Question: Jambo, Inc. - WACC Problem Following is the long-term debt and equity section of Jambo's balance sheet as of December, 2021: millions Bonds Payable, 6%,

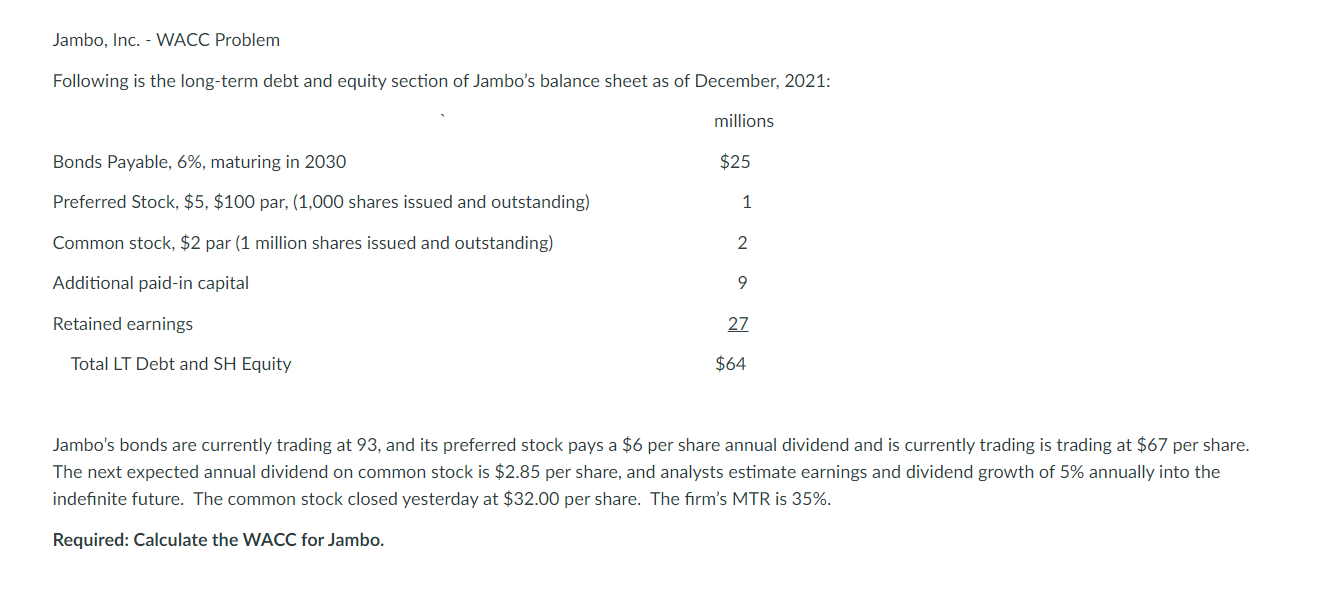

Jambo, Inc. - WACC Problem Following is the long-term debt and equity section of Jambo's balance sheet as of December, 2021: millions Bonds Payable, 6%, maturing in 2030 $25 Preferred Stock, $5, $100 par, (1,000 shares issued and outstanding) 1 Common stock, $2 par (1 million shares issued and outstanding) 2 Additional paid-in capital 9 Retained earnings 27 Total LT Debt and SH Equity $64 Jambo's bonds are currently trading at 93, and its preferred stock pays a $6 per share annual dividend and is currently trading is trading at $67 per share. The next expected annual dividend on common stock is $2.85 per share, and analysts estimate earnings and dividend growth of 5% annually into the indefinite future. The common stock closed yesterday at $32.00 per share. The firm's MTR is 35%. Required: Calculate the WACC for Jambo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts