Defend your