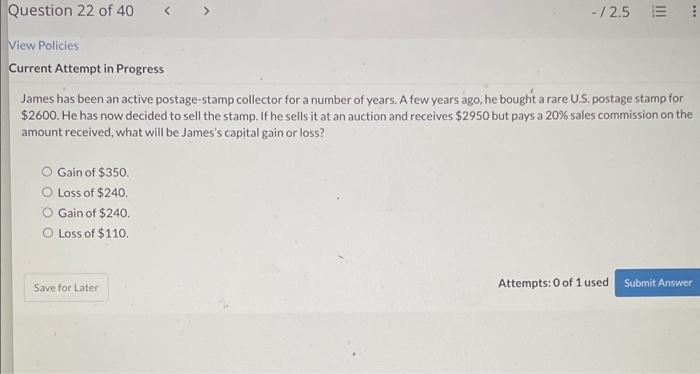

Question: James has been an active postage-stamp collector for a number of years. A few years ago, he bought a rare U.S. postage stamp for $2600.

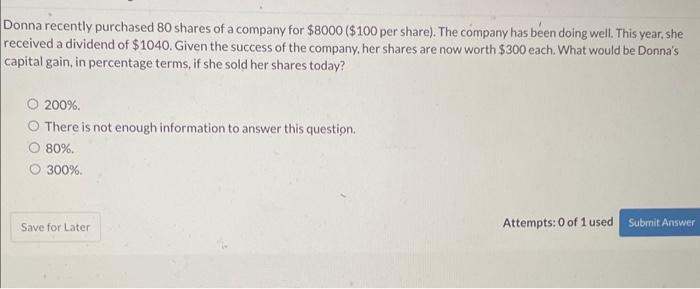

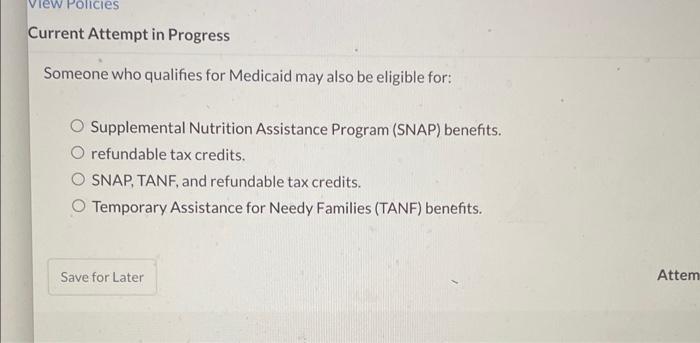

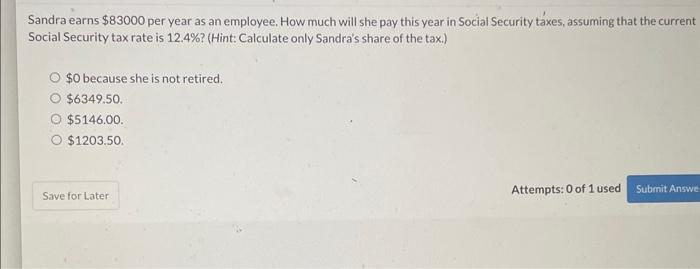

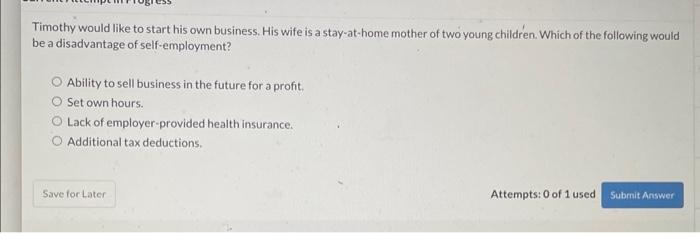

James has been an active postage-stamp collector for a number of years. A few years ago, he bought a rare U.S. postage stamp for $2600. He has now decided to sell the stamp. If he sells it at an auction and receives $2950 but pays a 20% sales commission on the amount received, what will be James's capital gain or loss? Gain of $350. Loss of $240 Gain of $240 Loss of $110. Donna recently purchased 80 shares of a company for $8000 ( $100 per share). The company has been doing well. This year, she received a dividend of $1040. Given the success of the company, her shares are now worth $300 each. What would be Donna's capital gain, in percentage terms, if she sold her shares today? 200% There is not enough information to answer this question. 80% 300% Someone who qualifies for Medicaid may also be eligible for: Supplemental Nutrition Assistance Program (SNAP) benefits. refundable tax credits. SNAP, TANF, and refundable tax credits. Temporary Assistance for Needy Families (TANF) benefits. Sandra earns $83000 per year as an employee. How much will she pay this year in Social Security taxes, assuming that the current Social Security tax rate is 12.4% ? (Hint: Calculate only Sandra's share of the tax.) $0 because she is not retired. $6349.50 $5146.00 $1203.50 Attempts: 0 of 1 used Timothy would like to start his own business. His wife is a stay-at-home mother of two young children. Which of the following would be a disadvantage of self-employment? Ability to sell business in the future for a profit. Set own hours. Lack of employer-provided health insurance. Additional tax deductions. Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts